BACK TO BASICS: PETRON (TP: RM13.71) - BULLISH Q4FY17 OUTLOOK!

George Leong

Publish date: Fri, 19 Jan 2018, 11:37 AM

As predicted previously, Petron Malaysia Refining & Marketing delivered superior financial performance for its 3QFY2017.

Let us explore key factors to assess whether Petron can continue to do well in 4QFY2017.

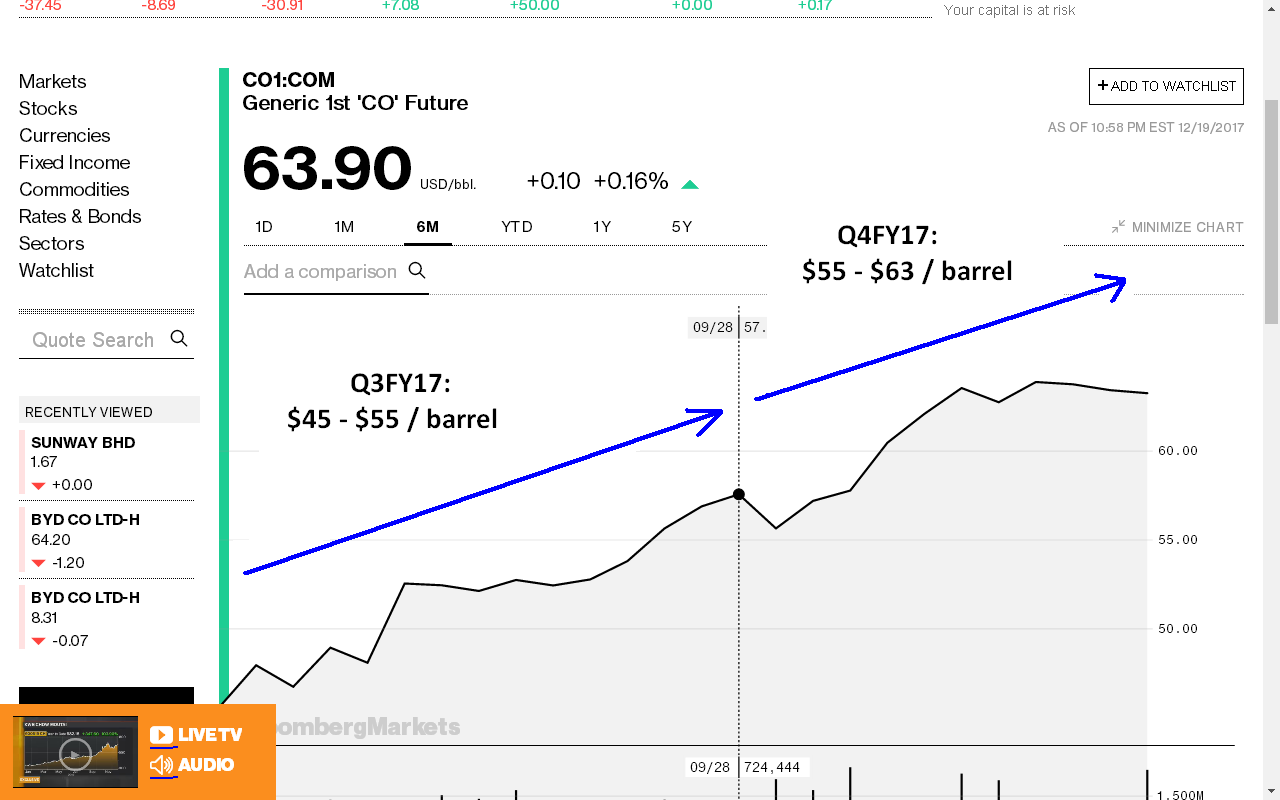

1) Surge in Brent Crude Oil Price

Year 2017:

Jan - $53.59

Feb - $54.35

Mar - $50.90

1QFY17 Profits: rm108.54m

Apr - $52.16

May - $49.89

Jun - $46.17

2QFY17 Profits: rm90.99m (rm39m gains on disposal of service stations for MRT development)

