Daily technical highlights – (POHKONG, BAHVEST)

kiasutrader

Publish date: Tue, 16 Nov 2021, 09:12 AM

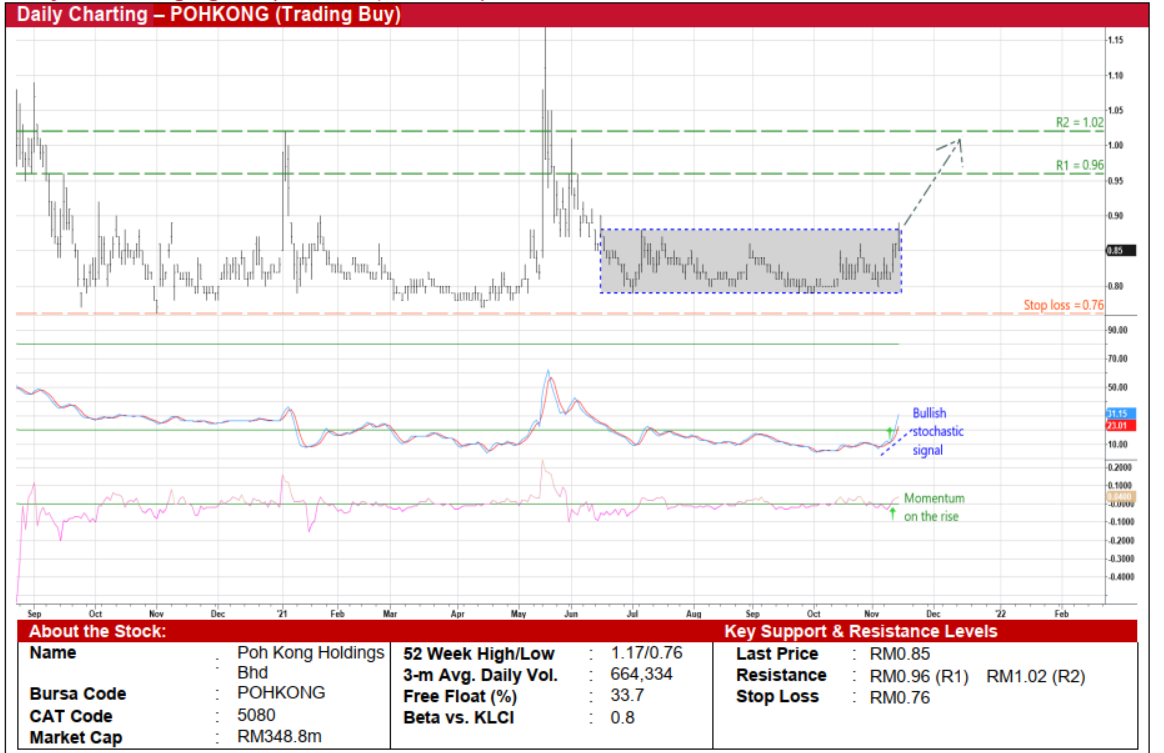

Poh Kong Holdings Bhd (Trading Buy)

• Gold prices – which have climbed 8.0% since end-September this year to USD1,862 per oz currently – will probably continue to trend higher going forward as investors hunt for assets as a hedge against rising global inflation amid a prolonged low interest rate environment.

• Higher gold prices will likely benefit POHKONG – a manufacturer cum retailer of jewellery in gold and gemstones – which could boost its profit margins because of the lag effect of the gold raw material costs catching up with increasing selling prices.

• This, in turn, will boost forward earnings for the group, which had posted net profit of RM36.8m (+50.5% YoY) in FY ended July 2021 in spite of the business disruptions arising from various movement restrictions imposed to control the Covid-19 outbreak during the period.

• Meanwhile, POHKONG shares may play catch-up with listed peer TOMEI, whose share price has soared since last Wednesday by as much as 22.5% before settling for a gain of 13.1% to close at RM1.08 yesterday.

• On the chart, POHKONG (up 5.6% since last Wednesday) is on the edge of breaking out from an existing rectangle pattern that stretches back to mid-June this year.

• An upward shift in the share price is now anticipated following the triggering of bullish technical signals by: (i) the stochastic (as the %K line has cut above the %D line in the oversold area), and (ii) the rising momentum indicator (which has just crossed above the zero-line).

