Kenanga Research & Investment

Daily Technical Highlights - EATECH | SKPRES| SKPETRO

kiasutrader

Publish date: Wed, 15 Jul 2015, 10:22 AM

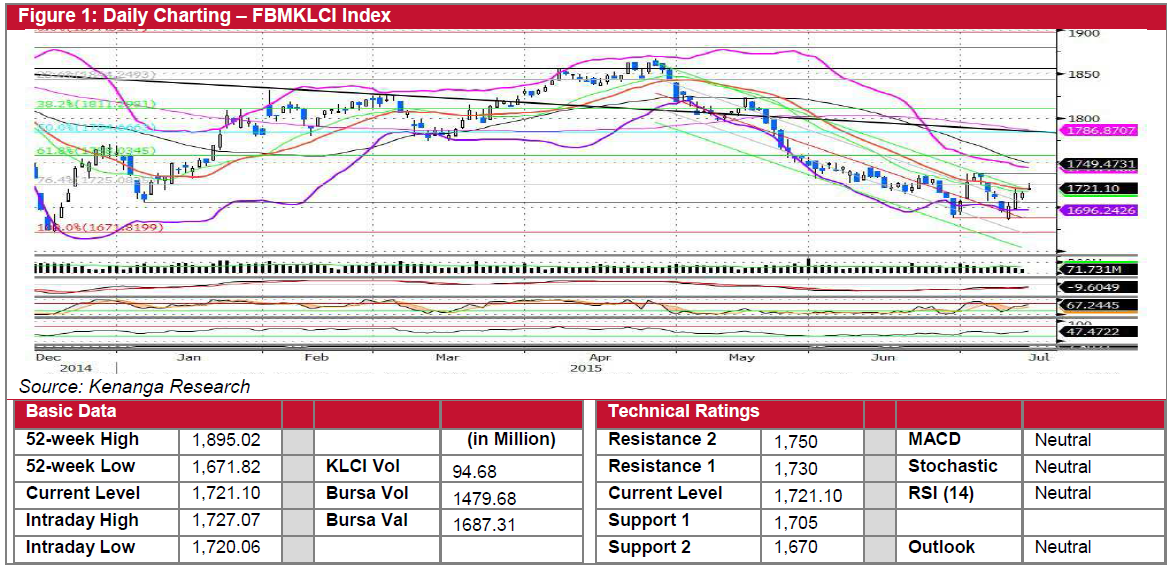

The FBMKLCI continued to move upwards

The FBMKLCI climbed 4.99 points to settle at 1,721.10 yesterday on the back of positive sentiment from the recent conditional deal

between Greece and the Eurozone. On the broader market, gainers outnumbered the losers 477 to 287 with 326 counters traded

unchanged. Despite edging upwards, trading volume remained subdued, coupled with neutral readings from key momentum

indicators, this implies quiet trade ahead of the Raya holidays. As such, we reiterate our view that the key index could continue to

trade within the range of 1,690-1,730 level. Nevertheless, if the key index break above the 1,725 (R1) level with strong volume, it

stands a chance to rally towards 1,750 (R2) next.

