Daily Technical Highlights - (TASCO, BETA)

kiasutrader

Publish date: Wed, 31 May 2023, 09:31 AM

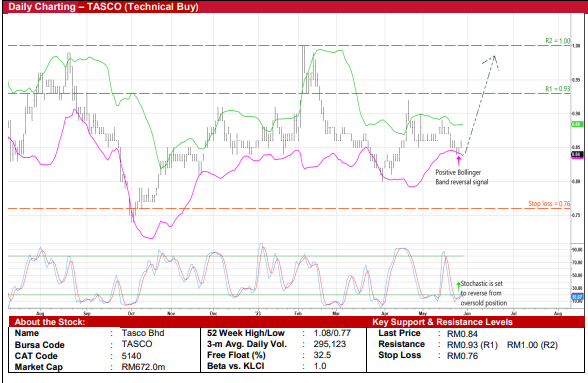

Tasco Bhd (Technical Buy)

• After pulling back from its peak of RM1.00 in early February this year to close at RM0.84 yesterday, TASCO’s share price is set to shift upwards ahead.

• On the chart, the rising momentum is expected to be driven by the stock price crossing back above the lower Bollinger Band and the unwinding from the oversold position by the stochastic indicator.

• This could then push the stock to challenge our resistance targets of RM0.93 (R1) and RM1.00 (R2), offering upside potentials of 11% and 19%, respectively.

• Our stop loss price level is seen at RM0.76 (or a downside risk of 10%).

• A provider of total logistics solutions, TASCO’s services range from warehouse and storage solutions to air, sea and land transportation solutions, serving as a one-stop logistics centre to handle domestic and international shipments.

• The group reported net profit of RM21.8m (-13% YoY) in 4QFY23, which brought its full-year’s bottomline to RM90.8m (+39% YoY).

• Going forward, consensus is forecasting TASCO to register net earnings of RM90.1m in FY March 2024 and RM97.1m in FY March 2025.

• Valuation-wise, this translates to prospective PERs of 7.5x and 6.9x, respectively with its 1-year rolling forward PER currently hovering at 1.5SD below its historical mean.

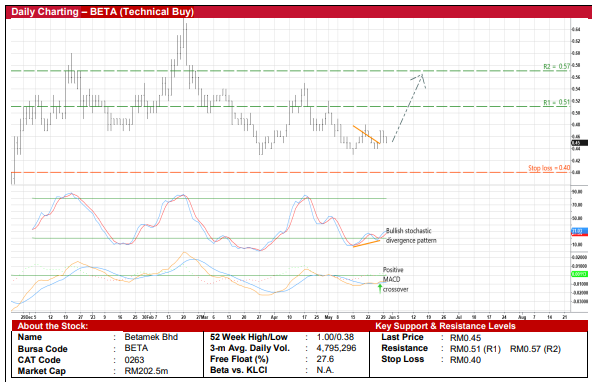

Betamek Bhd (Technical Buy)

• After recently bouncing off twice (in late-March 2023 and mid-May this year) from a low of RM0.43 – which now represents its intermediate support line – BETA’s share price could attempt to stage a technical rebound ahead.

• From a charting standpoint, an upward shift is anticipated following: (i) the occurrence of a bullish stochastic divergence pattern (which saw the indicator plotting rising bottoms while the price was drifting listlessly), and (ii) the positive crossover by the MACD above the signal line.

• Riding on the strengthening momentum, the stock will likely climb towards our resistance thresholds of RM0.51 (R1; 13% upside potential) and RM0.57 (R2; 27% upside potential).

• We have placed our stop loss price level at RM0.40 (or a downside risk of 11% from yesterday’s closing price of RM0.45).

• Listed in late October 2022 at an IPO offer price of RM0.50, BETA is an electronics manufacturing services (EMS) provider specialising in the design & development, procurement and manufacturing of customised electronics and components for the automotive industry (such as vehicle audio products and components).

• Earnings-wise, the group posted net profit of RM5.7m in 4QFY23, taking its full-year net earnings to RM16.3m for FY March 2023 (partly dragged by non-recurring listing expenses of RM2.9m).

• Based on its book value per share of RM0.30 as of end-March 2023 – which is backed by net cash holdings of RM41.7m (or 9.3 sen per share) – the stock is presently trading at a Price / Book Value multiple of 1.5x.

• In terms of recent corporate development, in March this year, BETA has entered into a Memorandum of Understanding with Singapore-based Krakatoa Technologies Pte Ltd to explore a potential collaboration to develop a battery management system-on-a-chip for electric vehicles.

Source: Kenanga Research - 31 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Dec 23, 2024

Created by kiasutrader | Dec 23, 2024