• On the way up, the stock could advance towards our resistance thresholds of RM0.96 (R1; 13% upside potential) and RM1.02 (R2; 20% upside potential).

• We have pegged our stop loss price at RM0.76 (representing a 11% downside risk from the last traded price of RM0.85).

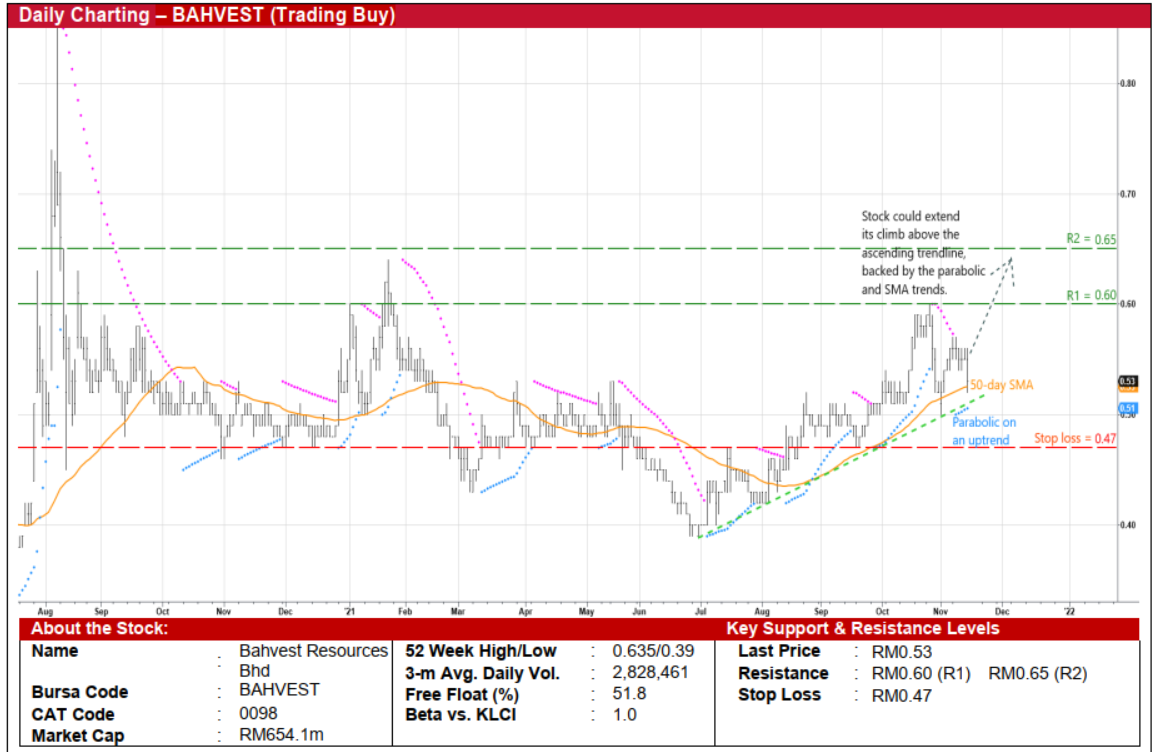

Bahvest Resources Bhd (Trading Buy)

• BAHVEST – whose business operation is in gold mining production on a total mining area of 317.7 hectares in Tawau, Sabah (with a leasehold period ending in 2048) – is an upstream play on rising gold prices (up 8.0% since end-September this year to USD1,862 per oz currently).

• After posting a net loss of RM14.1m in FY March 2021, the group’s bottomline is on track to return to the black in FY22. Yesterday, BAHVEST reported a record high quarterly net profit of RM9.0m in 2Q ended September 2021 (versus 2QFY21’s RM1.5m), taking its first half’s result to RM12.2m (+266% YoY) as its overall performance was lifted mainly by higher gold output (amounting to 310 kg).

• From a charting standpoint, BAHVEST’s share price – which saw strong trading volume yesterday to close at RM0.53 – is expected to continue its upward trajectory on an ascending trendline with the 50-day SMA providing added support.

• On the back of the positive technical signal arising from an upward acceleration in the Parabolic SAR indicator, the stock could challenge our resistance targets of RM0.60 (R1; 13% upside potential) and RM0.65 (R2; 23% upside potential).

• Our stop loss price level is set at RM0.47 (or a 11% downside risk).

Source: Kenanga Research - 16 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024