Daily technical highlights – (HIBISCS, YTL)

kiasutrader

Publish date: Wed, 10 Aug 2022, 09:12 AM

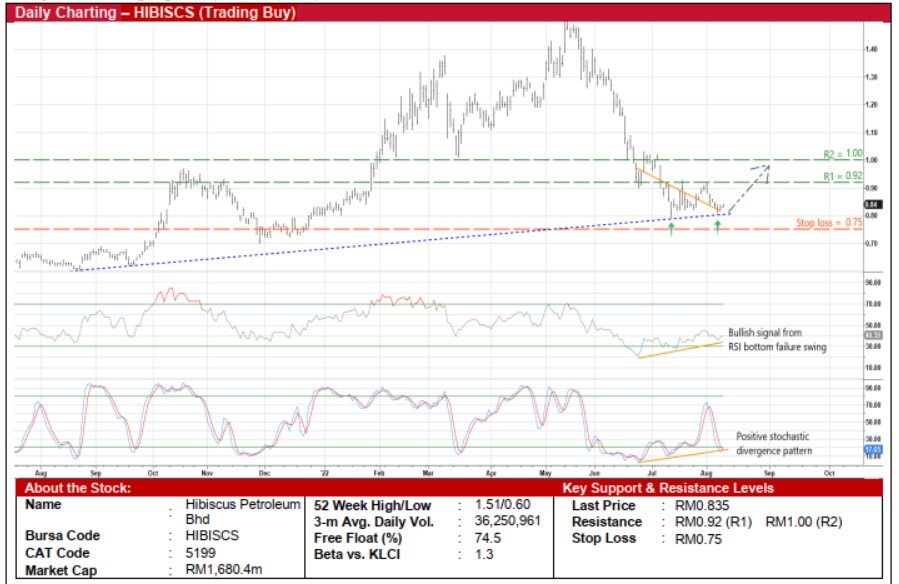

Hibiscus Petroleum Bhd (Trading Buy)

• A share price retracement from a peak of RM1.51 in mid-May this year has led HIBISCS’ share price to hover near an upward sloping trendline that stretches back to November 2020.

• This may then set the stage for the shares to bounce-off the trendline following the existence of: (i) a bottom failure swing in the RSI indicator (which has plotted higher lows in the oversold zone amid a weakening share price), and (ii) the bullish stochastic divergence pattern (after forming rising bottoms while the price was drifting lower).

• Hence, the stock could climb towards our resistance thresholds of RM0.92 (R1; 10% upside potential) and RM1.00 (R2; 20% upside potential).

• We have pegged our stop loss price level at RM0.75 (representing a 10% downside risk from its last traded price of RM0.835).

• An independent oil and gas exploration and production company, HIBISCS’ key activities are focused on oil producing fields with a portfolio of development and production assets located in Malaysia, United Kingdom, Australia and Vietnam.

• Earnings-wise, the group registered net profit of RM307.5m (up almost 10-fold YoY) in 3QFY22, taking 9MFY22 net earnings to RM397.6m (+7-fold YoY increase), mainly lifted by negative goodwill from business combination (amounted to RM317.3m).

• Based on consensus expectations, HIBISCS is projected to post adjusted net earnings of RM289.6m in FY June 2022 and RM517.8m in FY June FY 2023. This translates to forward PERs of 5.8x this year and 3.2x next year, respectively (with its 1- year forward rolling PER currently trading at 1 SD below its historical mean).

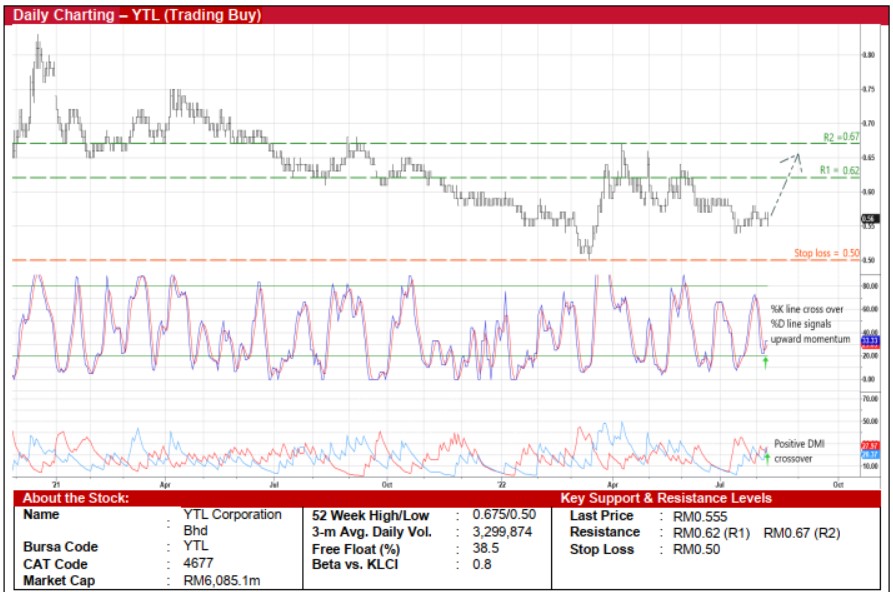

YTL Corporation Bhd (Trading Buy)

• A technical rebound is anticipated for YTL shares after pulling back by 17% from a recent high of RM0.665 in early April this year to close at RM0.555 yesterday.

• On the chart, an ensuing upward shift in the share price is likely in view of the bullish crossovers by both the stochastic and DMI indicators.

• With that said, the stock is expected to rise to challenge our resistance targets of RM0.62 (R1; 12% upside potential) and RM0.67 (R2; 21% upside potential).

• Our stop loss price level is set at RM0.50 (or a 10% downside risk).

• A conglomerate with multiple businesses ranging from utilities, cement manufacturing & trading, construction, property investment & development, hotel operations to information technology & e-commerce, YTL reported net profit of RM414.6m (up 18.5-fold YoY) in 3QFY22, bringing its 9MFY22 bottomline to RM521.9m (+13-fold YoY) mainly driven by net gain from disposal of companies (of RM1.3b).

• Going forward, consensus is projecting the group to make net loss of RM173.6m in FY June 2022 before turning around with net profit of RM158.5m in FY June 2023, which translate to forward PER of 38.4x next year (or at 0.5 SD below its historical mean).

Source: Kenanga Research - 10 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

HIBISCS2024-11-23

YTL2024-11-22

HIBISCS2024-11-22

YTL2024-11-22

YTL2024-11-22

YTL2024-11-21

HIBISCS2024-11-21

YTL2024-11-20

HIBISCS2024-11-20

HIBISCS2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-18

HIBISCS2024-11-15

HIBISCS2024-11-15

YTL2024-11-15

YTL2024-11-15

YTL2024-11-14

HIBISCSMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024