Daily technical highlights – (ARMADA, DAYANG)

kiasutrader

Publish date: Fri, 19 Aug 2022, 10:29 AM

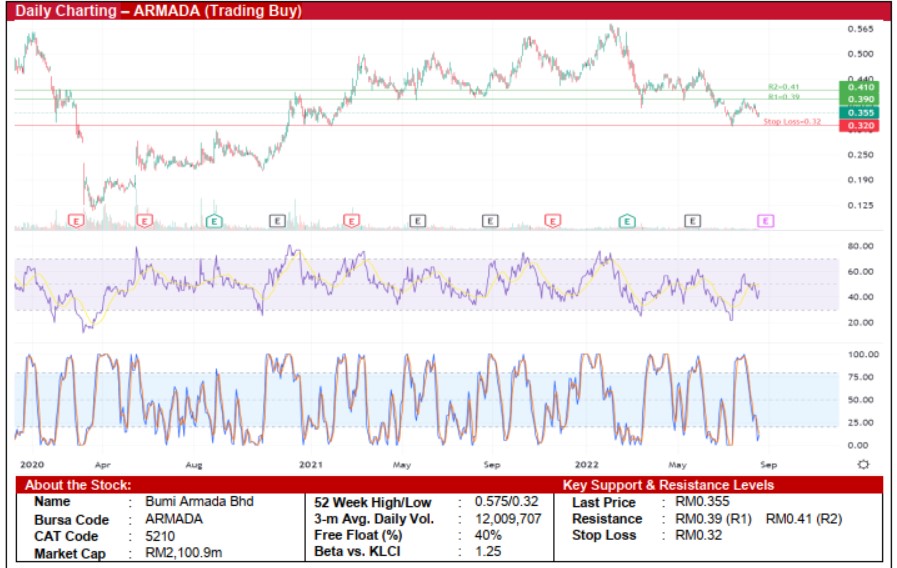

Bumi Armada Bhd (Trading Buy)

• ARMADA’s share price has fallen 38% since early February this year from its 52-week high of RM0.575 to close at RM0.355 yesterday. With the share price finding support near its 52-week low of RM0.32 and the appearance of a tweezer bottom yesterday, a technical rebound could be anticipated.

• Chart-wise, we believe the share price will shift upward as both the Stochastic and RSI indicators climb out from the oversold zone.

• Hence, we expect the stock to rise and test our resistance thresholds of RM0.39 (R1; 10% upside potential) and RM0.41 (R2; 15% upside potential).

• Conversely, our stop loss price has been identified at RM0.32 (representing a 10% downside risk).

• ARMADA is an international offshore energy facilities and services provider which owns and operates offshore vessels to support oil & gas exploration and production activities.

• Earnings-wise, the group reported a net profit of RM185.8m in 1QFY22 compared with a net profit of RM162.8m in 1QFY21, lifted mainly by lower depreciation charge, tax expense and finance costs.

• Based on consensus forecasts, ARMADA’s net earnings are projected to come in at RM660.2m in FY December 2022 and RM682.3m in FY December 2023, which translate to forward PERs of 3.2x this year and 3.1x next year, respectively.

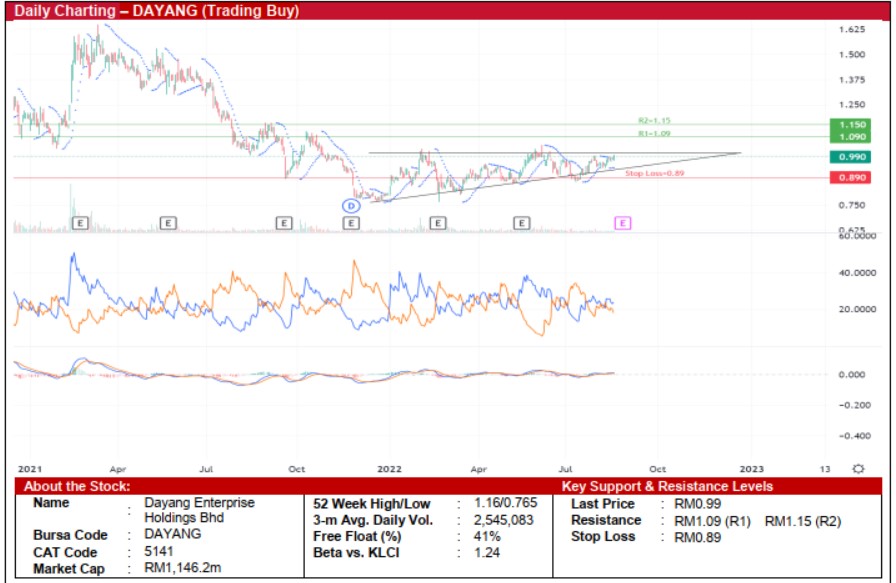

Dayang Enterprise Holdings Bhd (Trading Buy)

• The share price of DAYANG has slid from a peak of RM3.01 in February 2020 to as low as RM0.765 in December 2021 before making a rebound since then to close at RM0.99 yesterday. Following that, the formation of a potential ascending triangle pattern has set the stage for a likely technical rebound ahead.

• On the chart, the share price is expected to continue its upward momentum backed by: (i) the rising Parabolic SAR trend, (ii) the DMI Plus crossing above the DMI Minus, and (iii) the 12-day moving average still hovering above the 26-day moving average following the MACD golden cross in late July.

• A technical breakout from the ascending triangle could then lift the stock to challenge our resistance levels of RM1.09 (R1; 10% upside potential) and RM1.15 (R2; 16% upside potential).

• Our stop loss level is pegged at RM0.89 (representing a 10% downside risk).

• Fundamentally speaking, DAYANG provides offshore topside maintenance services, minor fabrication works and offshore hook-up and commissioning services for oil and gas companies.

• Earnings-wise, the group reported a net profit of RM42m in 2QFY22, reversing from a net loss of RM21.9m in 2QFY21 driven by a revival of work orders, insurance claims received and lower depreciation charge. This took 1HFY22 bottomline to RM55.8m (versus net loss of RM49.4m previously).

• Based on consensus forecasts, DAYANG’s net earnings are projected to come in at RM65.9m in FY December 2022 and RM96.2m in FY December 2023, which translate to forward PERs of 17.4x this year and 11.9x next year, respectively.

Source: Kenanga Research - 19 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

DAYANG2024-11-23

ARMADA2024-11-22

ARMADA2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-21

DAYANG2024-11-18

ARMADA2024-11-18

ARMADA2024-11-18

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-16

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANGMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024