Daily technical highlights – (TALIWRK, YTL)

kiasutrader

Publish date: Wed, 04 Aug 2021, 09:31 AM

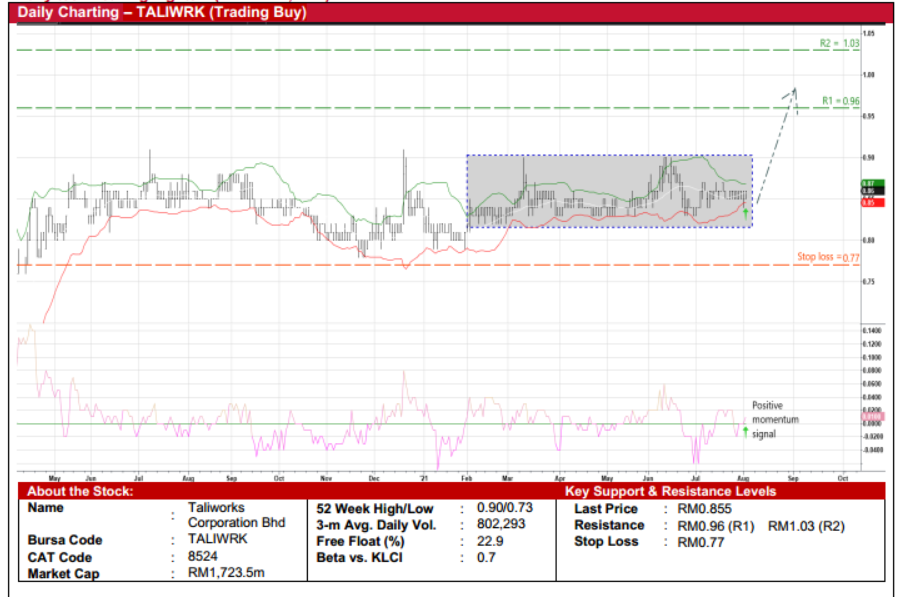

Taliworks Corporation Bhd (Trading Buy)

• TALIWRK shares will probably swing upwards soon after oscillating inside a rectangle pattern since February this year.

• This comes as the stock (after slipping below the Bollinger Band recently) has now crossed back above the lower band whilethe momentum indicator is on the rise following its crossover above the zero-line.

• On the back of the positive technical signals, the share price could shift higher towards our resistance thresholds of RM0.96(R1; 12% upside potential) and RM1.03 (R2; 20% upside potential).

• We have set our stop loss price at RM0.77 (or 10% downside risk).

• As an infrastructure group that derives recurring income from its businesses in operation & maintenance of water treatmentplant, highway & toll management, waste management, renewable energy and construction & engineering, TALIWRK hasrewarded its shareholders with consistent annual DPS income (of between 4.8 sen to 6.6 sen in the last five years).

• Going forward, based on consensus DPS forecasts of 6.7 sen each for FY December 2021 (of which 1.65 sen has alreadybeen paid YTD) and FY December 2022, the stock offers appealing prospective dividend yields of 7.8% p.a.

• In terms of profitability, after posting net profit of RM12.4m (-22% YoY) in the first quarter ended March 2021, consensus isprojecting the group to make net earnings of RM60.3m for FY December 2021 and RM65.5m for FY December 2022. Thistranslates to forward PERs of 28.6x this year and 26.3x next year, respectively.

• TALIWRK is also financially healthy with net cash holdings & investments of RM72.3m (or 3.6 sen per share) as of end-March2021.

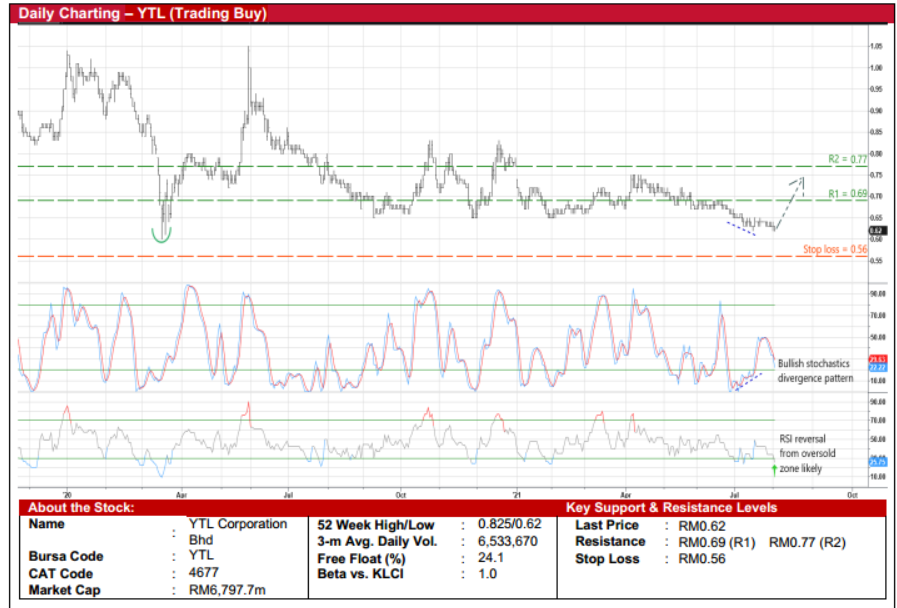

YTL Corporation Bhd (Trading Buy)

• After sliding to fresh lows recently, with the stock currently hovering near its March 2020 trough of RM0.58, YTL’s oversoldshare price is poised to stage a technical rebound ahead.

• On the chart, a bounce-up in the share price could be forthcoming following: (i) the appearance of bullish stochasticsdivergence pattern (where the %D line has formed rising bottoms in the oversold area as the share price slipped further), and(ii) an anticipated reversal of the RSI indicator from the oversold territory.

• With that, the stock will likely climb towards our resistance thresholds of RM0.69 (R1; 11% upside potential) and RM0.77 (R2;24% upside potential).

• Our stop loss price is set at RM0.56 (or 10% downside risk).

• A conglomerate with multiple businesses ranging from utilities, cement manufacturing & trading, construction, propertyinvestment & development, hotel operations to information technology & e-commerce, YTL posted net profit of RM39.8m (-36% YoY) for the nine-month period ended March 2021.

• Despite the soft YTD earnings performance, consensus is projecting that YTL’s bottomline will recover to RM228.3m in FYJune 2021 before increasing further to RM307.0m in FY June 2022, which translate to forward PERs of 29.8x this year and22.1x next year, respectively.

Source: Kenanga Research - 4 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024