Kenanga Research & Investment

Daily Technical Highlights – (HEXTAR, INARI)

kiasutrader

Publish date: Tue, 02 Jun 2020, 09:15 AM

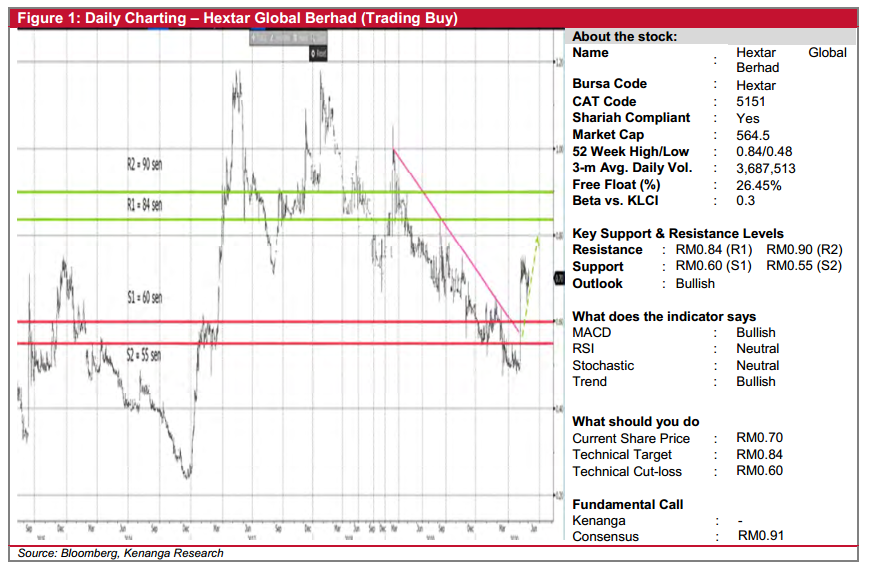

Hextar Global Bhd (Trading Buy, TP: RM0.84, SL: RM0.60)

- Hextar Global offers promising fundamental prospects as the Group is set to ride on its exposure in the food/plantation industry (via its agrochemicals business) and healthcare sector (as a manufacturer and distributor of healthcare disposable products, such as wet wipes, cotton-based products, sanitary towels and tissue products).

- Its recently released result for the first quarter ended Mar 2020 showed net profit surging to RM9.5m (+56% YoY and +22% QoQ) as revenue jumped to RM104.6m (+28% YoY and +26% QoQ).

- This comes after the Group has completed a related party acquisition of a 100% stake in Hextar Chemicals Limited (HCL) for RM596.8m (which was settled via the issuance of new Hextar Global shares at RM0.81 per share and RM17.9m in cash) in April 2019.

- Meanwhile, the Company has been buying back its own shares from 17 Mar to 30 Apr this year, scooping up 6.7m shares at an average price of 53 sen apiece.

- Technically speaking, Hextar Global shares are looking interesting. After breaking out from a negative sloping trendline that stretches back to a share price high of RM1.05 in mid-Mar 2019, a trend reversal pattern could be in the works.

- We reckon the stock – which is currently in a consolidation mode after hitting a recent high of RM0.75 – is poised to resume its positive momentum to reach our immediate resistance target of RM0.84 (R1). A convincing breakout will then push the share price to challenge our next resistance barrier of RM0.90 (R2).

- This represents potential upsides of 20% and 29%, respectively from yesterday’s closing price of RM0.70.

- On the downside, we have placed our support levels at RM0.60 (S1) and RM0.55 (S2), translating to downside risks of 14% and 21%, respectively.

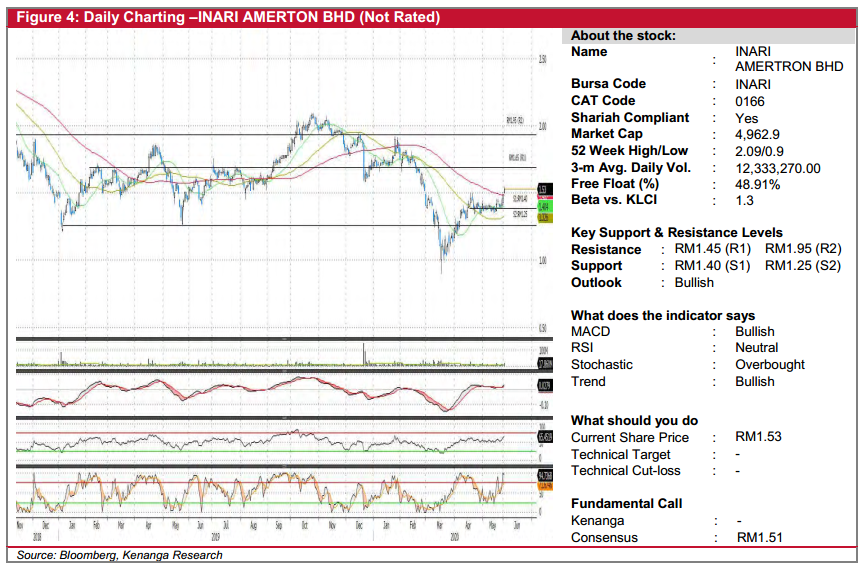

INARI (Not Rated)

- INARI gained 4.0 sen (+2.68%) to close at RM1.53 yesterday.

- Chart-wise, the stock has been consolidating since mid-April this year.

- Yesterday’s closed higher with the formation of a bullish candlestick, which closed above the 100-Day moving average indicating a potential trend reversal should the upward momentum persist.

- Should the stock continue heading upward, overhead resistance is seen at RM1.65 (R1) and RM1.95 (R2).

- Conversely, support levels can be identified at RM1.40 (S1) and RM1.25 (S2).

Source: Kenanga Research - 2 Jun 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

INARI2024-11-21

INARI2024-11-20

HEXTAR2024-11-20

HEXTAR2024-11-20

INARI2024-11-19

HEXTAR2024-11-19

HEXTAR2024-11-19

INARI2024-11-18

INARI2024-11-15

HEXTAR2024-11-15

HEXTAR2024-11-15

HEXTAR2024-11-14

HEXTAR2024-11-14

HEXTAR2024-11-14

HEXTAR2024-11-14

INARI2024-11-14

INARI2024-11-14

INARIMore articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments