Daily technical highlights – (ARBB, SOLUTN)

kiasutrader

Publish date: Tue, 09 Feb 2021, 11:19 AM

ARB Bhd (Trading Buy)

• From timber processing previously, ARBB has now ventured into the information technology (IT) business, focussing on Enterprise Resource Planning (ERP) and Internet of Things (IoT) system solutions.

• The business transformation initiative has borne fruits after the Group registered net profit of RM32.8m in FY Dec 19, up from RM4.2m the year before. And the earnings momentum continued in FY20 with ARBB’s bottomline coming in at RM23.7m (+8% YoY) for the nine-month period ended September 2020.

• In addition, its debt-free balance sheet is backed by cash holdings of RM26.9m (or 5.8 sen per share) as of end-September last year.

• On the chart, ARBB shares are currently hovering near a support line that stretches back to September last year. The stock is also eager to breach a descending trendline at this juncture.

• With the stochastic indicator showing the %K line just crossed above the %D line when both values were below the oversold level recently, there is a fair chance that the share price would stage a technical breakout ahead.

• That being the case, the stock could be on its way to test our resistance thresholds of RM0.32 (R1; 14% upside potential) and RM0.37 (R2; 32% upside potential).

• We have placed our stop loss price at RM0.24 (or 14% downside risk from yesterday’s close of RM0.28).

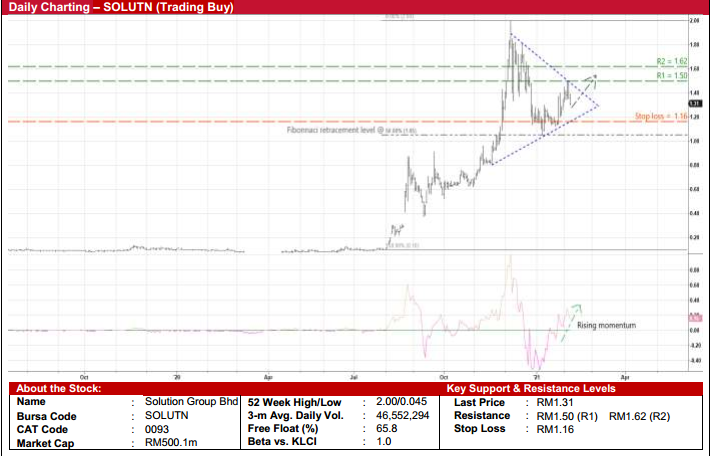

Solution Group Bhd (Trading Buy)

• SOLUTN – which is presently involved in 5 business segments, namely engineering equipment, industrial automation, biotechnology, industrial lubricants, metal fabrication & assembly – has proposed to diversify into pharmaceutical related businesses.

• Via its collaboration with CanSino from China, SOLUTN would be undertaking the fill and finish services for various types of vaccines (to be supplied by CanSino) and any other related business opportunities in the pharmaceutical industry.

• Meanwhile, in late January this year, SOLUTN signed a term sheet agreement with the Government of Malaysia for the supply of 3.5m doses of COVID-19 vaccine to the government.

• From a technical perspective, the share price uptrend – which started from a trough of RM0.10 in the beginning of August to a peak of RM2.00 in early December last year – remains intact following the bounce off from the 50% Fibonacci retracement level in early January this year.

• With the momentum indicator currently hovering above zero and still on the increase – signaling an upward bias – a breakout from a symmetrical triangle pattern is expected to lift the stock towards our resistance targets of RM1.50 (R1; 15% upside potential) and RM1.62 (R2; 24% upside potential).

• Our stop loss price is set at RM1.16 (or 11% downside risk).

Source: Kenanga Research - 9 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024