Rep20200821_Technical-REVENUE-AME-200821-(Kenanga).pdf

kiasutrader

Publish date: Fri, 21 Aug 2020, 12:26 PM

Revenue Group Bhd (Trading Buy)

• REVENUE is a payment solution platform which offers: (i) EMV smart card technology, (ii) terminal management system, (iii) loyalty system, (iv) consumer behavioural management system, (v) web-based payment system, and (vi) payment transaction management system.

• Given the intense competition in the merchant service platform, the group intends to create new business segments and has purchased a 51% stake in Buy Mall (which operates an online marketplace that provides procurement services for consumers goods from overseas e-commerce websites). Also, in the pipeline is the acquisition of a 40% stake in Wannatalk that the group plans to leverage on its facial recognition centred products and services to enhance its payment security features.

Chart-wise, the share price has been consolidating with an upward bias since early April this year. On the back of a bullish MACD crossover and higher than average trading volume, we thus expect the shares to continue trending upwards based on our projected trend channel.

• With that, our overhead resistance levels are set at RM1.45 (R1) and RM1.53 (R2), which translates to upside potentials of 8% and 14%, respectively.

• Our stop loss is pegged at RM1.25 (-7% downside risk).

• Based on consensus estimates, the group is expected to generate net profit of RM10.0m in FY20 and RM13.9m FY21. This translates to forward PERs of 51x and 37x, respectively

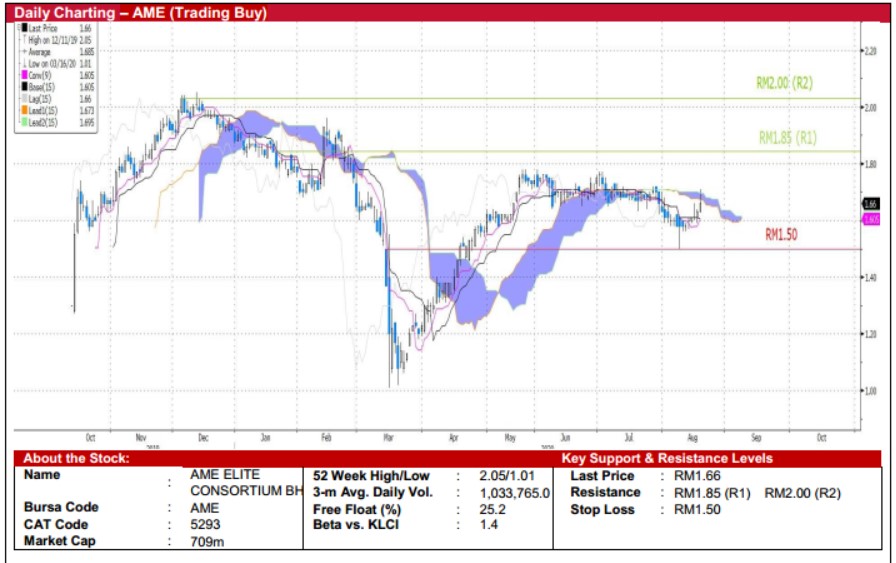

AME Elite Consortium (Trading Buy)

• AME is an industrial property development specialist. The group stands to benefit from the potential inflows of FDI given the escalating US-China tension. This is seen in its resilient earnings at RM14.8m (flat QoQ) in 4QFY20 despite the on-going pandemic, which brought its FY20 result to RM63.7m in its first full financial year since listing.

• The group has recently entered into a JV agreement with Baozhou New Energy Technology Sdn Bhd to provide businesses with a one-stop solution and service provider for solar energy systems, engineering, procurement, construction and commissioning (“EPCC”) of renewable energy projects. The move would better provide AME with a more complete suite of industrial property development solutions.

• Ichimoku-wise, the stock appears to be challenging a “Kumo Breakout”, backed by above-average trading volume. Should the buying momentum persist, we believe a trend reversal could be in sight following signs of a “Kumo Twist” too. • With that, our resistance levels are set at RM1.85 (R1) and RM2.00 (R2), which represent upside potentials of 11% and 20%, respectively.

• Our stop loss level is set at RM1.50 (or 10% downside risk).

• Based on consensus estimates, the group’s net incomes are projected to come in at RM60.1m (-9% YoY) in FY21E and at RM74.8m (+24% YoY) in FY22E. This represents PERs of 12x and 10x, respectively

Source: Kenanga Research - 21 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024