Daily technical highlights – (CCK, LHI)

kiasutrader

Publish date: Tue, 28 Feb 2023, 10:29 AM

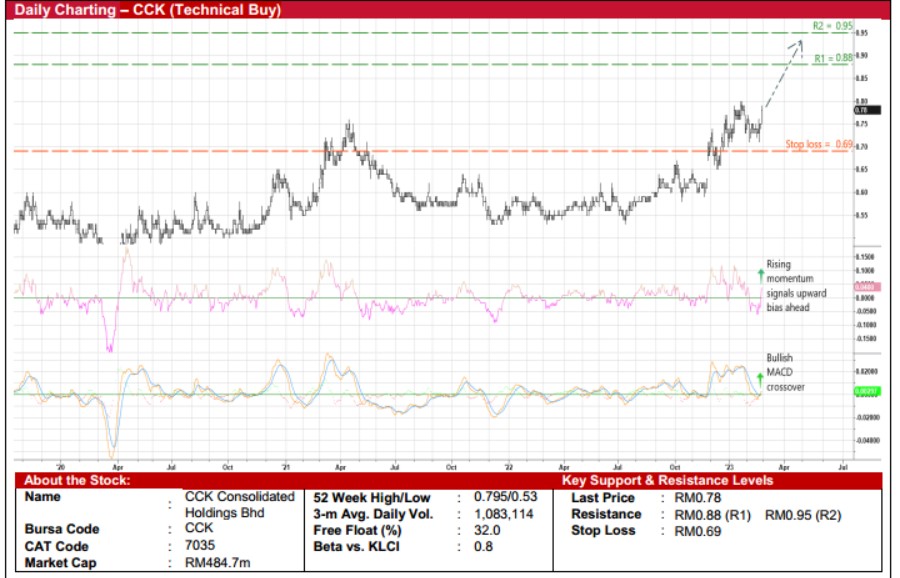

CCK Consolidated Holdings Bhd (Technical Buy)

• The government’s recent decision to lift the price controls on chickens and eggs after June this year under an initiative toovercome food shortage may benefit CCK, which is involved in retailing and poultry farming (with an integrated supply chainconsisting of feed mill, breeder farms, hatchery, broiler farms, layer farm, abattoirs and retail stores).

• The group has just reported a net profit jump to RM13.0m (+81% YoY) in 4QFY22, bringing full-year bottomline to RM62.1m(up 2.5-fold YoY).

• Going forward, based on consensus projections, CCK will probably made net earnings of RM58.6m for FY December 2023and RM64.8m for FY December 2024.

• Valuation-wise, this translates to forward PERs of 8.3x this year and 7.5x next year, respectively with its 1-year rolling forwardPER presently hovering at 1.5SD below its historical mean.

• From a technical standpoint, CCK’s share price – which surged 4.0% to close at RM0.78 yesterday backed by strongtransaction volume – is anticipated to ride on the upward trajectory after climbing from a trough of RM0.53 in mid-July lastyear to plot higher highs along the way.

• Hence, driven by a rising momentum indicator and the bullish MACD crossover, the stock could advance further to challengeour resistance targets of RM0.88 (R1; 13% upside potential) and RM0.95 (R2; 22% upside potential).

• We have pegged our stop loss price level at RM0.69 (representing a downside risk of 12%).

Leong Hup International Bhd (Technical Buy)

• After tumbling from a high of RM0.54 in early December last year to as low as RM0.465 in mid-February, which wassubsequently followed by a recovery to settle at RM0.485 yesterday, a technical rebound may be underway for LHI shares.

• On the chart, an extended climb is likely based on the following positive technical signals: (i) the stochastic indicator’s %K linehas cut above the %D line in the oversold zone, (ii) the golden cross by the 50-day SMA above the 100-day SMA, and (iii) theappearance of multiple dragonfly doji candlesticks lately.

• With that said, the stock could shift higher towards our resistance thresholds of RM0.54 (R1; 11% upside potential) andRM0.60 (R2; 24% upside potential).

• Our stop loss price level is set at RM0.43 (or a downside risk of 11%).

• Business-wise, LHI is one of the largest fully integrated producers of poultry, eggs and livestock feed in Southeast Asia with astrong and growing presence in Malaysia, Singapore, Indonesia, Vietnam and the Philippines.

• The group saw a turnaround from net loss of RM53.4m in 3QFY21 to net profit of RM67.3m in 3QFY22, which took 9MFY22bottomline to RM128.2m (+170% YoY).

• According to consensus expectations, LHI is forecasted to make net earnings of RM171.0m for FY December 2022,RM186.8m for FY December 2023 and RM214.0m for FY December 2024, translating to forward PERs of 9.5x this year and8.3x next year, respectively (with its 1-year rolling forward PER currently trading at approximately 1.5SD below its historicalmean).

• Meanwhile, LHI may benefit from a deregulated industry landscape when the prices of chickens and eggs are floated afterJune this year as part of the government’s efforts to overcome food shortage.

Source: Kenanga Research - 28 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024