Daily technical highlights – (LCTITAN, ASTRO)

kiasutrader

Publish date: Tue, 01 Mar 2022, 09:19 AM

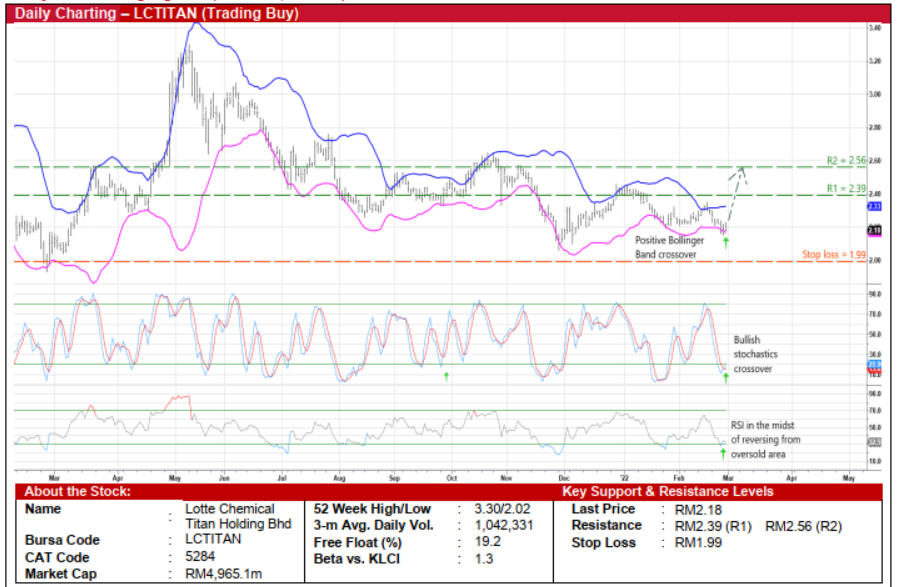

Lotte Chemical Titan Holding Bhd (Trading Buy)

• LCTITAN stands to benefit from widening margin spreads arising from climbing oil prices via its two business activities: (i) the manufacture and sale of polyolefin products, and (ii) the manufacture and sale of olefins & derivative products.

• The group made net profit of RM186.8m in 4QFY21 (+24% YoY), taking its full-year earnings to RM1.06b (up 7.1-fold YoY) as the buoyant performance was mainly fuelled by higher product average selling prices vis-à-vis the increased naphtha feedstock costs (which had then resulted in better product margin spreads).

• Prior to the recent jump in Brent crude oil price (currently hovering at a 7½-year high of USD103 per barrel), consensus has forecasted LCTITAN to log net profit of RM341.0m for FY December 2022 and RM324.3m for FY December 2023. This translates to forward PERs of 14.6x this year and 15.3x next year, respectively.

• Financially sound, the group’s debt-free balance sheet is backed by cash holdings, short-term deposits & fund placements amounting to RM4.60b (or RM2.02 per share which nearly equals its existing share price) as of end-December 2021.

• From a technical standpoint, LCTITAN shares could see a price rebound after retracing from a high of RM3.30 in May last year to close at RM2.18 yesterday.

• An upward shift is now anticipated following: (i) the share price crossing back above the lower Bollinger Band, (ii) the bullish crossover by the stochastic indicator in an oversold territory, and (iii) the RSI indicator in the midst of climbing out from an oversold position.

• With that, the stock will probably advance towards our resistance thresholds of RM2.39 (R1; 10% upside potential) and RM2.56 (R2; 17% upside potential).

• We have placed our stop loss price level at RM1.99 (or a 9% downside risk).

Astro Malaysia Holdings Bhd (Trading Buy)

• ASTRO shares may attempt to break away from a rectangle pattern on the back of increased buying interest.

• This comes as the share price has just cut above both the 50-day and 100-day SMA lines, paving the way for a probable golden crossover by the faster SMA above the slower SMA.

• With the DMI Plus also crossing above the DMI Minus recently, the stock could stage an upward bias, making its way to challenge our resistance targets of RM1.10 (R1; 11% upside potential) and RM1.18 (R2; 19% upside potential).

• Our stop loss price level is pegged at RM0.89 (representing a 10% downside risk from the last traded price of RM0.99).

• A leading content and entertainment group serving its customers across the TV, radio, digital and commerce platforms, ASTRO reported net profit of RM334.3m (-10% YoY) in the nine-month financial period ended October 2021.

• According to consensus estimates, the group is projected to make net earnings of RM475.3m for FY January 2022, RM547.2m for FY January 2023 and RM582.2m for FY January 2024, which translate to PERs of 10.9x, 9.4x and 8.9x, respectively.

• The stock offers attractive forward dividend yields of 7.6% and 8.2% based on consensus DPS forecasts of 7.5 sen for FY23 and 8.1 sen for FY24, respectively.

Source: Kenanga Research - 1 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024