Daily technical highlights – (OCK, SCGBHD)

kiasutrader

Publish date: Tue, 18 Apr 2023, 09:23 AM

OCK Group Bhd (Technical Buy)

• Following a foreign newswire report stating that the government plans to set up a second 5G network next year, OCK stands to benefit from an anticipated increase in infrastructure works for the rolling out of 5G networks by the telecommunication industry.

• Backed by an existing portfolio of more than 5,300 towers in Malaysia, Myanmar and Vietnam, the group is principally involved in the provision of telecommunication services with four major business divisions, namely (i) telecommunication network services, (ii) trading of telco and network products, (iii) green energy and power solutions, and (iv) M&E engineering services.

• It registered net profit of RM10.0m (+59% YoY) in 4QFY22, taking full-year FY December 2022’s bottomline to RM33.7m(+33% YoY).

• According to consensus estimates, OCK is forecasted to make stronger net profit of RM39.5m for FY23 and RM50.1m forFY24, translating to forward PERs of 11.1x this year and 8.7x next year, respectively (with its 1-year rolling forward PERcurrently hovering at 1.5SD below its historical mean).

• Technically speaking, after bouncing off from a trough of RM0.355 in late July last year, plotting higher lows along the way, OCK shares are on track to extend the rising trajectory.

• An upward shift in the share price is on the cards following the crossover by the DMI Plus above the DMI Minus as the stochastic indicator unwinds from the oversold condition.

• On the chart, the stock could be making its way to challenge our resistance targets of RM0.46 (R1; 11% upside potential) and RM0.52 (R2; 25% upside potential).

• Our stop loss price level is pegged at RM0.37 (or a downside risk of 11% from its last traded price of RM0.415).

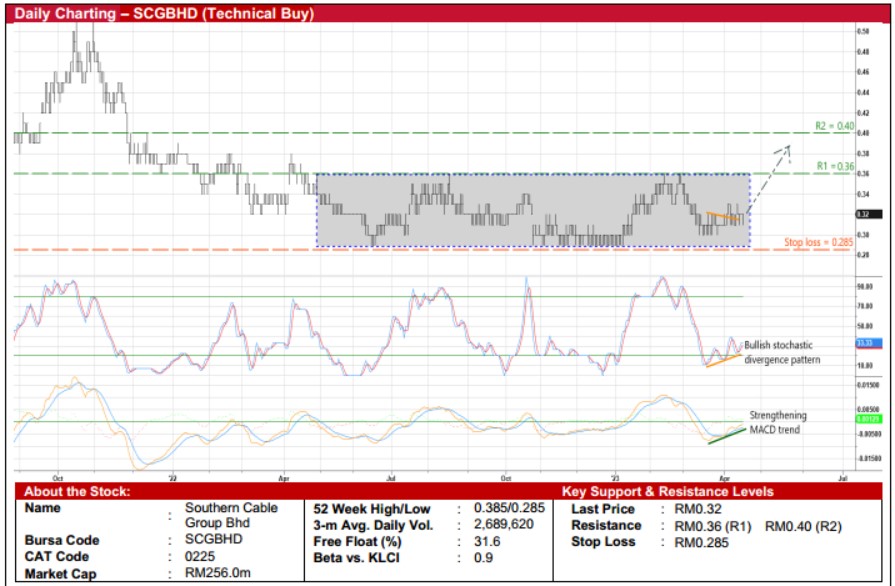

Southern Cable Group Bhd (Technical Buy)

• From a charting standpoint, SCGBHD’s share price – which has been oscillating inside a rectangle pattern since end-Aprillast year – will likely shift upwards ahead following the existence of a bullish stochastic divergence pattern (which saw theind icator plotting rising bottoms in the oversold area as the price was drifting listlessly) and the strengthening MACD trend.

• With that said, the stock could climb to challenge our initial resistance threshold of RM0.36 (R1), a break of which may then pave the way for the shares to reach our next resistance target of RM0.40 (R2). This represents upside potentials of 13% and 25%, respectively.

• We have placed our stop loss price level at RM0.285 (or a downside risk of 11%).

• Fundamental-wise, as a manufacturer of cables and wires that are used for power distribution and transmission, communications as well as control and instrumentation applications, SCGBHD is a proxy to infrastructure spending by the likes of Tenaga Nasional, Telekom Malaysia, Sarawak Energy, Sabah Electricity and Petroliam Nasional.

• In the most recent quarter ended December 2022, the group logged net profit of RM4.6m (+59% YoY), which brought FYDecember 2022’s bottom line to RM14.5m (+33% YoY).

• Forward earnings will be underpinned by an existing order book of RM578.4m (as of end-December 2022) to be recognized over the next 24 months.

• Based on its book value per share of RM0.36 as of end-December 2022, the stock is trading at a Price / Book Value multiple of 0.89x (or around its historical mean).

Source: Kenanga Research - 18 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024