Daily technical highlights – (TGUAN, SCGM)

kiasutrader

Publish date: Wed, 24 Mar 2021, 09:54 AM

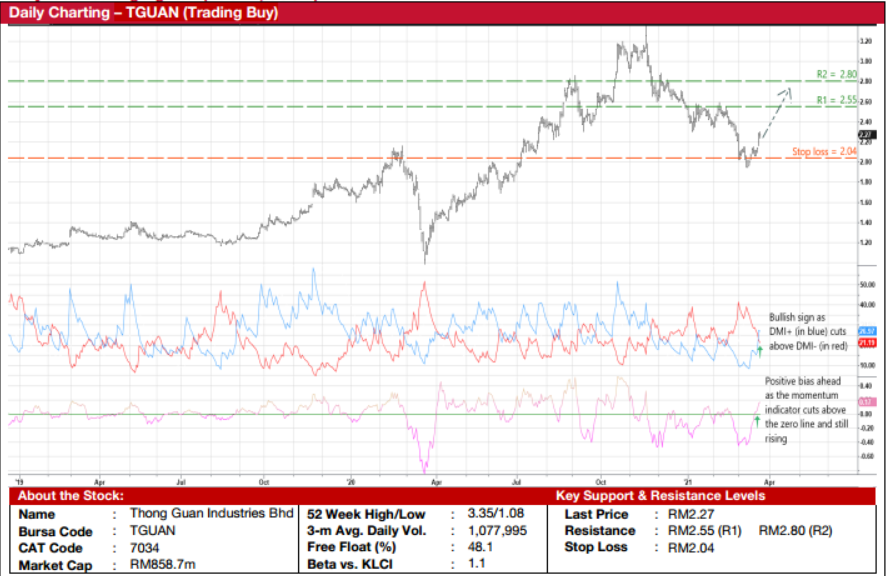

Thong Guan Industries Bhd (Trading Buy)

• TGUAN – which is principally a manufacturer of plastic packaging products (and is also involved in the manufacturing of food, beverages and other consumable products) – could benefit from margin expansions due to the lag effect arising from a faster increase in selling prices for the plastic packaging products as management factors in higher resin costs (being the main raw material input) following the swift crude oil price rally.

• As such, the Group will probably extend its earnings momentum in the coming quarters, after registering net profit of RM75.5m in FY Dec 2020, up 22% YoY to post its third consecutive year of annual earnings growth.

• Based on consensus net profit projections of RM83m for FY21 and RM94m for FY22, the stock is presently trading at undemanding forward PERs of 10.3x this year and 9.1x next year respectively, which sit somewhere between -1SD and -0.5SD from its historical mean.

• An added positive is the Group’s healthy balance sheet that is backed by net cash position of RM147.4m (translating to 39 sen per share or 17% of the current share price) as of end-December last year.

• On the chart, after tumbling from a peak of RM3.35 in mid-November last year to as low as RM1.95 about two weeks ago, TGUAN shares could be on the way to plot higher lows ahead.

• Essentially, given the positive signals triggered by the simultaneous crossovers in the DMI+ above the DMI- and the momentum indicator above the zero-line, the stock is set to stage a price reversal.

• We have pegged our resistance targets at RM2.55 (R1; 12% upside potential) and RM2.80 (R2; 23% upside potential) while our stop loss price is placed at RM2.04 (10% downside risk).

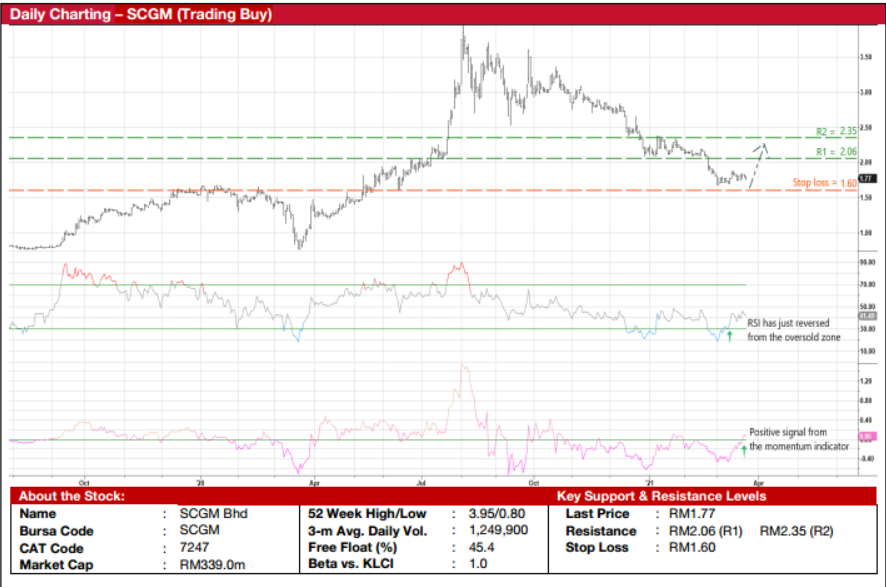

SCGM Bhd (Trading Buy)

• SCGM provides one-stop plastic packaging solutions to customers in Malaysia and overseas across diversified sectors, including the food & beverage, electronics and medical industries. And last year, the Group has ventured into the production and supply of medical-grade face shields and face masks for the domestic and export markets.

• In a rising resin prices environment following the crude oil price run-up, the Group is in a position to raise selling prices quicker than the raw material (namely resin) cost increases, which would then translate to better profit margins in the coming quarters.

• After posting first half earnings of RM17.9m (up almost 3-fold YoY), consensus is currently projecting SCGM to make net profit of RM33m for FY April 2021 and RM38m for FY April 2022. This translates to attractive forward PERs of 10.3x this year and 8.9x next year respectively, which are hovering around -2SD from its historical mean.

• Meanwhile, SCGM shares are due for a technical rebound following a 55% price plunge from a peak of RM3.95 in early August last year to close at RM1.77 yesterday.

• As the RSI climbs out from the oversold region and the momentum indicator continues to rise after cutting above the zeroline, the stock is expected to bounce up towards our resistance thresholds of RM2.06 (R1; 16% upside potential) and RM2.35 (R2; 33% upside potential).

• We have set our stop loss price at RM1.60 (10% downside risk).

Source: Kenanga Research - 24 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024