Kenanga Research & Investment

Hektar REIT - Merry Yield & Happy Yule

kiasutrader

Publish date: Mon, 30 Dec 2019, 09:29 AM

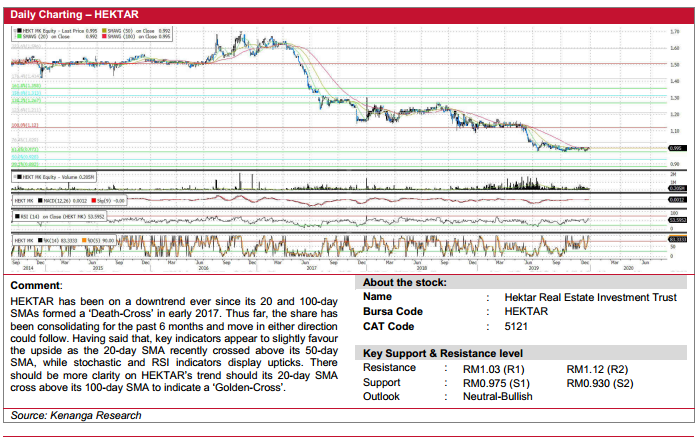

Trading Buy with a Fair Value of RM1.05. We like HEKTAR as dividends remain attractive at 7.0-6.7% in FY19-20E despite our conservative reversions assumptions of -3%/- 2% vs. actual of +0.8%. Targeting FY19-20E RNI of RM32.4- 30.8m. Long term positive on the Groups commitment to improve operational efficiency.

Declining YoY earnings, but worst-case dividend scenario suggests attractive 6.7% yield. Our worst-case scenario assumptions are based on -3%/-2% reversions over FY19-20 on lease expiries of 23% in FY19 and 20% in FY20 which we believe is extremely conservative as 9MFY19 reversion remained positive at +0.8%. Thus far, 9MFY19 top-line was weighed down by the tenancy remixing at Subang Parade and Segamat Central which should be completed by 2HFY20 targeting more family-centric outlets, while occupancy is expected to remain at 90%.

Working on improving operational efficiency. The latest 9MFY19 results saw higher opex (+9% Ytd-YoY) mainly from increased manpower and on-going maintenance initiatives. However, we believe this is a long-term positive for the Group which is embarking on efforts to lower operating cost by expanding energy and water efficiency initiatives and upgrading old equipment causing higher opex for now, but would eventually lower utilities and property maintenance cost over the longer run (refer to overleaf). For now, the group has already committed to lower portfolio energy consumption by 10% by 2022 (electricity cost currently makes up c.12% of total cost) which translates to annual cost savings of RM0.7m (est. 2.2% of FY20E CNP).

Looking to open malls in underserviced locations. We favour HEKTAR’s strategy of targeting malls outside the Klang Valley that are capable of being market leaders in their locality. As at 3QFY19, their smaller town malls have recorded strong positive reversions of 7.4% to 16.4% such as (i) Central Square, Kedah which recorded the highest positive rental reversions of +16.4%, (ii) Kulim Central with +15.7%, (iii) Wetex Parade, Johor with 14.7% reversion, and Mahkota Parade, Melaka at +7.4%. The Group plans to double its asset value to RM2.4bil by 2026 but high gearing of 0.44x suggest it can only borrow up to RM150m for an acquisition before hitting the REIT gearing limit of 0.50x, and may have to adopt a hybrid debt-equity funding which would also help improve liquidity.

Expecting FY19/FY20 RNI of RM32.4m/RM30.8m on conservative top-line assumptions of -3%/-2% reversions despite positive reversions YTD (+0.8%), while our RNI margins are also slightly below 9MFY19 (26%) at 25% each. Even on our conservative worst case assumptions, we believe HEKTAR is commanding attractive7.0%/6.7% yields.

Trading Buy with a FV of RM1.05. We believe HEKTAR warrants a buy at current levels, trading at a hefty 28% discount below its NTA/share of RM1.38, while our FV is based on a +3.0ppt to the 10- year MGS of 3.40% on FY20E DPS which is the highest among retail MREITs under our coverage (between +1.3ppt to +2.6ppt) due to HEKTAR’s suburban malls that do not fare as well as prime malls given oversupply conditions, high gearing and liquidity issues. However, given that most concerns have been accounted for, we believe investors may view HEKTAR as a flight for safety stock given the attractive yields.

Declining YoY earnings, but worst-case dividend scenario suggests attractive 6.7% yield. Our worst-case scenario assumptions are based on -3%/-2% reversions over FY19-20 on lease expiries of 23% in FY19 and 20% in FY20 which we believe is extremely conservative as 9MFY19 reversion remained positive at +0.8%. Thus far, 9MFY19 top-line was weighed down by the tenancy remixing at Subang Parade and Segamat Central which should be completed by 2HFY20 targeting more family-centric outlets, while occupancy is expected to remain at 90%.

Working on improving operational efficiency. The latest 9MFY19 results saw higher opex (+9% Ytd-YoY) mainly from increased manpower and on-going maintenance initiatives. However, we believe this is a long-term positive for the Group which is embarking on efforts to lower operating cost by expanding energy and water efficiency initiatives and upgrading old equipment causing higher opex for now, but would eventually lower utilities and property maintenance cost over the longer run (refer to overleaf). For now, the group has already committed to lower portfolio energy consumption by 10% by 2022 (electricity cost currently makes up c.12% of total cost) which translates to annual cost savings of RM0.7m (est. 2.2% of FY20E CNP).

Looking to open malls in underserviced locations. We favour HEKTAR’s strategy of targeting malls outside the Klang Valley that are capable of being market leaders in their locality. As at 3QFY19, their smaller town malls have recorded strong positive reversions of 7.4% to 16.4% such as (i) Central Square, Kedah which recorded the highest positive rental reversions of +16.4%, (ii) Kulim Central with +15.7%, (iii) Wetex Parade, Johor with 14.7% reversion, and Mahkota Parade, Melaka at +7.4%. The Group plans to double its asset value to RM2.4bil by 2026 but high gearing of 0.44x suggest it can only borrow up to RM150m for an acquisition before hitting the REIT gearing limit of 0.50x, and may have to adopt a hybrid debt-equity funding which would also help improve liquidity.

Expecting FY19/FY20 RNI of RM32.4m/RM30.8m on conservative top-line assumptions of -3%/-2% reversions despite positive reversions YTD (+0.8%), while our RNI margins are also slightly below 9MFY19 (26%) at 25% each. Even on our conservative worst case assumptions, we believe HEKTAR is commanding attractive7.0%/6.7% yields.

Trading Buy with a FV of RM1.05. We believe HEKTAR warrants a buy at current levels, trading at a hefty 28% discount below its NTA/share of RM1.38, while our FV is based on a +3.0ppt to the 10- year MGS of 3.40% on FY20E DPS which is the highest among retail MREITs under our coverage (between +1.3ppt to +2.6ppt) due to HEKTAR’s suburban malls that do not fare as well as prime malls given oversupply conditions, high gearing and liquidity issues. However, given that most concerns have been accounted for, we believe investors may view HEKTAR as a flight for safety stock given the attractive yields.

OTHER POINTS

Initiatives to improve opex. Key initiatives include retrofitting the air-conditioning and mechanical ventilation (ACMV) system at Subang Parade, replacing old chillers pumps and cooling towers that lack efficiency while upcoming efforts planned include installing heat-repellent materials in the building to minimise excessive air conditioning, managing lighting effectively installing solar panels and rain water harvesting.

Source: Kenanga Research - 30 Dec 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments