Daily technical highlights – (EATECH, PRLEXUS)

kiasutrader

Publish date: Thu, 17 Dec 2020, 09:01 AM

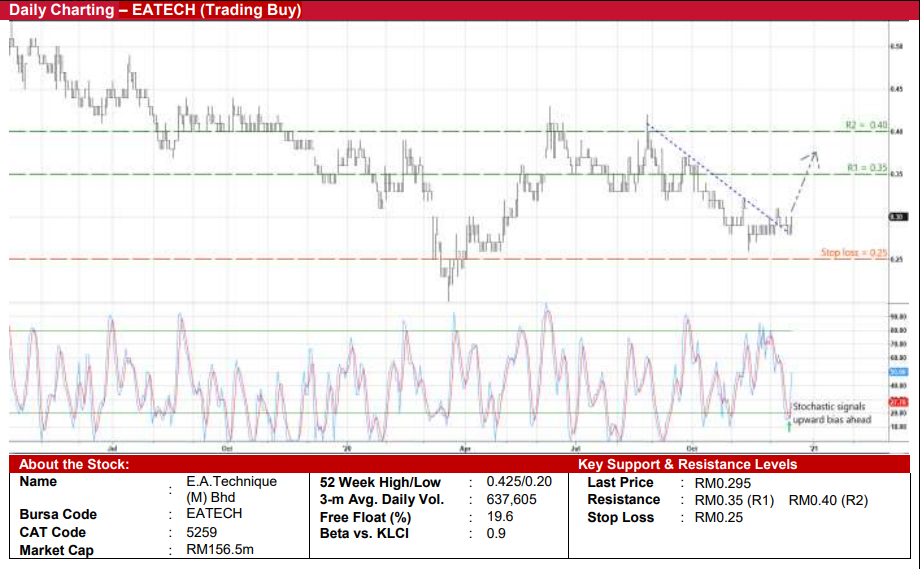

E.A. Technique (M) Bhd (Trading Buy)

• A technical rebound could be in the offing for EATECH after its share price slid from a recent high of RM0.42 in late August to end at RM0.295 yesterday.

• On the chart, the stock has extended its recovery from a low of RM0.26 in mid-November to overcome a short-term downward sloping trendline recently.

• Coupled with the positive stochastic signal – which saw the %K line crossing above the %D line in the oversold territory – EATECH shares will likely ride on an upward bias ahead.

• On the way up, we reckon the share price could challenge our resistance targets of RM0.35 (R1; 19% upside potential) and RM0.40 (R2; 36% upside potential).

• Our stop loss level is pegged at RM0.25 (or 15% downside risk).

• Fundamentally, EATECH (an owner and operator of marine vessels) is in the business of providing marine transportation, offshore storage of oil & gas and port marine services.

• The Group slipped into the red with a net loss of RM65.8m for the nine-month ended September 2020 (compared with a net profit of RM24.1m previously) mainly attributable to lumpy accounting items, comprising provisions arising from arbitration costs, impairment loss on vessels and foreign exchange losses.

• Forward earnings will be underpinned by an existing order book of RM544m with an additional RM323m for extension period as of end-September this year.

Prolexus Bhd (Trading Buy)

• PRLEXUS – which has ventured into the manufacturing of reusable fabric face masks in March this year to complement its existing core business of sportswear apparels manufacturing – just reported net profit of RM15.2m in 1QFY21 (up from RM2.0m previously) on the back of strong contribution from fabric face masks.

• The Group also saw its net cash holdings rising in tandem from RM9.8m as of end-July 2020 to RM57.3m as of end-October 2020, which works out to be 32 sen per share (or about one-fifth of the current share price).

• On the chart, after soaring from a low of RM0.64 on 10 September to peak at RM1.95 on 20 October this year, the stock subsequently pulled back and entered into a consolidation phase. This, in turn, led to the emergence of a pennant formation, which is seen as a bullish continuation pattern.

• With the share price still treading above the 38.2% Fibonacci retracement line, PRLEXUS could break away to resume its upward trajectory soon.

• When the buying momentum returns, the stock is expected to climb towards our resistance thresholds of RM1.72 (R1; 10% upside potential) and RM1.85 (R2; 19% upside potential).

• We have placed our stop loss price at RM1.40 (or 10% downside risk from its last traded price of RM1.56).

Source: Kenanga Research - 17 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024