Daily technical highlights – (BAHVEST, CARIMIN)

kiasutrader

Publish date: Wed, 23 Feb 2022, 10:56 AM

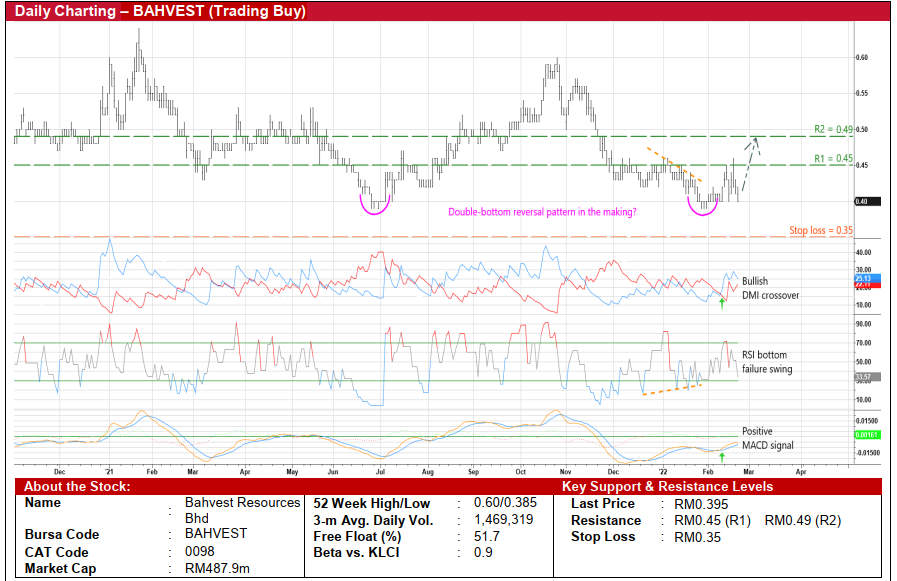

Bahvest Resources Bhd (Trading Buy)

• A proxy to rising gold prices – which have crept up 7.2% since mid-December last year to an eight-month high of USD1,896 per oz currently – BAHVEST offers upstream exposure via its gold mining operation in an area of 317.7 hectares in Tawau, Sabah (with a leasehold period ending in 2048).

• After reporting net profit of RM12.2m (+266% YoY) in 1HFY22, the group posted net loss of RM8.3m in 3QFY22 (versus net loss of RM21.7m in 3QFY21) as its overall performance was temporarily affected by lower gold output due to plant shutdown for repair & maintenance works in October, production disruptions caused by unexpected heavy rainfall in December and increased operating cost. This brought its 9MFY22’s net earnings to RM3.9m (versus 9MFY21’s net loss of RM18.4m).

• On the chart, following its decline from a high of RM0.60 in late October last year, the share price could be in the midst of plotting a double-bottom reversal pattern with the upward trajectory likely to persist in light of the bullish technical signals triggered by: (i) the DMI Plus crossing above the DMI Minus; (ii) the bottom failure swing in the RSI indicator (which has formed rising bottoms in the oversold zone as the stock was sliding); and (iii) the MACD cutting over the signal line.

• With that, BAHVEST’s share price will probably make its way to challenge our resistance thresholds of RM0.45 (R1; 14% upside potential) and RM0.49 (R2; 24% upside potential).

• We have pegged our stop loss price level at RM0.35 (which translates to a downside risk of 11% from the last traded price of RM0.395).

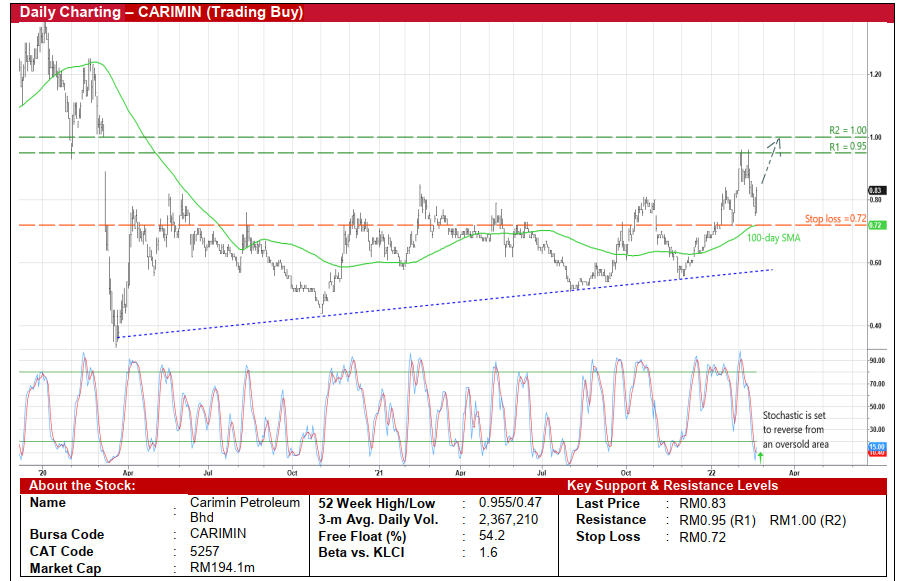

Carimin Petroleum Bhd (Trading Buy)

• CARIMIN shares – which jumped 9.9% amid high trading volume to settle at RM0.83 yesterday – may climb further as the share price remains above both the 100-day SMA and an ascending trendline, suggesting its uptrend pattern is still intact.

• With the stochastic indicator (which saw the %K line crossing over the %D line) also reversing from the oversold territory, the strengthening momentum could lift the stock towards our resistance thresholds of RM0.95 (R1; 14% upside potential) and RM1.00 (R2; 20% upside potential).

• Our stop loss price level is set at RM0.72 (representing a 13% downside risk).

• Business-wise, CARIMIN is involved in the provision of technical and engineering support services in the oil & gas industry in Malaysia, focussing mainly on integrated maintenance, rejuvenation, hook-up & commissioning (HUC) of onshore/offshore facilities and the provision of sub-sea underwater inspections, repair, maintenance works & services (IRM) for oil majors.

• After registering net profit of RM13.3m (+3% YoY) in FY June 2021, the group’s bottomline came in at RM4.1m (-41% YoY) in 1QFY22.

• CARIMIN’s balance sheet is backed by net cash holdings & short-term investments of RM98.0m (translating to 41.9 sen per share or approximately half of its current share price) as of end-September 2021.

Source: Kenanga Research - 23 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024