Kenanga Research & Investment

WeeklyTechnical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Mon, 30 Sep 2024, 12:24 PM

Dow Jones Industrial Average (DJIA)

- U.S. stocks rose for the third consecutive week, with the S&P 500 and Dow up 0.6%, reaching new record highs, and the NASDAQ gaining 1.0%, now 2.8% below its peak. The rally was fuelled by positive economic data and Chinese government stimulus, driving one of the largest weekly gains for China stocks on record. On Friday, the Fed’s preferred inflation measure, the PCE Index, rose 2.2% annually in August, its lowest since February 2021, while core PCE (excluding energy and food) matched expectations at 2.7%.

- Moving forward, while stock valuations remain elevated, positive economic data continues to support the possibility of a soft or no landing, maintaining the market's upward momentum. This week's focus will likely shift to key economic data, particularly Friday's jobs report and Tuesday's JOLTS report, providing insights into the labor market. While positive sentiment persists, investors should stay alert to the traditional October effect and developments in the U.S. presidential election. For the bullish trend to continue, strong 3Q earnings—set to begin in two weeks—will be needed to support current valuations. FactSet's current estimate for 3Q earnings growth is 3.8%, down from 7.8% at the start of the quarter.

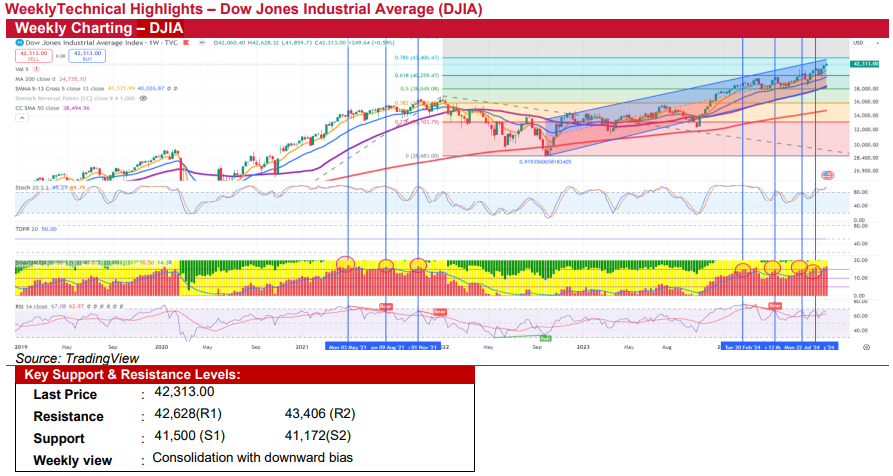

- Technically, the DJIA remains in an upward trend, staying above its key 5- and 13-week SMAs. However, with the weekly MCDX banker bar surpassing the 15 level and the stochastic indicator signalling overbought conditions, the market may enter a consolidation phase before resuming its upward trend.

- In summary, we anticipate the market to consolidate this week with some downside risk, though the index is expected to remain above the critical 5-week SMA at 41,172. A renewed uptrend could emerge if the index breaks through the key resistance level of 43,406. Key immediate resistance levels to watch are 42,628 and 43,406, while support levels are 41,500 and 41,172.

Source: Kenanga Research - 30 Sept 2024

More articles on Kenanga Research & Investment

Actionable Technical Highlights - RANHILL UTILITIES BHD (RANHILL)

Created by kiasutrader | Dec 23, 2024

Actionable Technical Highlights - HUP SENG INDUSTRIES BHD (HUPSENG)

Created by kiasutrader | Dec 23, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments