Kenanga Research & Investment

Daily technical highlights – (SCGM, MAGNI)

kiasutrader

Publish date: Fri, 03 Jul 2020, 09:43 AM

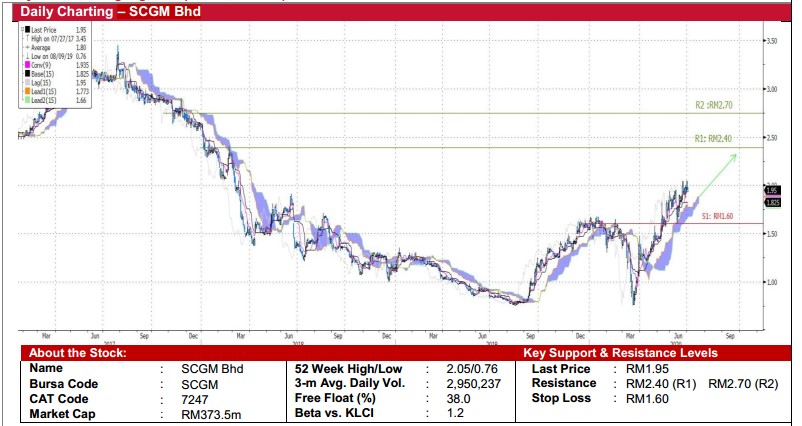

SCGM Bhd (Trading Buy)

- SCGM’s share price has made a comeback after dropping from a 3-year high of RM3.35. This follows the group’s strengthening fundamentals arising from: (i) its shift to a new facility at Kulai Plant at the end of April last year, which resulted in better operational efficiency (via automation), (ii) obtaining better margins by tapping into the healthcare segment (PP products i.e Face Shield and Face Mask) recently, and (iii) shifting into higher margins customised products.

- Yesterday, the stock declined marginally (-0.51%) to end at RM1.95 as it continues to display signs of a healthy uptrend based on the Ichimoku Cloud. We thus expect a likely breakout towards our resistance target of RM2.40 (R1) and RM2.70 (R2), which translates to potential upsides of 23% and 38%, respectively.

- Our stop loss is positioned at RM1.60 (-18% from its last price).

- From a fundamental perspective, the group has turned around with a profit of RM17.3m in FY20 (vs. a net loss of RM5.1m previously). In addition, we believe the group will be able to sustain its better margins going forward as seen in its 4Q20 results (which saw margin rising 8.5bps QoQ to 15.8%)

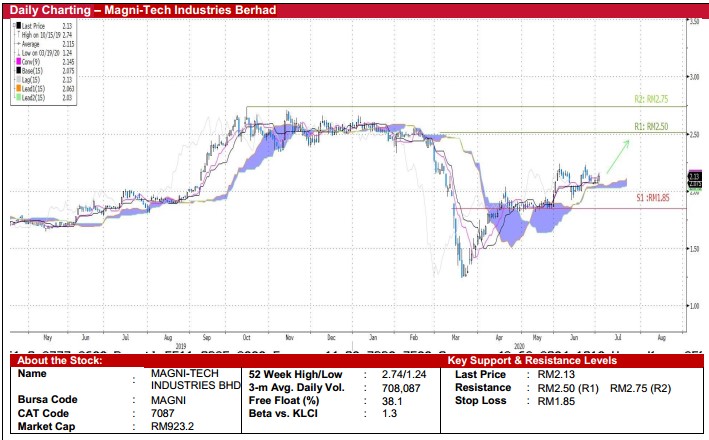

Magni-Tech Industries Berhad (Trading Buy)

- MAGNI is seen as a beneficiary of better sales from its major customer Nike (U.S), which announced in its quarterly statement that it is experiencing strong growth in China. The group also stands to benefit from a stronger USD.

- The stock has been staging a recovery since late March and was up 3.0 sen to end at RM2.13 (+1.4%) yesterday.

- Based on Ichimoku Cloud indications, the stock has experienced a “Kumo Twist” recently, which serves as an uptrend confirmation. Should the trend persist, we expect the share to test its next resistance at RM2.50 (+17% potential upside) (R1). A further breakout may lift the stock to the next resistance level of RM2.75 (+29%) (R2).

- Our stop loss level is set at RM1.85 (or 13% downside risk).

- Fundamentally, MAGNI – which delivered a net profit of RM121.8m (+18.7% YoY) in FYApr20 – is currently trading at a low FY20 PER of 7.8x, and sits on a net cash and short-term investments of RM276.0m (or 63.0 sen per share)

Source: Kenanga Research - 3 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments