Kenanga Research & Investment

Daily technical highlights – (RGB, VITROX)

kiasutrader

Publish date: Thu, 30 Jan 2020, 09:42 AM

RGB International (Trading Buy, TP:RM0.225, SL: RM0.155)

- From a technical perspective, RGB International (RGB)’s share price (which closed at RM0.175 yesterday) is on the verge of breaking away from a negative sloping trendline after languishing inside a tight price range since early Sep 2019.

- Interestingly, there is renewed interest from investors in accumulating RGB shares. Trading activity in the stock is on the rise with daily average trading volume increasing from 2.2m shares last week to 3.2m shares so far this week.

- A breakout on the upside could lift the share price to our resistance targets of RM0.225 (R1) and RM0.255 (R2). This represents potential returns of 28.6% and 45.7%, respectively.

- In terms of downside risk, we have set the support levels at RM0.155 (S1) and RM0.135 (S2), which are 11.4% and 22.9% below its last traded price, respectively.

- Fundamentally, RGB has shown better sequential quarterly earnings, with net profit rising from RM6.7m in 1Q19 to RM7.2m in 2Q19 to RM11.2m in 3Q19. Assuming 4Q19 result (due to be out next month) is similar to 3Q19, estimated full-year earnings of RM36.3m would translate to an undemanding FY19 P/E of 7.4x.

- RGB – a leading supplier of electronic gaming machines and casino equipment as well as a key machine concession provider primarily in Malaysia, Singapore and IndoChina – is in a position to ride on the growing gaming industry in the region. It is also currently in a strong financial position with a net cash position of RM32.1m or 2.1 sen per share as of end Sep 2019.

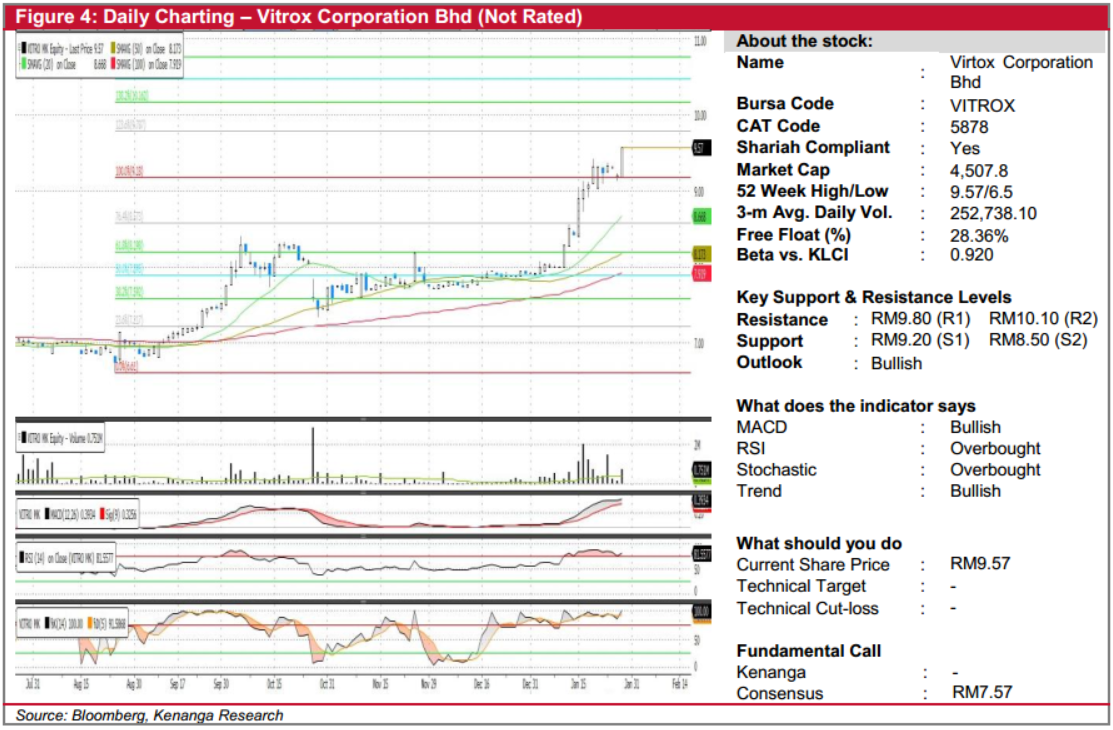

VITROX (Not Rated)

- VITROX gained 37.0 sen (+4.02%) to close at RM9.57 yesterday.

- Chart-wise, the stock has been on an uptrend since last year October.

- Yesterday’s candlestick closed higher with the formation of a “Marubozu” candlestick backed by above average trading volume. Coupled with key health SMAs, which gives us reason to believe the buying momentum would persist.

- Should buying momentum persist, overhead resistance are at RM9.80 (R1) and RM10.10 (R2).

- Conversely, support levels can be identified at RM9.20 (S1) and RM8.50 (S2).

Source: Kenanga Research - 30 Jan 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments