Daily technical highlights – (COASTAL, JOHOTIN)

kiasutrader

Publish date: Wed, 10 Feb 2021, 10:51 AM

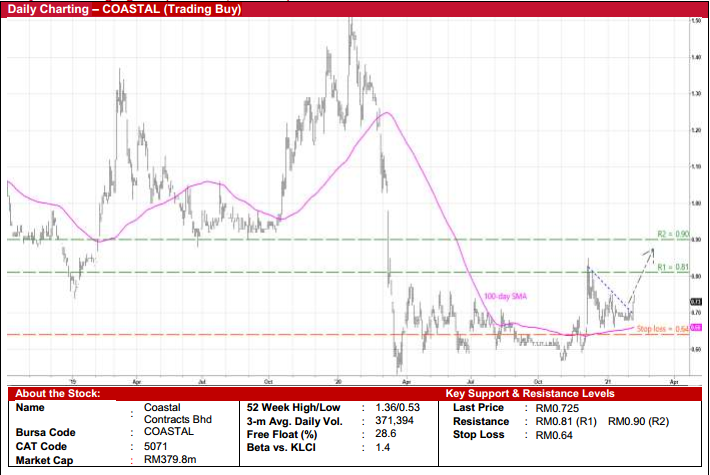

Coastal Contracts Bhd (Trading Buy)

• COASTAL derives its incomes primarily from shipbuilding, ship repair, vessel chartering and trading of marine support vessels, serving its clients in the offshore oil & gas industry, mining and commodities sectors.

• Sentiment on the stock could get a lift from positive news flows relating to: (i) rising oil prices with Brent oil price surging 56% since the beginning of November last year to USD61/barrel currently; and (ii) Petronas inviting bids for its tender to build 16 OSVs (offshore support vessels).

• In addition, in early February this year, the Group has announced its plan to venture into liftboat chartering business (via the acquisition of Elite Point Pte Ltd) and is also eyeing the wind farm renewable energy market.

• While currently loss-making (with net loss of RM8.2m in 1QFY21 ended September 2020), COASTAL’s balance sheet is backed by net cash holdings & short-term investments of RM196.5m (or 37.5 sen per share translating to slightly more than half of its existing share price) as of end-September 2020.

• From a technical perspective, after pulling back from a recent high of RM0.85 in early December last year, the stock has just overcome a short-term descending trendline.

• And with COASTAL shares still treading above the key 100-day SMA line, we reckon an extension of the price breakout is probable, which in turn could push the stock to test our resistance thresholds of RM0.81 (R1; 12% upside potential) and RM0.90 (R2; 24% upside potential).

• Our stop loss price is set at RM0.64 (12% downside risk from yesterday’s closing price of RM0.725).

Johore Tin Bhd (Trading Buy)

• JOHOTIN’s principal activity is in: (i) tin cans manufacturing; and (ii) food & beverage, namely the manufacturing and selling of milk and other related dairy products (comprising sweetened condensed milk, evaporated milk as well as milk powder).

• The Group’s bottomline has been growing annually over the past 2 years, almost doubling from RM25.7m in FY17 to RM47.5m in FY19. And despite the business disruptions triggered by the Covid-19 outbreak last year, its performance has remained resilient with net profit coming in at RM31.4m (-12% YoY) for the nine-month period ended September 2020 while balance sheet is backed by net cash holdings of RM17.2m (or 5.6 sen per share).

• On the chart, JOHOTIN’s share price will probably extend its upward trajectory inside a positive sloping channel as the stock currently hovers near the lower trendline.

• With the momentum indicator just crossed above zero and still on the increase, the shares are expected to trend higher ahead, possibly climbing towards our resistance thresholds of RM2.16 (R1; 14% upside potential) and RM2.30 (R2; 22% upside potential).

• We have pegged our stop loss price at RM1.66 (12% downside risk from its last traded price of RM1.89)

Source: Kenanga Research - 10 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024