Kenanga Research & Investment

Actionable Technical Highlights – (EKOVEST)

kiasutrader

Publish date: Fri, 13 Oct 2023, 09:27 AM

EKOVEST BERHAD (Technical Buy)

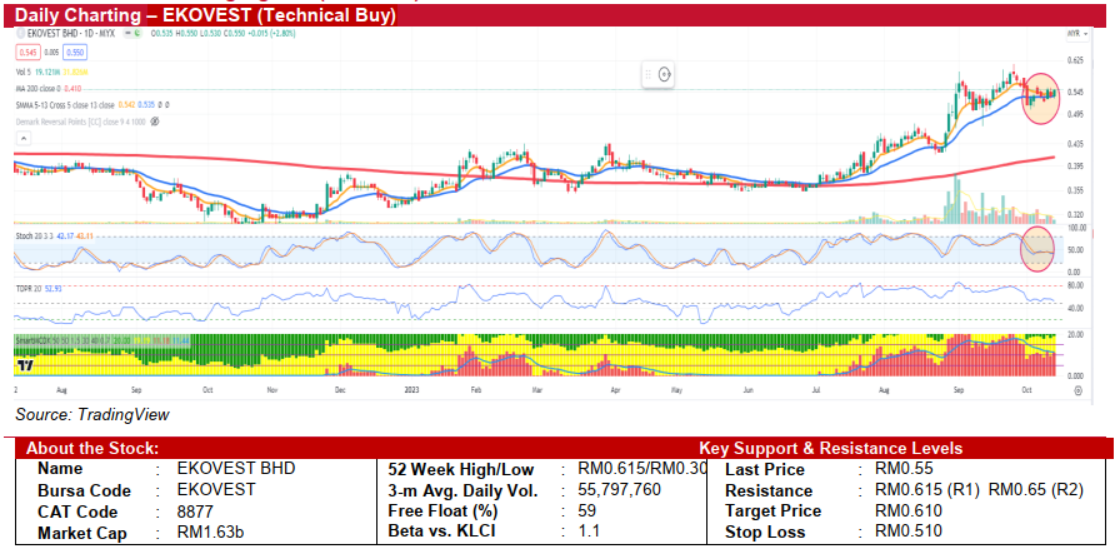

- After peaking at RM0.615 in late September, EKOVEST experienced a measured pull-back and is currently consolidating within the RM0.515-RM0.555 range, closely aligned with its SMA 5 and 13 levels. The stock's long-term upward trajectory remains unbroken, as evidenced by the appearance of a "bullish engulfing" candlestick pattern in the latest trading session, signalling a potential directional shift.

- From a technical standpoint, both the stochastic oscillator and the Tom DeMark Pressure Ratio (TDRP) are currently situated mid-range, indicating a lack of clear directional momentum for the stock. However, the ascending trend observed in the banker bar under the MCDX suggests increasing buying momentum.

- A decisive move above the immediate resistance level of RM0.555 could set the stage for the stock to retest its recent high of RM0.615. Conversely, a fall below the recent low of RM0.515 would trigger a new downtrend, with the next support level identified at RM0.485.

- We recommend that investors consider entering the stock at RM0.55, targeting a profit-taking level at RM0.61. This strategy offers an estimated upside of approximately 11%. A stop-loss is advised at RM0.510, representing a downside risk of 7.3%.

Source: Kenanga Research - 13 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments