Daily technical highlights – (MI, AWC)

kiasutrader

Publish date: Thu, 30 Apr 2020, 11:51 AM

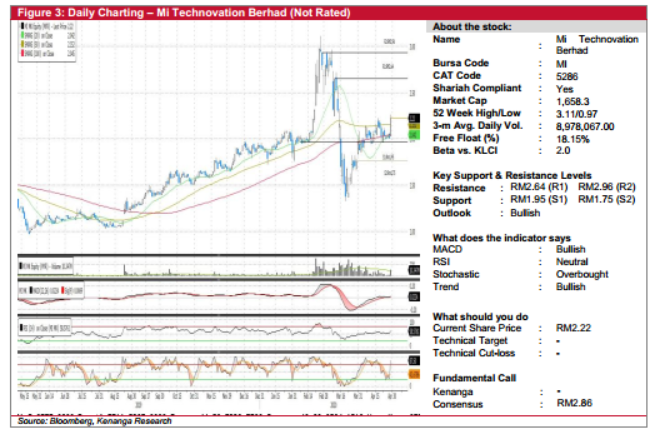

MI (Not Rated)

• MI rose 21.0 sen (+10.45%) to close at RM2.22 yesterday.

• Chart-wise, the stock has crossed above all the key SMAs yesterday, backed by higher-than-average trading volume.

• Coupled with bullish signal from MACD and uptick in momentum indicators, we believe that the stock may move higher.

• Resistance levels can be seen at RM2.64 (R1) and RM2.96 (R2).

• Conversely, downside supports can be identified at RM1.95 (S1) and RM1.75 (S2).

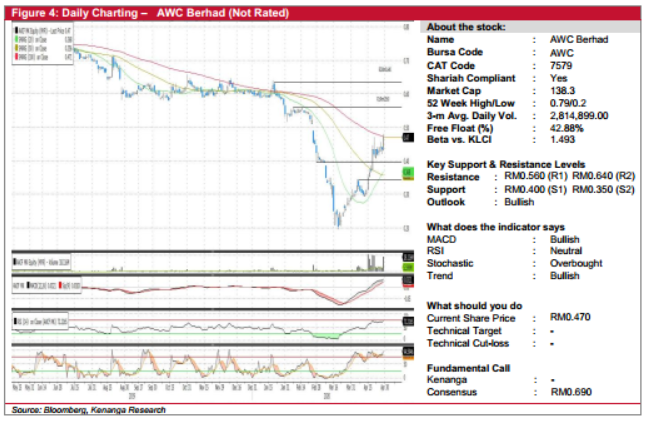

AWC (Not Rated)

• Yesterday, AWC gained 3.5 sen (+8.05) to end at RM0.470.

• Chart-wise, the stock continued to close higher after breaking above 20 and 50-days SMAs lines last week, supported by higher-than-average trading volumes.

• Given the bullish MACD signal, we believe that there may be more upside.

• From here, overhead resistance is seen at RM0.560 (R1) and RM0.640 (R2).

• Conversely, support levels can be identified at RM0.400 (S1) and RM0.350 (S2).

Source: Kenanga Research - 30 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024