Daily technical highlights – (KGB, SWIFT)

kiasutrader

Publish date: Wed, 01 Mar 2023, 11:37 AM

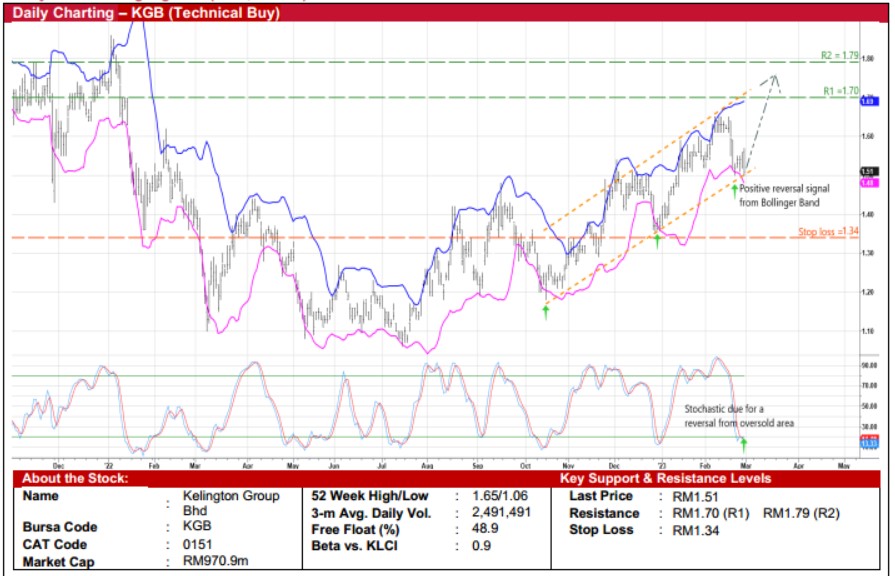

Kelington Group Bhd (Technical Buy)

• Following its reversal from a trough of RM1.18 in mid-October last year – plotting higher lows and higher highs along the way– KGB’s share price uptrend remains intact.

• Presently hovering near the bottom range of the ascending price channel, the stock is expected to resume its upwardtrajectory after crossing back above the lower Bollinger Band with the stochastic indicator set to climb out from the oversoldposition.

• That being the case, the stock price could be making its way to reach our resistance targets of RM1.70 (R1; 13% upsidepotential) and RM1.79 (R2; 19% upside potential).

• Our stop loss price level is pegged at RM1.34 (representing a downside risk of 11% from the last traded price of RM1.51).

• Business-wise, KGB is an integrated engineering services provider with a niche in ultra-high purity (UHP) gas and chemicaldelivery solutions for the high technology industry. It is also involved in the industrial gases business (providing on-site gassupply & manufacturing of liquid carbon dioxide), process engineering and general contracting activities.

• The group has just announced a strong set of financial results with net profit coming in at RM17.8m (+120% YoY) in 4QFY22,which consequently lifted its full-year bottomline to RM55.4m (+91% YoY) for FY December 2022.

• According to consensus estimates, its net earnings is forecasted to increase further to RM56.4m in FY23 and RM62.6m inFY24 (to be underpinned by an outstanding orderbook of RM1.7b as of end-2022). This implies forward PERs of 17.2x thisyear and 15.5x next year, respectively with its 1-year rolling forward PER currently standing at 0.5SD below its historicalmean.

• Financially sound, the group’s balance sheet is backed by net cash holdings of RM22.3m (or 3.5 sen per share) as of endDecember 2022.

Swift Haulage Bhd (Technical Buy)

• Locked inside a sideways trading range since mid-December last year, SWIFT shares may attempt to swing higher aheadbacked by positive technical signals.

• On the chart, the share price is set to bounce off from the bottom of a rectangle pattern, a level which had previously providedsupport several times in late December and early January 2023.

• And with the stochastic indicator showing the %K line crossing over the %D line in the oversold zone, an ensuing upward shiftcould then propel the stock to reach our first resistance threshold of RM0.52 (R1; 11% upside potential). This may then pavethe way for the shares to challenge our next resistance hurdle of RM0.56 (R2; 19% upside potential) thereafter.

• We have placed our stop loss price level at RM0.43 (representing a downside risk of 9%).

• Meanwhile, SWIFT – a multimodal transport operator offering logistics solutions ranging from container haulage, landtransportation, warehousing & container depot and freight forwarding services – has just reported net profit of RM11.2m (-17% YoY) in 4QFY22 and RM50.5m (+7% YoY) for the full-year ended December 2022.

• Based on consensus estimates, the group is forecasted to make net earnings of RM59.2m for FY23 and RM64.6m forFY24.

• Valuation-wise, this translates to forward PERs of 7.0x this year and 6.4x next year, respectively with its 1-year rollingforward PER currently hovering at 1SD below its historical mean.

Source: Kenanga Research - 1 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

KGB2024-11-21

KGB2024-11-20

SWIFT2024-11-20

SWIFT2024-11-20

SWIFT2024-11-19

KGB2024-11-18

KGB2024-11-18

KGB2024-11-18

KGB2024-11-18

SWIFT2024-11-18

SWIFT2024-11-18

SWIFT2024-11-15

KGB2024-11-15

KGB2024-11-15

KGB2024-11-15

SWIFT2024-11-15

SWIFT2024-11-15

SWIFT2024-11-15

SWIFT2024-11-14

KGB2024-11-14

KGB2024-11-14

KGB2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

SWIFT2024-11-12

KGBMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024