CASE STUDY: HOW SOME PROFIT FROM HIGHER FUEL PRICES!

George Leong

Publish date: Thu, 09 Nov 2017, 01:46 PM

Source: Malaysiakini

Source: Bloomberg

PROFIT FROM FUEL PRICES!

.

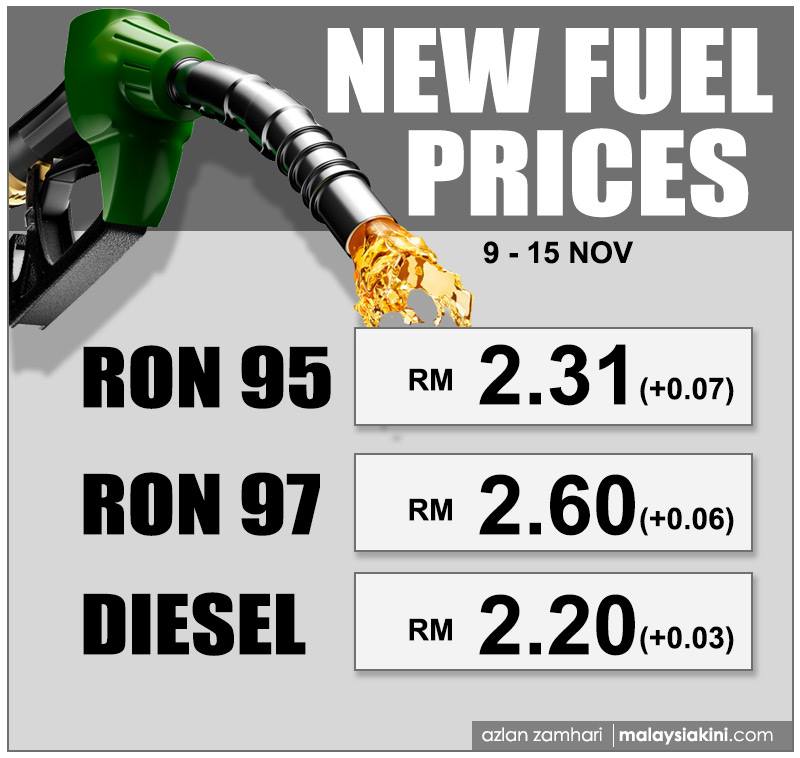

According to our post on 6 November 2017 (https://www.facebook.com/financialeducation4youth/), it was mentioned that fuel prices is most likely to increase this week or next, just last evening, we witnessed fuel prices increased by 7 cents for RON 95 and 6 cents for RON 97.

There was a public outcry, with long queue in some of the petrol stations across the country to save rm2 to rm5.

As predicted, it was the talk in town with everyone blaming the hike in Crude Oil and the government. Transportation cost just increased dramatically and it won't be surprising to see coming inflation data reflecting that.

While the world is complaining, blaming, yelling, some people are celebrating.

WHY???

Because they PROFIT from it.

But their transportation cost increases too right? Why are they celebrating?

This is because the profits they made, far outweigh the increased fuel cost multiple times. And here are a few examples how they profit from it, We will just name a few here:

a) They trade the Brent / WTI Crude Oil Futures

b) They bought Oil & Gas companies shares like:

- Petron Malaysia (Refinery & Retail)

- Hengyuan (Refinery)

- Petronas Dagangan (Retail)

- etc...

When OPEC / non-OPEC strike a historical deal to cut production output by 1.8 million barrels a day to stabilize oil prices, Brent Crude Oil price holds stable between $46 to $53 per barrel, a few investors / traders bought Petron Malaysia shares to anticipate higher profits.

Indeed, the company has announced increased profits over 2 quarters. Its share price skyrocketed, from rm6 (March) to rm12 (November) per share, that is a 100% increase.

Some bought Hengyuan Refining (previously known as Shell) due to improving refinery margins. Its share price jump from rm3.80 (March) to rm9.50 (November) per share, a 150% increase.

