iVSA Article 6 - How to Detect Smart Money Movement

Joe Cool

Publish date: Sun, 15 May 2016, 09:03 AM

Introduction to Market Structure

Based on Richard Wyckoff’s price & volume trading method and well known concept of “Composite Operator”, the market is made by the mind of man, which means that market fluctuations are actually created synthetically by professional trades whose position taking are big enough to make an influence to the market price. Hence, these big positions’ taking is referred to as “Smart Money” in Volume Spread Analysis trading approach.

The ultimate goal of smart money is to manipulate the market so that they could buy low and sell high to make a huge profit. I am sure reader especially from public internet forum and popular chat group similar to the one you are reading now, know exactly what I'm talking when reading the remaining of the article. Experienced traders/investors are discovering there are many "wolf dressed as sheep amongst us", persuading, motivating and convincing why such and such stock should be bought or sold.

In order to do so by these "wolves", they must create a campaign usually a series of well-timed "stories" to induce and trap the uninformed traders to “Buy High and Sell Low”. Yes, it is not a typo, the smart money intention is to trick you to “Buy High and Sell Low”.

The century old Volume Spread Analysis (VSA) system used by professional worldwide, has been proven to help traders/investors to understand smart money movement so that VSA traders/investors are always moving with the smart money and not against it.

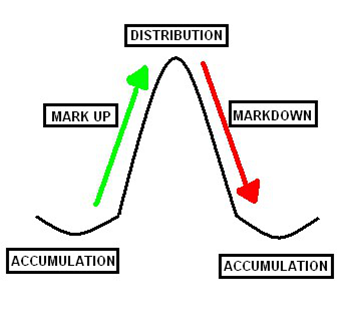

In order to detect smart money movement and avoid being a sheep i.e. a victim to the wolf, VSA traders/investors/investors must first understand that the market structure consists of four phases, namely “Accumulation”, “Mark Up”, “Distribution” and “Mark Down”. We shall discuss in detail what does the smart money do in each phases.

Accumulation

In this phase, smart money’s goal is to acquire as much shares as they can at the lowest price possible. To ensure that they purchase at a low price, smart money will not buy stock in huge quantities as this action will cause the price to surge up. Instead, smart money has to accumulate the shares over a substantial period of time by buying some and then selling some to bring the price back down, but overall they are buying more than they are selling. This is the reason why share price remains flat during this phase and it is accompanied by low trading volume. The public and uninformed traders will normally not pay attention to the share at this phase as price movement is little while VSA traders/investors/investors trained with right knowledge will know that this is the right time to take position.

Mark Up

In this phase, smart money’s goal is to mark up the share price for future selling. As large quantities of shares are acquired by the smart money, supply in the market becomes little. Smart money will then continue to create demand through continuous buying and price surges due to lack of supply. Share price will increase slowly with higher trading volume. Some public or uninformed traders will start to take positions as the upward price movement caught their attention while VSA traders/investors will run their profit as they already taken position earlier.

Distribution

In this phase, smart money will start to transfer the ownership of the share to the public buyers or uninformed traders by doing the opposite in the accumulation phase. They will not sell their shares in huge quantities as this will push down the share price. Instead smart money sells some and buys some to maintain the price but overall they are selling more than what they are buying, hence making profit as the selling price now is higher than the buying price during accumulation phase. Hence share price in this phase remains range bound and accompanied by lower trading volume. The public and uninformed traders will continue their buying induced by positive news flows and promotional campaign by smart money, hoping that price will continue to surge while VSA traders/investors will follow what the smart money does, namely starting to take profit.

Mark Down

In this phase, smart money has already disposed most of their accumulated shares and made a very huge profit, therefore they will intentionally crash down the price by creating plenty of supply and sometimes accompanied by negative news flow (e.g. reversal of the positive news announcement). Price will move downwards accompanied by high trading volume. The public and uninformed traders will be caught by surprise hence starts the wave of panic selling. The majority of uninformed traders will make losses during the rapid sell down as they cut losses. Some inexperienced traders will suffer even more losses in the region of 50% to 90% losses if they refused to cut loss and are not prepared to unload their holdings during the rapid downtrend. VSA traders/investors are trained to follow the footsteps of the smart money hence already unload their holdings much earlier.

Smart money will repeat the cycle and make their next round of big profit. This type of campaign by smart money is also referred to as Pump & Dump.

Conclusion

The above is a simplified illustration of the various market phases within a market structure in relation to smart money modus operandi. By knowing the market structure, newbie traders/investors need to be able to understand the footprints of the smart money, thereby following their next move.

By observing only price fluctuation, it will not give us a clear picture on what market phases the market/share is in currently. It has to be accompanied by volume and price spread to give us a clear picture. Therefore, knowledge on both volume and price spread through understanding of the Volume Spread Analysis (VSA) system is important to keep us in tuned and in harmony with smart money movements so that we are able to follow their footprints and grow our investments with above average returns consistently.

Watch out for next article in this series of education articles brought to you by iVSAChart, “Article 7 - Goal Setting” under Series B: Preparation Before Trading or Investing (what professionals worldwide are practicing).

Interested to learn more?

- Website https://www.ivsachart.com/events.php

- Email: sales@ivsachart.com

- WhatsApp: +6011 2125 8389/ +6018 286 9809

- Follow & Like us on Facebook: https://www.facebook.com/priceandvolumeinklse/

This article only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock. If you decide to buy or sell any stock, you are responsible for your own decision and associated risks.

More articles on iVSA Trading Tips and Plans

Created by Joe Cool | Sep 29, 2016

Created by Joe Cool | Jul 30, 2016

Discussions

Quite similar to my article ...http://ongmali.blogspot.my/2015/02/how-stock-pump-and-dump-works.html ...and mine more interesting hehehe

2016-05-15 14:49

1. Can the smart money compete with the public?

2. If they could buy at the bottom and sell at the top with VSA, why aren't they the richest men?

3. Smart money does not win all the time. Not even half of the time.

2017-06-03 17:57

buddyinvest

wow. best article of this week

2016-05-15 09:51