Daily technical highlights – (ANCOM, SPRING)

kiasutrader

Publish date: Fri, 05 Feb 2021, 11:16 AM

Ancom Group Bhd (Trading Buy)

• ANCOM is a company that is engaged in the manufacturing, trading and sale of agricultural and industrial chemical products.

• We expect the group to benefit from rising CPO prices which in turn will lead to an increase in demand for its agrichemical products. The group is also investing in three new customised lines for its agrichemical division, which we view positively for its incremental contributions to the group’s bottom-line in in the near term.

• QoQ, the group has seen a marginal improvement in revenue at RM357.3m (+3% QoQ) in 2QFY21 due to higher contributions from its agricultural chemicals. Meanwhile, its net profit doubled to RM6.2m (+200% QoQ) on the back of the improvement in its industrial chemicals division.

• Chart-wise, the stock has been on an uptrend since March last year. Given that all key SMAs continue to display a rising trend, we thus expect the stock to extend its upward momentum ahead.

• Based on our Fibonacci projections, our resistance levels are set at RM1.20 (R1; +12% upside potential) and RM1.30 (R2; +21% upside potential).

• Meanwhile, our stop loss is set at RM0.95 (-11% downside risk).

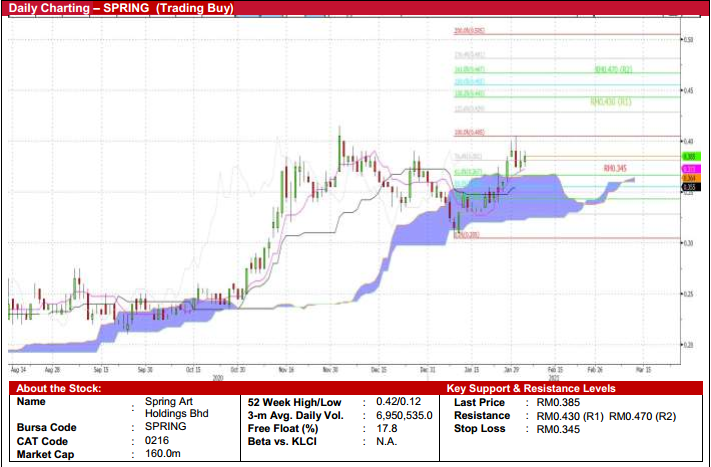

Spring Art Holdings Berhad (Trading Buy)

• SPRING is involved in the production of ready-to-assemble (RTA) furniture.

• The group is a beneficiary of the work-from-home trend. It has recently launched a new brand Elisa Home Sdn Bhd in November last year to cater to the online sales in the local market.

• QoQ, the group has achieved a revenue of RM17.3m (+308% QoQ) in 3QFY20 after resolving its logistic issues to ship its products to the U.S. And given the pick-up in productivity post MCO, the group registered a net profit of RM3m in 3QFY20 (from a net profit of RM159k previously).

• Ichimoku-wise, the stock has recently found support near the bottom of the “Bullish Kumo Clouds”. As the Kumo Clouds continue to indicate a positive upward bias, we thus expect the uptrend to persist.

• With that, based on our Fibonacci projections, our key resistance levels are set at RM0.430 (R1; +12% upside potential) and RM0.470 (R2; +22% upside potential).

• Meanwhile, our stop loss is pegged at RM0.345 (-10% downside risk).

Source: Kenanga Research - 5 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

ANCOMNY2024-11-21

ANCOMNY2024-11-20

ANCOMNY2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-18

ANCOMNY2024-11-18

ANCOMNY2024-11-18

ANCOMNY2024-11-18

ANCOMNY2024-11-18

ANCOMNY2024-11-15

ANCOMNY2024-11-14

ANCOMNY2024-11-13

ANCOMNYMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024