Jul - $47.66 (FY16: $44.13); Difference: $3.53

Aug - $49.94 (FY16: $44.87); Difference: $5.07

Sep - $52.95 (FY16: 45.04); Difference: $7.91

3QFY17 Profits: rm106.07m

Oct - $54.92 (FY16: $49.29); Difference: $5.63

Nov - $59.93 (FY16: $45.26); Difference: $14.67

Dec - $61.19 (FY16: $52.62); Difference: $8.57

4QFY17 Profits: rm??.??m

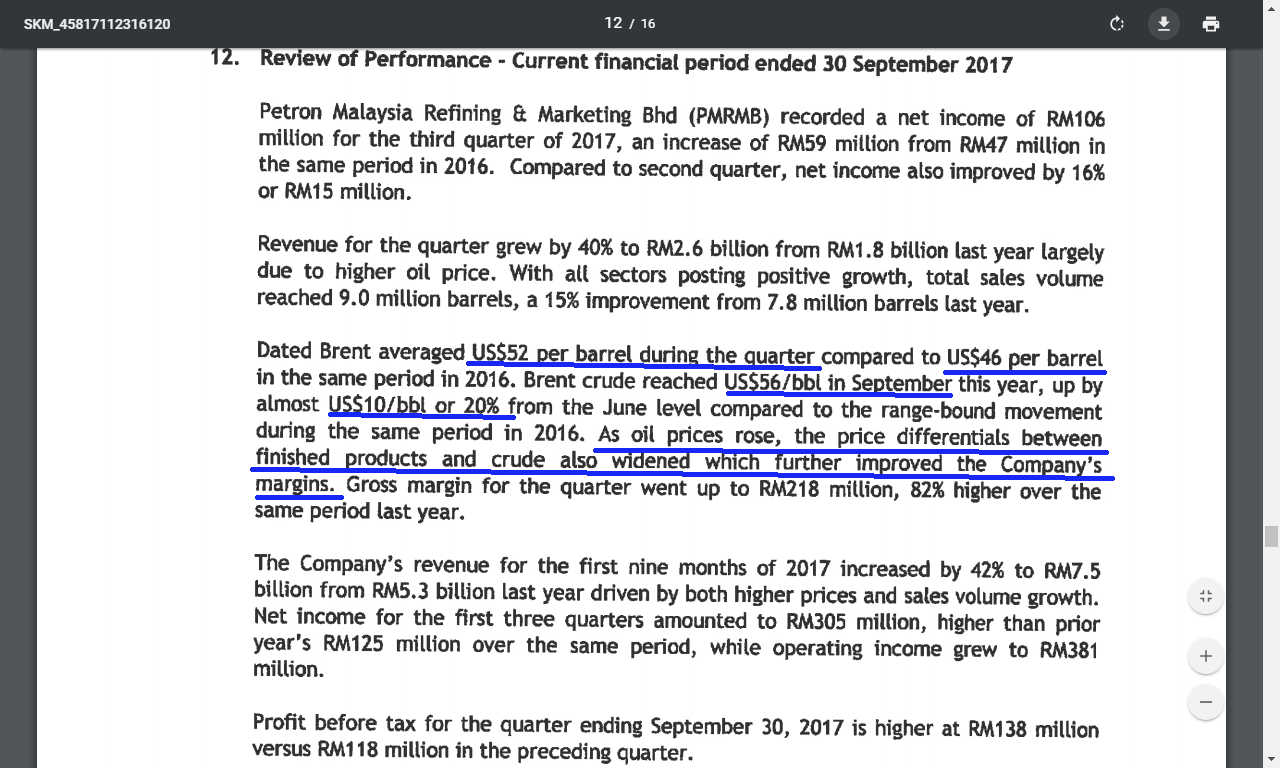

As there is some correlation of Petron's profits to crude oil prices,it is key to monitor its movement. Brent Crude Oil has settled above $50 / barrel for October and November, even closing above $60/barrel in December.

Brent crude reached $66/barrel by end of December last year, up by almost $9/barrel or 16% from end of September level of $57/barrel.

According to the quarterly report, as oil prices rise, the price differentials between finished products and crude should widen and further improve the Company's margins. Hence, we are of the view that Petron Malaysia should continue to register good profits for Q4FY17.

In addition, if u take notice from the comparison above, you will realize the Brent Crude difference (Q4FY17 vs Q4FY16) is actually much larger for Q4FY17, compared to the difference in Q3FY17.

2) Q1FY18 Outlook:

Year 2017:

Jan - $53.59

Feb - $54.35

Mar - $50.90

1QFY17 Profits: rm108.54m

Year 2018:

Jan - $??.??

Feb - $??.??

Mar - $??.??

1QFY18 Profits: rm???.??m

So far, Brent Crude is trading above $65/barrel from Jan 1 to Jan 19, let us hope it remains that way. If you look at Jan - Mar 2017 crude prices, it's trading between $50 - $55 and register rm108m profit, if Brent crude trades between $60 - $65 between Jan - Mar 2018, will the profits be higher than rm108m? In addition with the increased sales volume from expansion in the retail fuel stations and commercial component.

