Daily technical highlights – (CSCSTEL, WELLCAL)

kiasutrader

Publish date: Thu, 05 May 2022, 09:03 AM

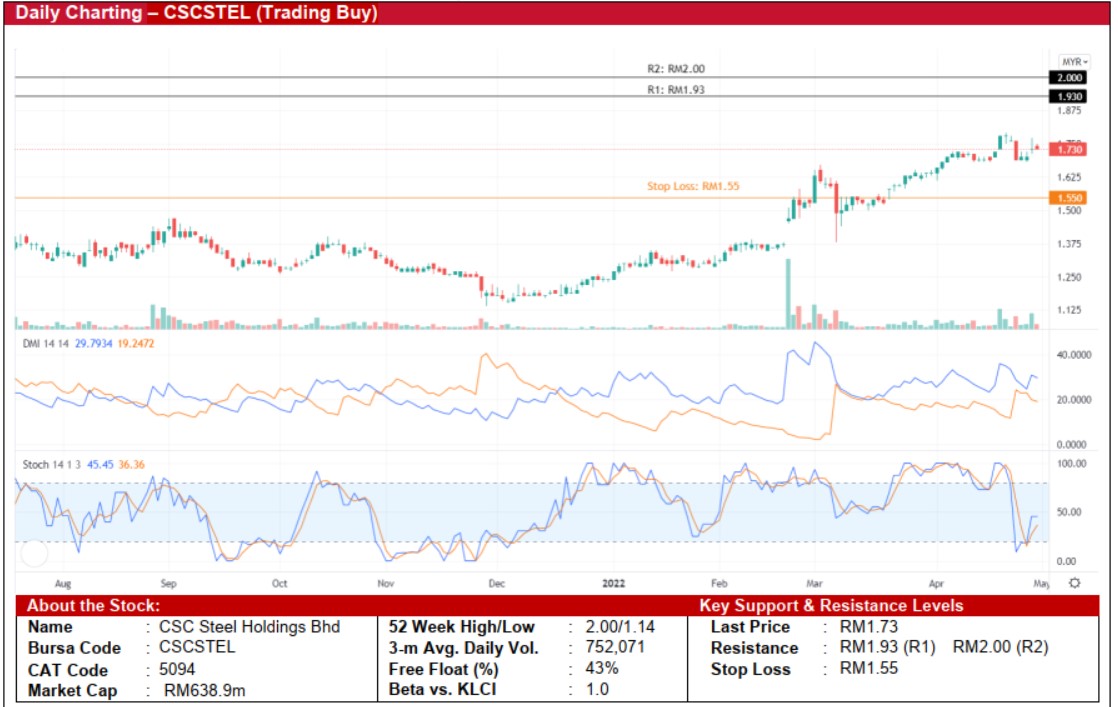

CSC Steel Holdings Bhd (Trading Buy)

• Following a sharp sell-off to hit a low of RM1.38 in early-March 2022, CSCSTEL shares have rebounded to form an ascending price channel.

• Technically speaking, the stock will likely break out from a short-term sideways pattern to resume its upward trajectory on the back of the stochastic indicator’s reversal from an oversold area and the DMI Plus hovering above the DMI Minus.

• With that, the stock could rise to challenge our resistance levels of RM1.93 (R1; 12% upside potential) and RM2.00 (R2; 16% upside potential).

• We have pegged our stop loss at RM1.55, which represents a downside risk of 10%.

• CSCSTEL is involved in the manufacturing and sales of steels and related products.

• Earnings-wise, the group reported net profit of RM38.9m (>100% QoQ) in 4QFY21, which brought full-year’s bottomline to RM86.1m (vs. FY20‘s RM37m), lifted mainly by higher steel prices. The strong earnings momentum may sustain in the coming quarter(s) amid the prevailing elevated steel prices.

• Going forward, consensus is projecting that the group will make net profit of RM70.4m for FY December 2022 and RM66.2m for FY December 2023, which translate to forward PERs of 9.1x and 9.7x, respectively.

Wellcall Holdings Bhd (Trading Buy)

• After a recent rebound from a trough of RM1.10 in early-March 2022, a price breakout from an intermediate ascending triangle pattern could be underway for WELLCAL shares.

• With the Parabolic SAR indicator showing its first uptick signal and coupled with the DMI Plus on the rise to widen its gap from the DMI Minus, we anticipate that the stock will continue to trend upwards.

• Thus, we believe that WELLCAL’s share price could climb towards our resistance thresholds of RM1.40 (R1; 10% upside potential) and RM1.47 (R2; 16% upside potential).

• Our stop loss price level is set at RM1.15 (or a downside risk of 9%).

• Business-wise, WELLCAL is engaged in the manufacturing of industrial rubber hoses and related products.

• Earnings-wise, the group reported a net profit of RM6.9m (-16% YoY) in 1QFY22 as its underlying performance was dragged down by higher raw material costs and global supply chain issues (such as surging freight costs and tight shipping schedules).

• Based on consensus forecasts, the group will make net profit of RM35.4m for FY September 2022 and RM39.9m for FY September 2023, which translate to forward PERs of 17.9x and 15.9x, respectively.

• Its forward earnings will likely improve on the back of: (i) strong demand for rubber hoses from a diversified customer base (as 90% of total revenue is derived from the exports market) as well as from various industries amid the global economic recovery, (ii) a new joint venture agreement with a Swedish company to offer new products, and (iii) an improvement in operating efficiency.

Source: Kenanga Research - 5 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024