**基本图表分析**Technical Analysis: Some basic chart analysis

akiha

Publish date: Sun, 25 Jan 2015, 11:57 PM

Charts are useful in terms of analyzing the strength and trends of a

certain stocks. However, this analysis can never and should never be

used as a sole factor to determine whether a stock is suitable to be

invested in. Every stock purchases must be done after both research

in terms of technical and fundamental has been made. Furthermore,

chart analysis can be correct most of the time but never all the time,

therefore it is necessary to include other type of analysis to farther

reduce the risk when investing.

Secondly, chart analysis is meant for short term trends and pattern

prediction, the longer the time, the more irrelevant it is. Therefore,

often case it can only be applied in period close to a certain period.

With that in mind, let’s look at some basic chart analysis:

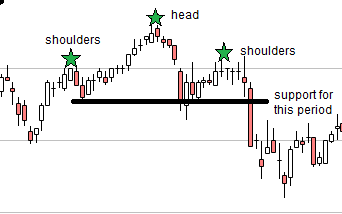

1) The most popular and reliable pattern we can observe in charts is

the head and shoulder pattern (either upright or reversed).

a few important characteristic in head and shoulder:

Head: the highest point achieved in the middle peak.

Shoulders: the peak before of after the head which has lower peak

value compared to the head. Can have more than one for each side.

Neckline: the support for the period the pattern occurs.

Head and shoulders usually points to CHANGE IN MOMENTUM

(bullish momentum stops or bearish momentum stops)

The chart attached is MAYBANK(1155) from July 2013 to August

2013. It shows a upright head and shoulder pattern. From the chart,

after it forms the shoulder after the head it is likely the bullish trend

will become weaker. The trend is further enforced when the price

breached the support line for the period. Therefore, at least in short

term of a few months we can assume the chances of creating new

height(compared to head) is very low.

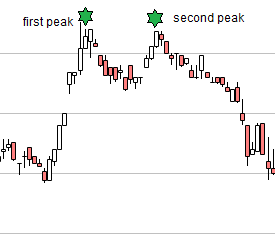

2)double tops/bottoms (have the same analysis as triple tops or

bottoms)

Important characteristic:

chart pattern shows twice (or thrice) in a short period, stock price

attempts to break through a certain price or drop lower than a certain

price but always drops/ rebounds back.

Points to:

a) A strong resistance/support line. Price of the stock will not breach

the line in a short time except there is stronger news (super high

profits, new investors, company crisis)

b) Intermediate momentum REVERSAL The momentum has high

possibility to shift from bullish to bearish or vice versa. This is because

the confidence of investors have been enforced by either i) The stock

will not create higher peaks or ii) The stock will not fall below a level.

Hitting the same level a few times make the impact of reversing the

momentum stronger than head and shoulder.

This is the chart for OSKPROP (6661) from August 2014 to September

2014. It shows the momentum reversal after failing to break throught

the same resistance 2 times in a row.

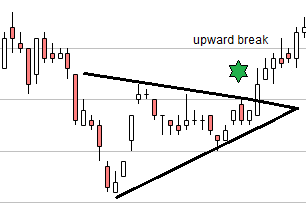

3) Triangle

Triangles consist of charts which shows a converging price to a single

point, until the triangle is broken by an abrupt drop/rise with a

substancial amount.

The drop or rise points to the likely trend to follow.

The following shows an example of upward breaking triangle. SYSTECH

(0050) from December 2014 to January 2015. The upward break in the

triangle points to the uptrend that follows.

The weakness of this pattern is most of the time a big change has

already happened before the prediction can be made from the graph.

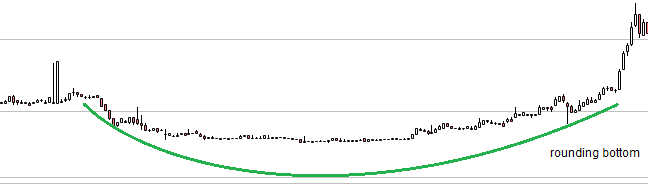

4) Rounding- The long, slow and weak transition between bullish

and bearish momentums that shapes like a rounding edge.

Usually takes a very long time,

hence, is very difficult to analyze or predict. The length of time also

increases the chances for unexpected development. The lack of triggers

also make it a very difficult phase to trade stocks.

Graph shows LATITUD (7006) from Jul 2011 to Jan 2014. The trend

change or formation takes a long time with bottom rounding pattern.

Lastly, we still have to bear in mind chart analysis do enforce the

chances but ultimately, market does not act as it should every time.

Therefore, applying fundamental analysis together with technical

analysis is still very important.

Any comment is appreciated.