Daily technical highlights – (ARMADA, AMBANK)

kiasutrader

Publish date: Thu, 26 Aug 2021, 09:51 AM

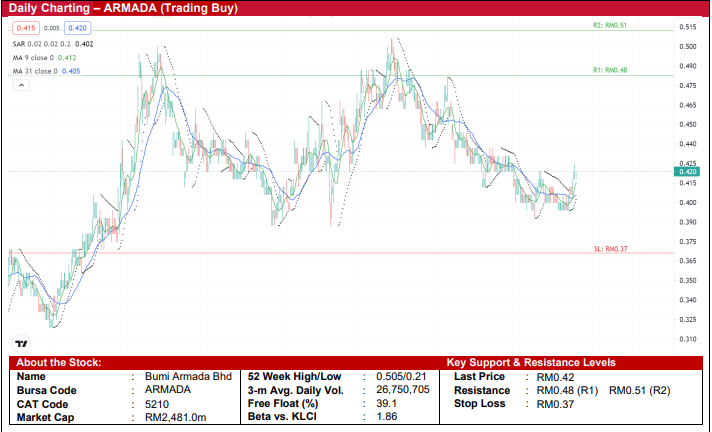

Bumi Armada Bhd (Trading Buy)

• Chart-wise, ARMADA’s share price has pulled back from a high of RM0.505 (in mid-June this year) to a low of RM0.39 (at the beginning of August 2021), representing a retracement of 23%.

• Since then, after bouncing up from a double-bottom pattern, the stock has recovered by 7.7% to close at RM0.42 yesterday, on track to reverse the series of lower highs and lower lows that started in mid-June.

• The upward momentum will likely persist based on the following technical signals: (i) the 9-day moving average has cut above the 31-day moving average and, (ii) the Parabolic SAR indicator is trending up.

• As such, ARMADA’s price could trend higher to challenge our resistance thresholds of RM0.48 (R1; 14% upside potential) and RM0.51 (R2; 21% upside potential).

• We have placed our stop loss price at RM0.37 (SL; 12% downside risk).

• Fundamentally, ARMADA has strategically positioned itself as an international offshore energy and facilities services provider that offers offshore services via two business units: (i) Floating Production and Operations (FPO), and (ii) Offshore Marine Services (OMS).

• ARMADA returned to profitability in 1QFY21 after reporting a net profit of RM162.8m (+172% QoQ) (versus a net loss of RM223.9m in 1QFY20), underpinned by lower operating cost.

• Going forward, consensus is expecting ARMADA to report a net profit of RM477.6m in FY21 and RM487.8m in FY22. This translates to forward PERs of 5.2x and 5.1x, respectively.

AMMB Holdings Bhd (Trading Buy)

• AMBANK’s stock price has retraced by 20.8% from a high of RM3.79 (in mid-December 2020) to close at RM3.00 yesterday. On the chart, a reversal of the downtrend could be on the cards following the bounce up from a double-bottom pattern recently.

• Technically speaking, the stock has just pierced above the upper band of the Keltner Channel, indicating an underlying price strength that could lift the stock higher.

• In addition, the rising momentum is supported by the Price Oscillator indicator’s crossing above the zero-line.

• With that, the stock could climb to our resistance targets of RM3.30 and RM3.48, which represent upside potentials of 10% and 16%, respectively.

• Our stop loss price has been set at RM2.79, which represents a downside risk of 7%.

• AMBANK’s business activities consist of: (i) Wholesale Banking, (ii) Investment Banking, (iii) Retail Banking, (iv) Islamic Banking, (v) General Insurance, (vi) Life Insurance, and (vii) Family Takaful.

• The group is projected to make net profit of RM1,270.0m in FY Mar 2022 and RM1,415.8m in FY Mar 2023 based on consensus estimates.

• The stock is currently trading at P/BV of 0.62x based on the latest BV per share of RM4.87 as of end-March this year.

Source: Kenanga Research - 26 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

AMBANK2024-11-23

ARMADA2024-11-22

ARMADA2024-11-21

AMBANK2024-11-21

AMBANK2024-11-20

AMBANK2024-11-20

AMBANK2024-11-20

AMBANK2024-11-19

AMBANK2024-11-19

AMBANK2024-11-19

AMBANK2024-11-18

AMBANK2024-11-18

AMBANK2024-11-18

ARMADA2024-11-18

ARMADA2024-11-16

ARMADA2024-11-15

AMBANK2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-14

AMBANK2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-13

AMBANK2024-11-13

AMBANK2024-11-12

AMBANKMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024