Daily technical highlights – (KGB, MBMR)

kiasutrader

Publish date: Tue, 30 May 2023, 09:43 AM

Kelington Group Bhd (Technical Buy)

• A resumption of KGB’s share price uptrend could be in the works following its retracement from a high of RM1.65 in midFebruary this year to close at RM1.40 yesterday.

• Technically speaking, the price momentum is expected to pick up in view of an emerging Parabolic SAR uptrend while boththe RSI and stochastic indicators are making their way out from the oversold territory.

• With that said, the stock will probably advance towards our resistance thresholds of RM1.53 (R1; 9% upside potential) andRM1.65 (R2; 18% upside potential).

• We have placed our stop loss price level at RM1.27 (representing a downside risk of 9%).

• Business-wise, KGB is an integrated engineering services provider with a niche in ultra-high purity (UHP) gas and chemicaldelivery solutions for the high technology industry. It is also involved in the industrial gases business (providing on-site gassupply & manufacturing of liquid carbon dioxide), process engineering and general contracting activities.

• After posting net profit of RM55.4m (+91% YoY) for FY December 2022, the group recently announced another set of strongnet earnings of RM16.2m (+95% YoY) for 1QFY23.

• According to consensus expectations, on the back of an outstanding orderbook of RM1.8b as of end-March 2023, KGB isprojected to record net earnings of RM60.9m in FY23 and RM63.7m in FY24.

• This translates to forward PERs of 14.8x this year and 14.1x next year, respectively with its 1-year rolling forward PERcurrently hovering marginally below the minus 1SD threshold from its historical mean.

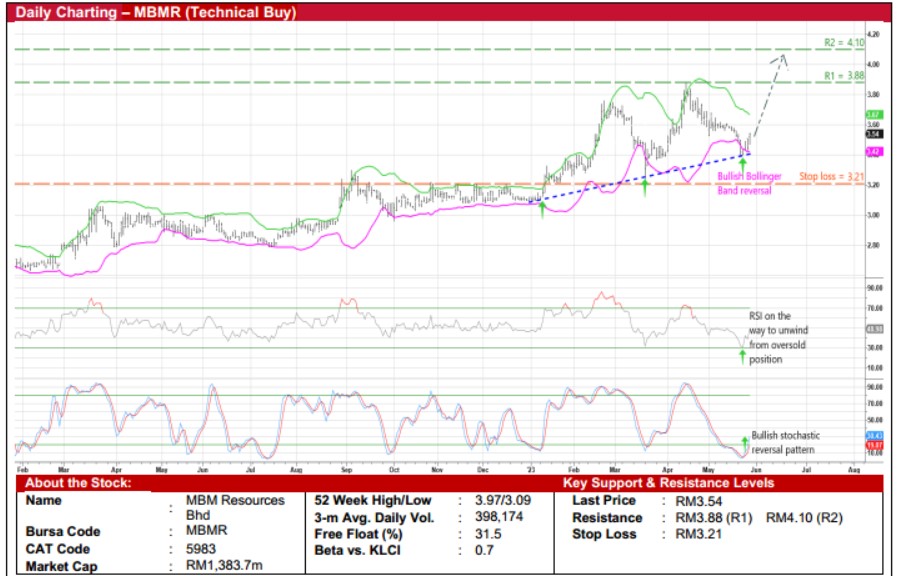

MBM Resources Bhd (Technical Buy)

• After climbing from a trough of RM3.01 in the beginning of December 2021, plotting a sequence of higher lows and higherhighs along the way, MBMR’s share price (up 2.6% to close at RM3.54 yesterday) is poised to extend its upward trajectoryahead.

• With the shares currently hovering near an intermediate ascending trendline, a bounce-up is anticipated following the pricecrossing back above the lower Bollinger Band as both the RSI and stochastic indicators are in the midst of unwinding from theoversold position.

• On the back of the strengthening momentum, the stock could make its way to challenge our resistance targets of RM3.88(R1; 10% upside potential) and RM4.10 (R2; 16% upside potential).

• Our stop loss price level is set at RM3.21 (representing a downside risk of 9%).

• An automotive group that operates through two business divisions – motor trading (with distributorship and dealership ofmajor vehicle brands such as Perodua, Volvo, Daihatsu) and auto parts manufacturing – MBMR registered net profit ofRM281.6m (+64% YoY) in FY22 that was followed by net earnings of RM80.0m (-10% YoY) in 1QFY23.

• Consensus is currently forecasting the group to show net profit of RM257.1m for FY December 2023 and RM239.4m for FYDecember 2024.

• Valuation-wise, this translates to forward PERs of 5.4x this year and 5.8x next year, respectively with its 1-year rolling forwardPER currently trading at 1SD below its historical mean.

• In terms of dividend returns, the stock will be traded ex-entitlement for its FY22 final dividend of 6.0 sen per share on 16 June.

• Based on consensus DPS forecasts of 30.1 sen in FY23 and 27.4 sen in FY24, MBMR shares presently offer prospectivedividend yields of 8.5% this year and 7.7% next year, respectively.

Source: Kenanga Research - 30 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

KGB2024-11-21

KGB2024-11-20

MBMR2024-11-19

KGB2024-11-19

MBMR2024-11-18

KGB2024-11-18

KGB2024-11-18

KGB2024-11-15

KGB2024-11-15

KGB2024-11-15

KGB2024-11-14

KGB2024-11-14

KGB2024-11-14

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-13

KGB2024-11-12

KGBMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024