Daily Technical Highlights – (HIBISCS, ARMADA)

kiasutrader

Publish date: Wed, 28 Apr 2021, 09:15 AM

Hibiscus Petroleum Bhd (Trading Buy)

• The current share price weakness of HIBISCS – which has pulled back 15% from a peak of RM0.745 in mid-February this year – presents a timely trading buy opportunity for investors.

• On the chart, the stock has been riding an uptrend marked by a sequence of higher lows after recovering from a trough of RM0.25 in March last year.

• With the share price presently hovering near the positive sloping trendline and the 100-day SMA line (both of which have provided steady support on several occasions recently), its immediate downside risk appears limited.

• In the opposite direction, a probable run-up is expected to lift the stock towards our resistance thresholds of RM0.71 (R1; 13% upside potential) and RM0.77 (22% upside potential).

• Our stop loss price is set at RM0.56 (representing a 11% downside risk).

• As Malaysia’s first listed independent oil and gas exploration and production company, HIBISCS’ key activities are focused on oil producing fields with a portfolio of development and production assets located in Malaysia, United Kingdom and Australia.

• The group – which stands to benefit from elevated crude oil prices – is on the road to earnings recovery after registering net profit of RM12.0m (-77% YoY / +20% QoQ) in the quarter ended December 2020, taking its first half earnings to RM22.0m (- 67% YoY).

• Going forward, based on consensus expectations, HIBISCS is projected to make net earnings of RM75m in FY June 2021 and RM108m in FY June FY 2022. This translates to forward PERs of 16.7x this year and 11.6x next year, respectively.

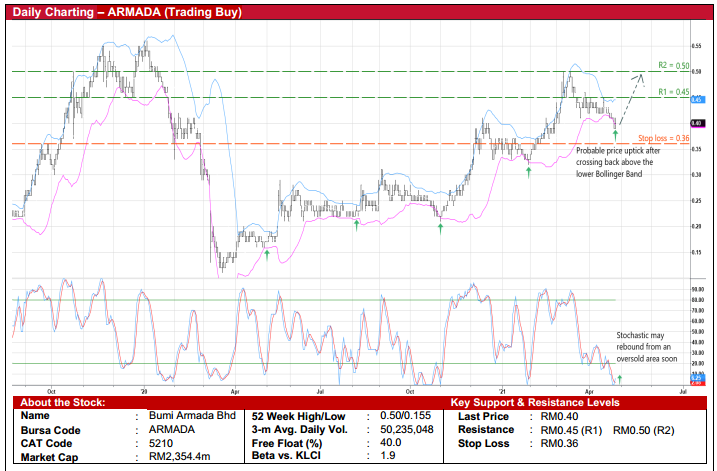

Bumi Armada Bhd (Trading Buy)

• ARMADA’s share price appears technically interesting following its tumble from a high of RM0.50 in mid-March this year to close at RM0.40 yesterday.

• With the stock on the verge of crossing back above the lower Bollinger Band after slipping below it previously and the stochastic indicator also looking eager to reverse from an oversold position, the shares are poised to stage an upward bias ahead.

• On the back of the anticipated rebound, the stock could climb towards our resistance thresholds of RM0.45 (R1; 13% upside potential) and RM0.50 (R2; 25% upside potential).

• We have placed our stop loss price at RM0.36 (or 10% downside risk).

• In terms of business activities, as an international offshore energy facilities and services provider, ARMADA offers offshore services via two business units – floating production & operations (FPO) and offshore marine services (OMS).

• Driven by a better performance from the FPO business, the group saw its 4QFY20 net profit jumping to RM144.1m (versus 4QFY19’s net loss of RM235.2m and 3QFY20’s net profit of RM85.6m), which then lifted the full-year bottomline to RM125.6m (+114% YoY) in FY December 2020.

• With its future earnings underpinned by an orderbook of RM16b as at end December last year, consensus is forecasting ARMADA to post net profit of RM428m in FY21 and RM448m in FY22. This implies forward PERs of 5.5x this year and 5.3x next year, respectively.

Source: Kenanga Research - 28 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

HIBISCS2024-11-23

ARMADA2024-11-22

ARMADA2024-11-22

HIBISCS2024-11-21

HIBISCS2024-11-20

HIBISCS2024-11-20

HIBISCS2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-18

ARMADA2024-11-18

ARMADA2024-11-18

HIBISCS2024-11-16

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

HIBISCS2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

HIBISCSMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024