3) Sales Volume

Q1 - 8.2 million barrels

Q2 - 7.8 million barrels

Q3 - 7.8 million barrels

Q4 - 8.3 million barrels

2017:

Q1 - 8.3 million barrels

Q2 - 8.5 million barrels

Q3 - 9.0 million barrels (Q3FY16: 7.8 million barrels)

Q4 - ?.? million barrels (Q4FY16: 8.3 million barrels)

2018:

Q1 - ?.? million barrels (Q1FY16: 8.2 million barrels)

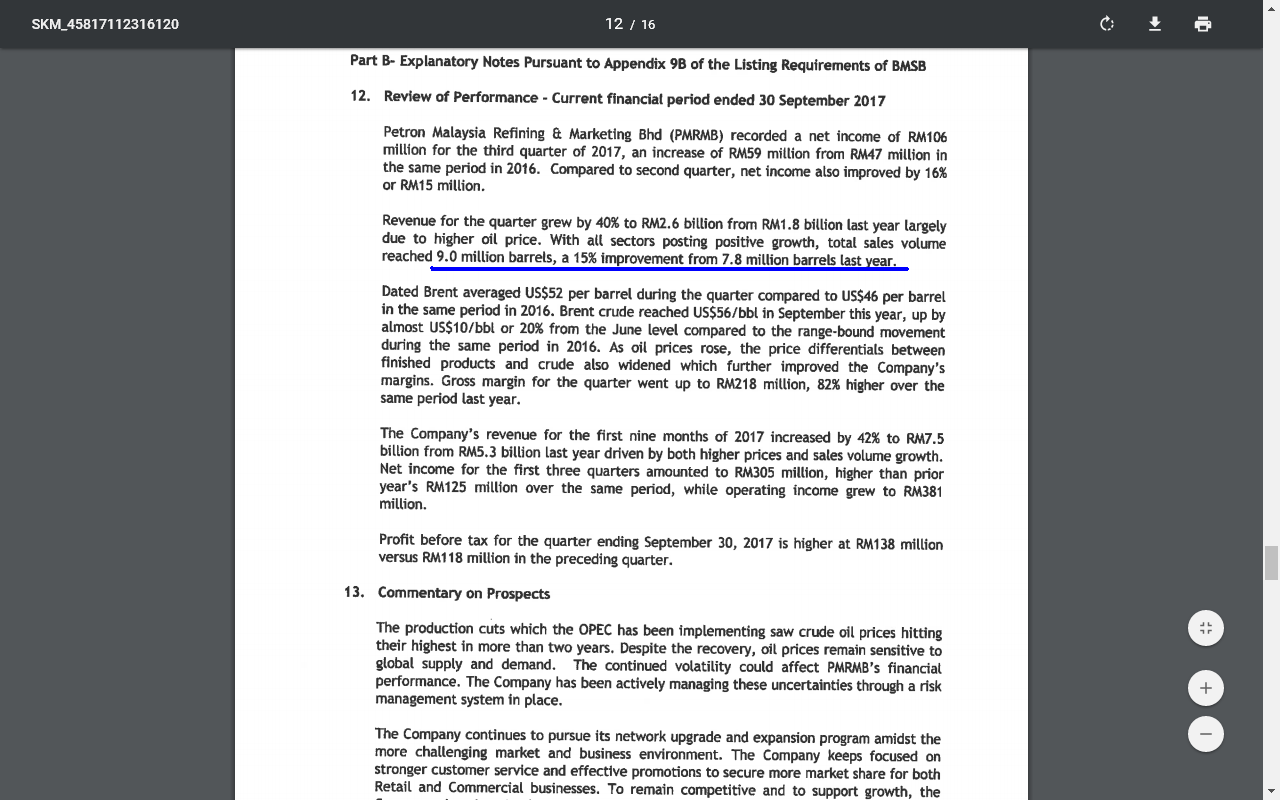

In Petron's 3QFY17 report, the company registered 9.0 million barrels of total sales volume, a 15% improvement from previous corresponding period. I am of the view that Petron will continue to register higher total sales volume in coming period. For Q4FY17, Petron Malaysia is expected to register sales volume of 9.0 million barrels or above, beating Q4FY16 sales volume of 8.3 million barrels.

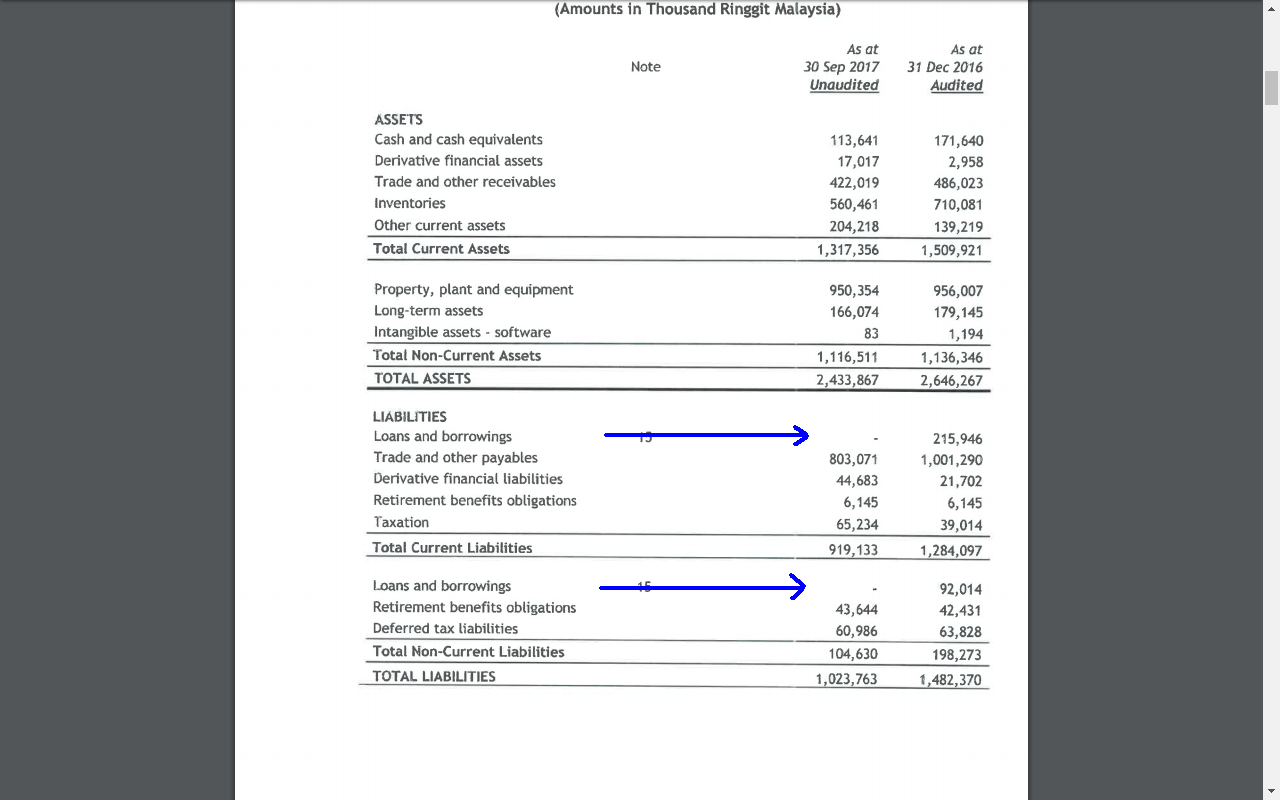

4) Healthy Cash Level

As of Q3FY17 financial report, Petron Malaysia has a healthy cash level of RM113 million (RM0.42 per share). What is amazing is, the company is able to CLEAR OFF all of its debts. It is now a DEBT FREE company. Petron has a net cash position of RM113 million.

Do take notice of its cash and debt level at 31 December 2016, it has a cash level of RM172 million, while its total debts amount to RM308 million, contributing to a net debt position of RM136 million.

In just 9 months, it has improved from a net debt position of RM136 million, to a net cash position of RM113 million, a DEBT FREE company with strong free cash flow (FCF). It is not surprising if Petron Malaysia can have a net cash position of RM200 million by 31 December 2017, with over RM250 million to RM300 million cash level, sufficient to undertake any major plant upgrades and expansion, via internally-generated funds.

5) Valuations:

If Petron Malaysia could record rm130 million net profits for its 4QFY17 (rm112m, 4QFY16), its immediate 4 rolling quarters Earnings Per Share (EPS) would stand at rm1.61. With a Price Earnings Multiple of 8.5x (conservative estimate), Petron Malaysia should be trading at rm13.71. From current price of rm11.30, there is 21% upside for this stock.

A number of research centres gave a higher PE of 11 to 12.5x for Petron Malaysia, I would stick to PE of 8.5x. Any re-rating would be a further boost to the company, and could trade above current target price of RM13.71

Any downside risk would be the fall in crude oil prices, product cracks and mishaps / maintenance shutdown in its refinery plant in Port Dickson. Further downside risks would be a deep surge in US Oil Production that would flood the market with crude oil supply.

Note: Please "LIKE" this page in Facebook ("Financial Education for Youth"), to support! https://www.facebook.com/financialeducation4youth/

Appreciate it very much!

Disclaimer: The above is for educational purposes only, please conduct your own due diligence before buying / selling a stock.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on George Leong's Blog

Created by George Leong | Oct 17, 2018

FATA94

It should be based on Singapore MOPS and not Brent Oil. Kindly take note of that.

2018-01-19 12:19