Daily technical highlights – (DRBHCOM, IHH)

kiasutrader

Publish date: Fri, 14 Dec 2018, 09:08 AM

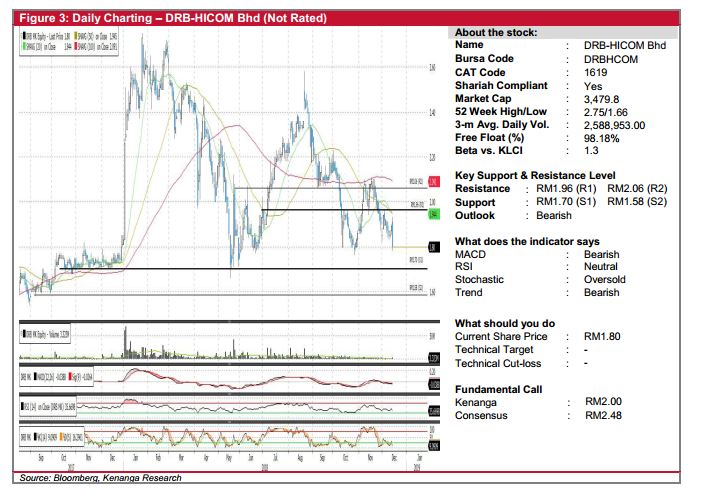

DRBHCOM (Not Rated)

• DRBHCOM declined by 9.0 sen (-4.76%) to end at RM1.80 yesterday.

• The share has been on a downtrend since late-August after breaking below its 20-day SMA.

• Although yesterday’s candlestick opened marginally higher, the share closed lower to form a bearish engulfing candlestick which indicates strong selling pressure. As such, we believe the downtrend may persist given that shorter term SMAs are below longer-term SMAs.

• Downside support levels can be seen at RM1.70 (S1) and RM1.58 (S2) while overhead resistance levels are at RM1.96 (R1) and RM2.06 (R2).

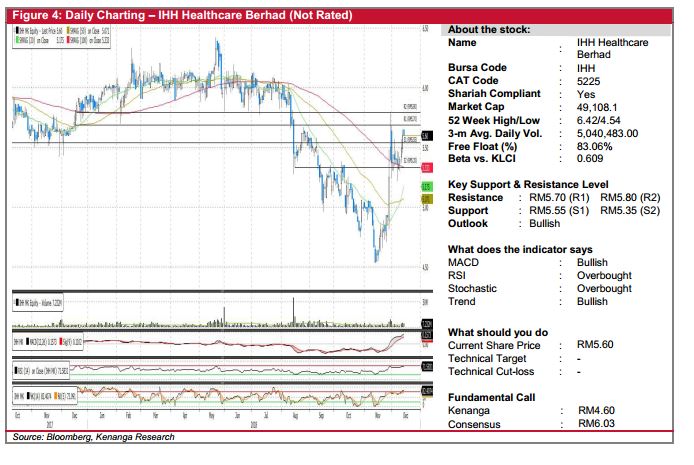

IHH (Not Rated)

• IHH closed flat at RM5.60 yesterday.

• Chart-wise, the share has been on a rally since early-November, breaking above all key SMAs. Recent share price has been trading above its key SMAs which could indicate a shift in momentum.

• Coupled with a “Golden-cross” from the 20 and 50-day SMAs, we believe that there could be a shift in its underlying trend.

• Should buying momentum continue, we look towards RM5.70 (R1) and RM5.80 (R2) as resistances. Conversely, support levels can be identified at RM5.55 (S1) and RM5.35 (S2) which could serve as attractive entry points for keen investors.

Source: Kenanga Research - 14 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

DRBHCOM2024-11-26

DRBHCOM2024-11-26

DRBHCOM2024-11-26

IHH2024-11-26

IHH2024-11-26

IHH2024-11-26

IHH2024-11-25

DRBHCOM2024-11-25

IHH2024-11-25

IHH2024-11-25

IHH2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

IHH2024-11-22

IHH2024-11-22

IHH2024-11-22

IHH2024-11-21

DRBHCOM2024-11-21

IHH2024-11-21

IHH2024-11-21

IHH2024-11-20

IHH2024-11-20

IHH2024-11-20

IHH2024-11-20

IHH2024-11-19

DRBHCOM2024-11-19

IHH2024-11-19

IHH2024-11-19

IHH2024-11-18

DRBHCOM2024-11-18

IHH2024-11-18

IHH