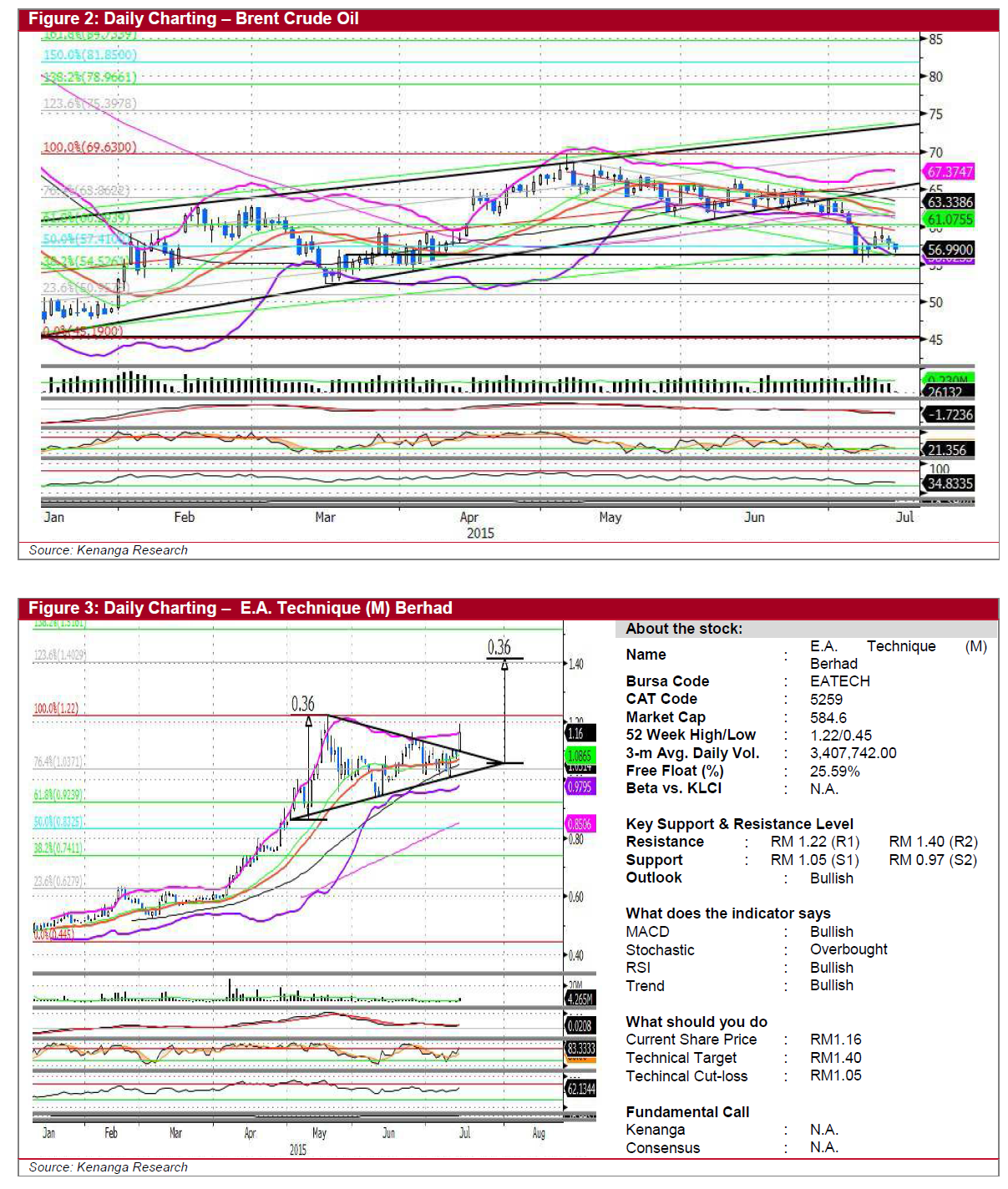

Cautious on Crude

Meanwhile, Brent crude oil price rose 1.14% overnight as speculation that the increase of exports from Iran will be gradual as

opposed to the expectation from the recent concluded US nuclear deal with Tehran could lead to an oversupply situation. The Brent

crude oil has formed a ‘Symmetrical Triangle’ chart pattern as the immediate key support level stands at USD56.18/bbl. Despite the

recent rise, we advocate investors to remain cautious as we felt it could be short-lived underpinned by the declining volume traded.

Hence investors should keep a close eye on the chart as any high-volume breakout above or below the above-mentioned support

level will provide better clarity on the crude oil price's direction. Having said that, both upstream oil & gas players such as EATECH

(TB, TP: RM1.40) and SKPETRO (NR)’s technical pictures have caught our interests, which current levels could be a good

opportunity for accumulation.

