Daily Technical Highlights – (YTL, YONGTAI)

kiasutrader

Publish date: Tue, 18 May 2021, 08:43 AM

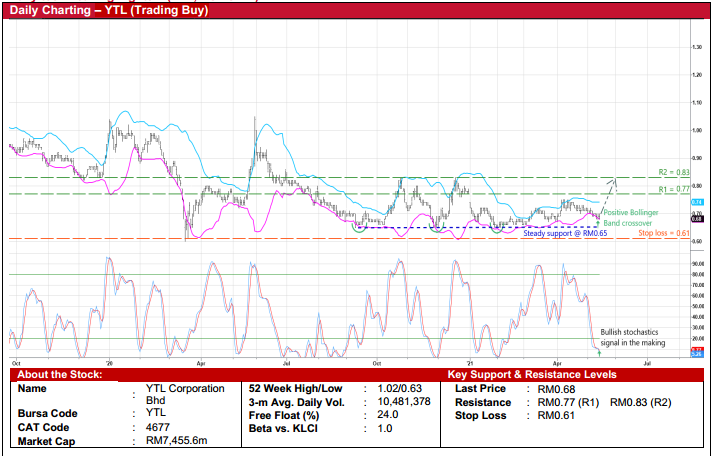

YTL Corporation Bhd (Trading Buy)

• A conglomerate with multiple businesses ranging from utilities, cement manufacturing & trading, construction, property investment & development, hotel operations to information technology & e-commerce, YTL has just unveiled its plans to streamline the cement business by merging the group’s operation under listed Malayan Cement Bhd (MCEMENT).

• Following its proposed injection of the cement and ready-mixed concrete businesses in Malaysia into MCEMENT for RM5.2b, YTL would be getting cash proceeds of RM2.0b, in addition to 375.5m shares and 466.7m preference shares in MCEMENT, which would then raise its stake (pre-conversion of the preference shares) to 78.6% in MCEMENT.

• In terms of earnings outlook, after logging net profit of RM17.4m (-47.1% YoY) in the first half ended December 2020, consensus is projecting that YTL’s bottomline will rebound to RM82.7m in FY June 2021 and RM220.3m in FY June 2022. This translates to forward PERs of 90.2x this year and 33.8x next year, respectively.

• Meanwhile, YTL shares will be added as a constituent in the MSCI Malaysia Index effective next Friday (28 May), which will then put the stock on the investment radar of a wider range of foreign funds.

• Technically speaking, the share price – which is currently treading close to a steady support line of RM0.65 that stretches back to September last year – is poised to bounce up after crossing back above the lower Bollinger Band while the stochastics indicator is turning positive on the back of an anticipated crossover by the %K line above the %D line in the oversold zone.

• An ensuing breakout could lift the stock towards our resistance thresholds of RM0.77 (R1; 13% upside potential) and RM0.83 (R2; 22% upside potential).

• Our stop loss price is pegged at RM0.61 (or 10% downside risk).

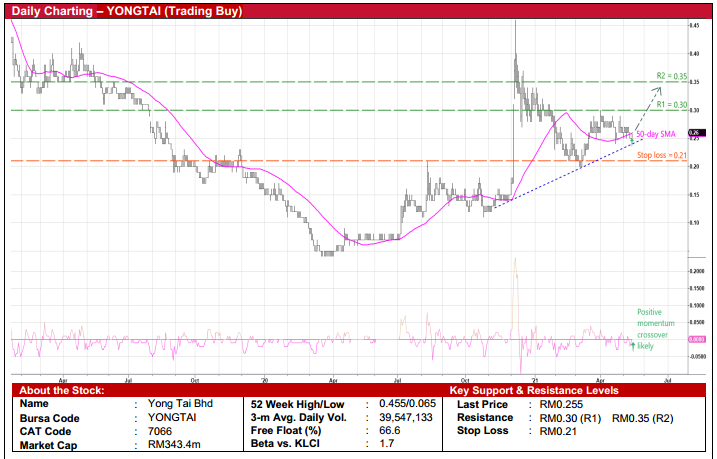

Yong Tai Bhd (Trading Buy)

• YONGTAI – whose core business is in tourism-related property development based in Melaka – is a potential beneficiary of rising gold price (which has climbed 10% since end-March this year to approximately USD1,850 per ounce currently).

• This follows the group’s venture into the gold mining business after entering into a mining agreement in late March this year whereby YONGTAI has been appointed to be the sole and exclusive mining operator to perform and undertake the exploration and exploitation works on an area covering 100 hectares located at Bukit Kenderak, Daerah Lipis in Pahang.

• From the group’s existing businesses, YONGTAI posted net profit of RM1.1m in the first half ended December 2020 versus 1HFY19’s net loss of RM5.9m.

• Technically speaking, the stock – which has charted higher lows since its rebound from a trough of RM0.11 in late October last year – will likely extend the uptrend pattern as the share price is on the verge of overcoming the 50-day SMA line while the momentum indicator is about to climb over the zero line.

• Continuing the upward trajectory, YONGTAI shares could advance to challenge our resistance targets of RM0.30 (R1; 18% upside potential) and RM0.35 (R2; 37% upside potential) going forward.

• We have set our stop loss price at RM0.21 (or 18% downside risk from the last traded price of RM0.255).

Source: Kenanga Research - 18 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024