Daily technical highlights – (SIME, MRDIY)

kiasutrader

Publish date: Fri, 27 May 2022, 10:01 AM

Sime Darby Bhd (Trading Buy)

• A technical rebound could be forthcoming for SIME shares after retracing from a recent high of RM2.54 in late March this year to as low as RM2.13 on Wednesday. The stock closed at RM2.17 yesterday.

• Following the price cross back above the lower Bollinger Band and the imminent reversal from oversold positions by both the RSI and stochastic indicators, the shares will likely bounce up ahead.

• Riding on the positive momentum, SIME’s stock price is expected to climb towards our resistance thresholds of RM2.36 (R1; 9% upside potential) and RM2.45 (R2; 13% upside potential).

• We have set our stop loss price level at RM2.00 (or an 8% downside risk).

• SIME – a conglomerate with businesses in the industrial, automotive, healthcare and logistics sectors – saw its 9MFY22’s net profit slipped to RM825m (-32% YoY) as its overall performance was dragged mainly by an absence of one-off gains (that were recognised in the previous corresponding period) as well as lower profit contributions from the industrial division (particularly from China due to the Covid-19 restrictions).

• Based on consensus estimates, SIME’s net earnings are projected to come in at RM1.165b in FY June 2022 and RM1.253b in FY June 2023, which translate to forward PERs of 12.7x this year and 11.8x next year, respectively.

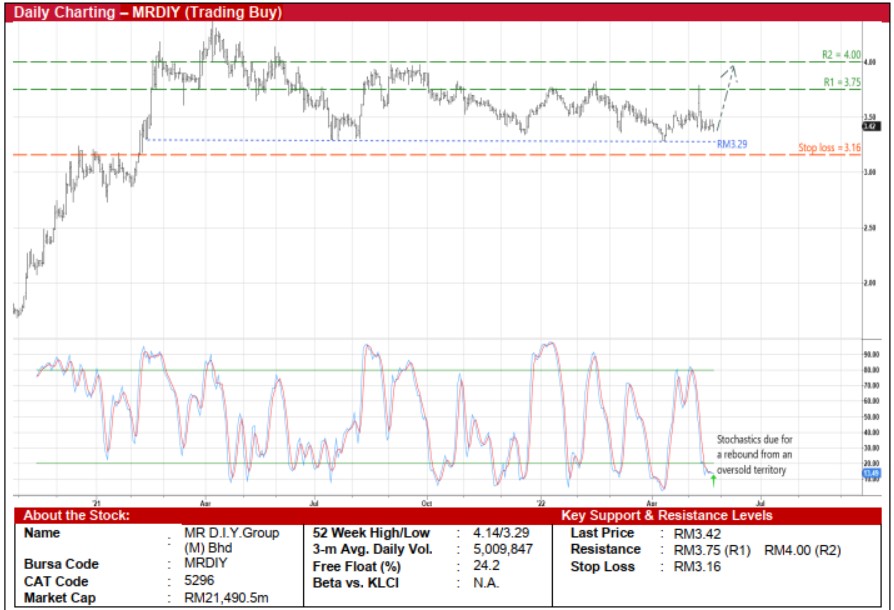

MR D.I.Y. Group (M) Bhd (Trading Buy)

• Currently hovering quite near to a support line (of RM3.29) that stretches back to mid-February last year, MYDIY’s share price will probably shift higher ahead.

• Backed by the stochastic indicator’s anticipated reversal from an oversold position, the stock could climb to challenge our resistance targets of RM3.75 (R1) and RM4.00 (R2). This represents upside potentials of 10% and 17%, respectively.

• Our stop loss price level is pegged at RM3.16 (translating to a downside risk of 8% from its last traded price of RM3.42).

• MRDIY – a home improvement retailer with 941 stores across Malaysia and 6 in Brunei – reported net profit of RM431.8m (+28% YoY) in FY December 2021 that was followed by net earnings of RM100.5m (-19% YoY) in 1QFY22.

• Going forward, consensus is forecasting the group to make stronger net profit of RM562.3m for FY22 and RM675.1m for FY23, translating to forward PERs of 38.2x this year and 31.8x next year, respectively.

• Separately, MRDIY shares – which would be included in the MSCI Malaysia Index after market close on 31 May (next Tuesday) – could see increased buying flows from index-tracking funds in the run-up to the effective date.

Source: Kenanga Research - 27 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

MRDIY2024-11-22

MRDIY2024-11-22

SIME2024-11-21

MRDIY2024-11-21

SIME2024-11-20

MRDIY2024-11-20

SIME2024-11-20

SIME2024-11-20

SIME2024-11-19

MRDIY2024-11-19

MRDIY2024-11-19

SIME2024-11-19

SIME2024-11-18

MRDIY2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-16

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

SIME2024-11-14

SIME2024-11-13

MRDIY2024-11-13

MRDIY2024-11-13

SIME2024-11-13

SIME2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

SIMEMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024