Now you know how some players in the market profit from the increased fuel price. When fuel price increase, the profit margins increase, contributing to higher profits.

When it is bad news for some, it is good news for some. That's the harsh reality of the world.

Invest in knowledge, you will reap many times more returns in the future. Now some people might be unhappy of us sharing this to the public, but we (Facebook: Financial Education for Youth) believe its meaningful to educate the public about finance. At least there is this awareness, to level up the playing field.

Whether readers choose to increase their knowledge further by taking action, it's entirely up to them. We have done our very best to educate them.

Please HELP to share this post if you find it beneficial, so your family and friends can benefit as well.

P/s: We will be launching our E-BOOK soon titled "HOW TO MAKE RM100,000 NET WORTH BY AGE 25!".

Stay tuned!

Please "LIKE" our page to get more financial updates, we TRULY APPRECIATE it!

https://www.facebook.com/financialeducation4youth/

NOTE: This post is intended to share how you could profit from the rise in fuel prices IN THE FUTURE. As we all know, fuel prices go up and down, what goes up may one day comes down. You could position yourself in the future when fuel prices increase. This post is for educational purpose only, no recommendation is made to buy or sell any stocks / futures contract above. If you do, you are doing at your own risk!

#CrudeOil

#HighTransportationCost

#WeHaveToDoSomething

#WeCanDoIt

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on George Leong's Blog

Created by George Leong | Oct 17, 2018

Created by George Leong | Jan 19, 2018

Discussions

nowadays 100k cant even buy u a tiny studio apartment.

ppl now talk in millions!

2017-11-09 14:55

The RON95 petrol price is determined by global benchmark price as follows : [average Singapore Mogas 95 Unleaded (Platts) * average USD/MYR / 159 litre per barrel + fixed margin of RM0.3173]. The forecast is usually off for one two cents only (at least for past few weeks). Therefore I don't think it's fair to blame the refiners for the high petrol price.

2017-11-09 15:02

applied the same thing to HRC when KYY posted a new article few days back...

2017-11-09 16:26

China’s producer prices were surprisingly strong in October, while consumer inflation picked up pace, suggesting economic momentum remained robust and easing market concerns of a slowdown in the world’s second largest economy.

2017-11-10 00:19

KYY now promoting Heng Yuan. So all of youbetter go to loan money to buy Heng Yuan??? KYY = God of stocks ???

2017-11-10 12:51

It's not just the US — emerging markets are having a record year

https://www.cnbc.com/2017/11/09/its-not-just-the-us--emerging-markets-are-having-a-record-year.html

A stronger U.S. dollar and higher interest rates in the U.S. typically hurt emerging market equities, as a stronger greenback may appear more attractive to foreign investors. Furthermore, some emerging markets are tethered to dollar-denominated commodities such as oil.

The dollar is unlikely to strengthen substantially from here, which should prove further support for emerging markets, said Gina Sanchez, CEO of Chantico Global.

"We like emerging markets because of the expansion of trade, and the fact that that has yet to make its way into the bottom line in terms of sales," Sanchez said Wednesday on "Trading Nation," adding that sales in many emerging markets' firms are continuing to grow.

Sanchez said even as price-earnings ratios in the space have expanded, much of that has simply been evident in emerging market technology stocks, and she still likes emerging markets.

2017-11-10 23:51

If RON95 reach mye3/litre- all 3 large refiners happy go lucky but we crying lei...its unbearable abnormal profit for refiners only lei not the mass malaysians. govt. should impose windfall tax on refiners, to be fair

2017-11-11 14:41

Ron 95 RM 3/ltr crying? Vote Pakatan in GE 14. They promise lower petrol.

2017-11-11 14:44

speakup

hallo brother, RM100,000 is nothing to shout about these days.

RM1MIL at least can talk

2017-11-09 14:19