Daily Technical Highlights - (BAUTO, TALIWRK)

kiasutrader

Publish date: Thu, 24 Sep 2020, 10:09 AM

Bermaz Auto Bhd (Trading Buy)

• BAUTO offers yield-seeking investors a prospective dividend return of 5% in FY ending April 2021 based on consensus DPS estimate of 7.0 sen.

• According to the latest consensus view, the Group is forecasted to make net profit of RM124m in FY April 2021 and RM156m in FY April 2022. This translates to forward PERs of 13x and 10x, respectively.

• For 1QFY21, its net earnings came in at RM9.2m (-82% YoY) as overall performance was hit by business disruptions arising from the Covid-19 pandemic.

• Nevertheless, driven by the sales tax exemptions granted by the government (which will last until end-2020) to jump-start the automobile industry, BAUTO – as a distributor of Mazda vehicles in Malaysia (and the Philippines) – is already seeing a recovery in the sales of Mazda passenger cars locally, which jumped to 1,205 units in August (+21% YoY) thus lifting its YTD sales to 6,612 units (-21% YoY).

• Technically speaking, the stock has recently overcome a descending trendline that stretches back to July last year, suggesting that a share price rebound could be on the cards.

• That said, we reckon BAUTO shares may climb towards our resistance thresholds of RM1.56 (R1) and RM1.74 (R2). This represents upside potentials of 11% and 24%, respectively.

• Our stop loss level is pegged at RM1.27 (or 9% downside risk).

Taliworks Corporation Bhd (Trading Buy)

• TALIWRK – which has rewarded its shareholders with annual DPS of 4.8 sen in the last four years – is projected to declare DPS of 6.7 sen each for FY20 and FY21 per consensus guidance. This translates to an attractive dividend yield of 8.0% based on yesterday’s closing price of RM0.835.

• So far this year, the Company has declared cumulative DPS of 3.3 sen in 1HFY20 (comprising 1.65 sen each in 1Q and 2Q), which is more than 1HFY19’s dividend payments of 2.4 sen.

• With net cash & investments backing of RM103.4m (or 5.1 sen per share) as of end-June 2020, the healthy balance sheet position will support TALIWRK’s ability to pay consistent dividends going forward.

• The Group, which is involved in the water treatment, supply & distribution and highway & toll management businesses, is forecasted to make net profit of RM64m in FY20 and RM57m in FY21 according to consensus expectations. Its bottomline came in at RM11.7m (+9% YoY) in 2QFY20, taking 1HFY20’s earnings to RM27.6m (+23% YoY).

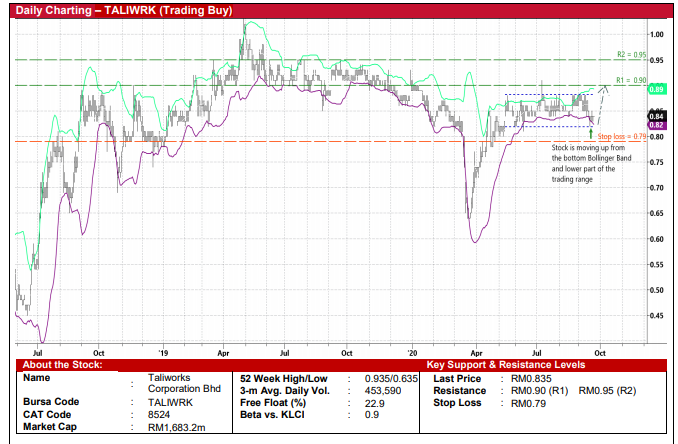

• On the chart, the stock has been in a consolidation mode after staging a recovery from the March’s trough level.

• Currently hovering around the bottom of its trading range, we reckon TALIWRK shares will probably show an upward bias in the near term.

• The positive technical momentum is also supported by its share price cutting above the lower boundary of the Bollinger Bands recently.

• With that, the stock could rise to test our resistance thresholds of RM0.90 (R1; 8% upside potential) and RM0.95 (R2; 14% upside potential) ahead.

• We have placed our stop loss level at RM0.79 (or 5% downside risk).

Source: Kenanga Research - 24 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024