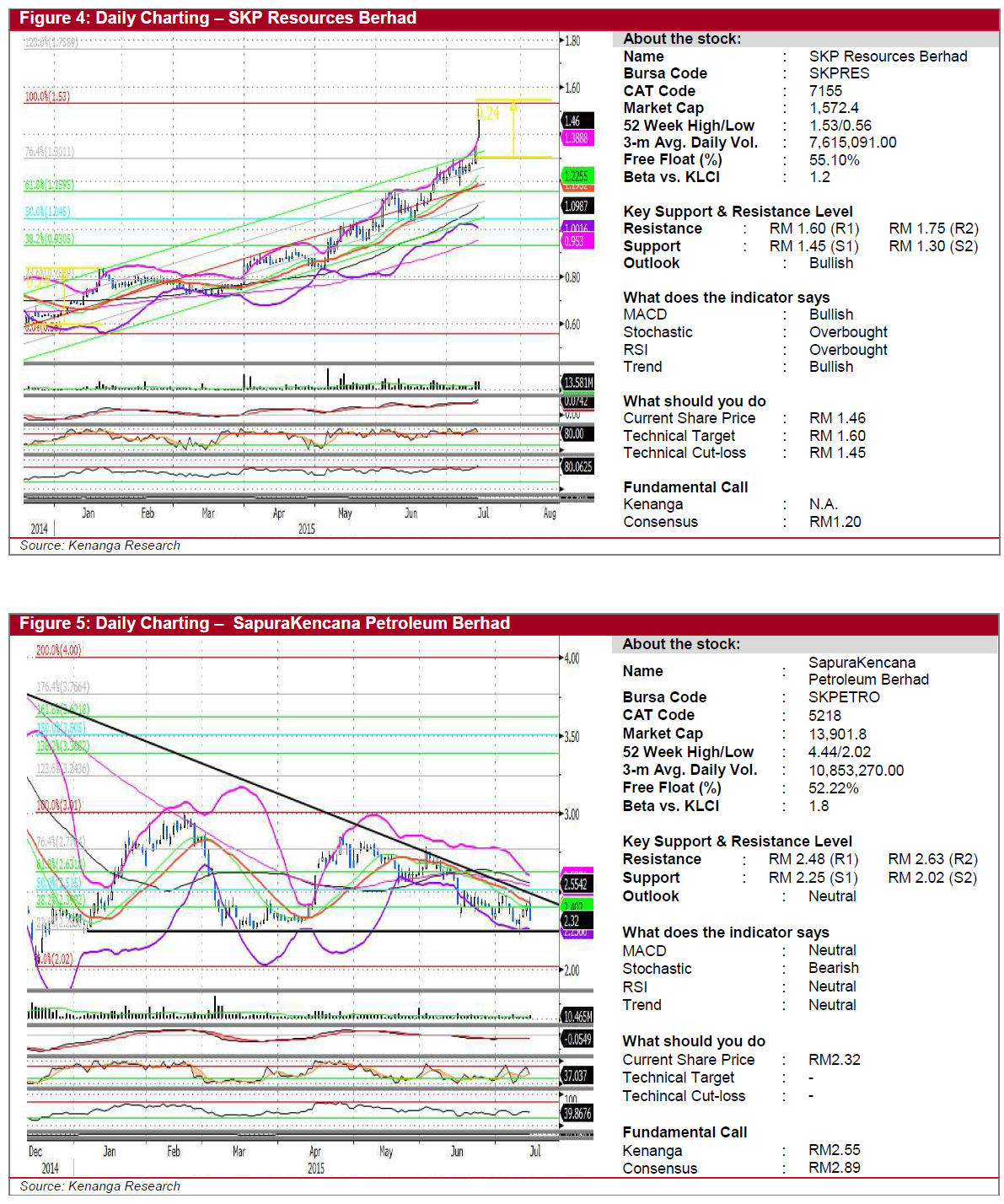

Daily Technical Highlights

· EATECH (TB, TP: RM1.40) has been consolidating over the past three months after reaching an all-time high level of RM1.22

back in May-15. Yesterday, the share price broke out from its ‘Symmetrical Triangle’ chart pattern as well as its upper-Bollinger

band by surging 7.0 sen or 6.42% to settle at RM1.16. In tandem with the above average trading volume, both Stochastic and

RSI indicators are showing an uptick to suggest that buying momentum is piling up. On the back of the technical breakout, we

are placing a Trading Buy call on this stock with at TP of RM1.40 and stop-loss of RM1.05.

· SKPRES (TB, TP: RM1.60) surged 8.15% or 11.0 sen yesterday to set a new record high of RM1.46, merely 1.0 sen below our

TP of RM1.47 to break out from its upper Bollinger band. The MACD’s bullish divergence continued to expand while key

momentum indicators such as Stochastic and RSI are also lending a hand to the bullish bias to trend further up north. We

reckon that the bullish sentiment coming from the recent contract secured from Dyson could continue to garner investor’s

interest to rally the stock further towards our upgraded TP of RM1.60 (R1). Meanwhile, we are revising our stop-loss level to

RM1.45 to secure our previous gains. Despite noting that both momentum indicators (Stochastic and RSI) are trending deeper

into overbought territory suggesting a possible near-term consolidation (towards RM1.40), this could provide a good opportunity

for traders to enter the stock to ride on the group’s bullish prospect.

· SKPETRO (Not Rated) was awarded a contract worth USD273m on Monday. The share price has consolidated and formed a

“Wedge” chart pattern. With the positive sentiment from the recent contract win, investors should look out for a technical

breakout from its “Wedge” chart pattern at RM2.48 (R1) with high trading volume in the short to medium term. Immediate

support is RM2.25 (S1).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-28

SAPNRG2024-11-28

SKPRES2024-11-26

SKPRES2024-11-26

SKPRES2024-11-26

SKPRES2024-11-26

SKPRES2024-11-25

SKPRES2024-11-22

SKPRES2024-11-21

SAPNRG2024-11-21

SAPNRG2024-11-21

SAPNRG2024-11-21

SKPRES2024-11-21

SKPRES2024-11-21

SKPRES2024-11-20

SKPRES2024-11-19

EATECH2024-11-19

EATECH2024-11-19

EATECH2024-11-19

EATECH2024-11-19

SAPNRG2024-11-18

EATECHMore articles on Kenanga Research & Investment

Actionable Technical Highlights - MALAYSIAN RESOURCES CORPORATION BHD (MRCB)

Created by kiasutrader | Nov 28, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments