Daily technical highlights – (LAGENDA, KPOWER)

kiasutrader

Publish date: Fri, 29 Jan 2021, 12:33 PM

Lagenda Properties Bhd (Trading Buy)

• LAGENDA is a company which is involved in the development and sales of affordable housing segment.

• The company, formerly known as D.B.E Gurney Resources (which was involved in the poultry business), has entered into an MOU with BDB Land Sdn Bhd (a unit of Bina Darulaman Bhd) to build affordable housing.

• Since its business transformation, the group’s 3QFY20 revenue has increased to RM194.7m (+824% QoQ) following the acquisition of new subsidiaries namely BESB, RUSB and YWTSB with contributions from the group’s affordable housing segment. Meanwhile, the group’s net income increased to RM49.8m (+915% QoQ) in tandem with the higher revenue.

• Chart-wise, the stock has been on an uptrend since March last year while testing its 20-day SMA. Given the healthy uptrend with the shorter SMA continuing to tread above the longer term SMA, we thus expect the uptrend to persist.

• Based on our Fibonacci projections, our resistance levels are set at RM1.68 (R1; +11% upside potential) and RM1.80 (R2; +19% upside potential).

• Meanwhile, our stop loss is set at RM1.35 (-11% downside risk).

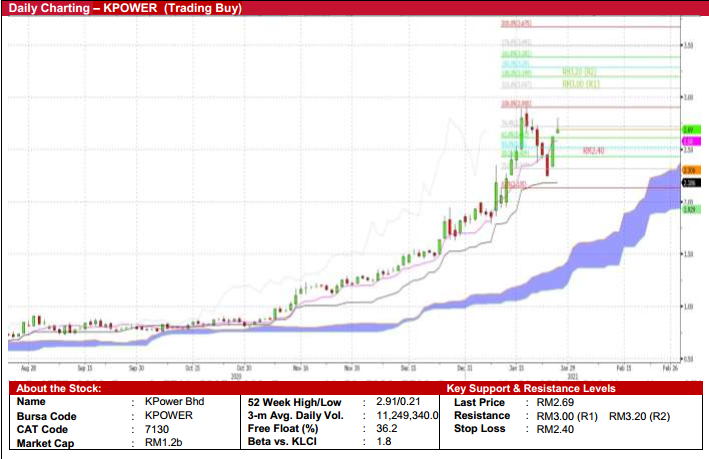

KPower Bhd (Trading Buy)

• KPOWER is a company that is involved in the: (i) energy & utilities, (ii) property, (iii) logistics, and (iv) healthcare & technologies sectors.

• On 27th January 2021, the group has entered into an Memorandum of Agreement (MOA) with Public Investment Bank Berhad (PIBB) to provide the financing and installation of solar photovoltaic systems to PIBB customers in relation to the net energy metering scheme, which is viewed positively.

• QoQ, the group’s revenue has increased to RM57.1m (+44% QoQ) in 1QFY21 due to the additional construction works and preliminary works from new projects in Laos PDR and Nepal. Meanwhile, its net income increased marginally to RM8.1m (+11% QoQ).

• Ichimoku-wise, the chart has been showing an upward continuation pattern as the stock continues to trade above the “Bullish Kumo Clouds”. With the bullish Kumo Clouds pattern still intact, we thus expect the uptrend to continue.

• With that, based on our Fibonacci projections, our key resistance levels are set at RM3.00 (R1; +12% upside potential) and RM3.20 (R2; +19% upside potential).

• Meanwhile, our stop loss is pegged at RM2.40 (-11% downside risk).

Source: Kenanga Research - 29 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024