Kenanga Research & Investment

Weekly Technical Highlights – FBM KLCI

kiasutrader

Publish date: Mon, 30 Sep 2024, 12:26 PM

FBM KLCI

- The FBM KLCI closed down by 8.73 points, or 0.52%, to 1,660.09 for the week, amid profit-taking despite positive regional sentiment following China’s fresh stimulus measures. Continued foreign outflows since last Monday also added pressure to the local market. Most sectors recorded negative weekly performance, led by Technology (-5.1%), Health Care (-3.5%), and Utilities (-3.0%), while Consumer Products & Services, REIT, and Plantation were the only sectors that posted slight gains of 0.2%-1.0% WoW. Weekly turnover increased to 16.6b units worth RM15.1b, up from 13.7b units worth RM16.1b the previous week.

- Looking ahead, the market's attention will be on key U.S. economic data this week, with Tuesday's JOLTS report and Friday’s jobs report offering insights into the resilience of the world’s largest economy. Additionally, China will start its National Day Golden Week holiday from October 1 to 7, with President Xi's policy speech on October 1 expected to shed more lights on recent stimulus measures aimed at boosting growth and stabilizing the property sector. On the local front, trading opportunities in certain speculative themes or sectors may arise as we approach the upcoming Budget 2025 announcement on October 18.

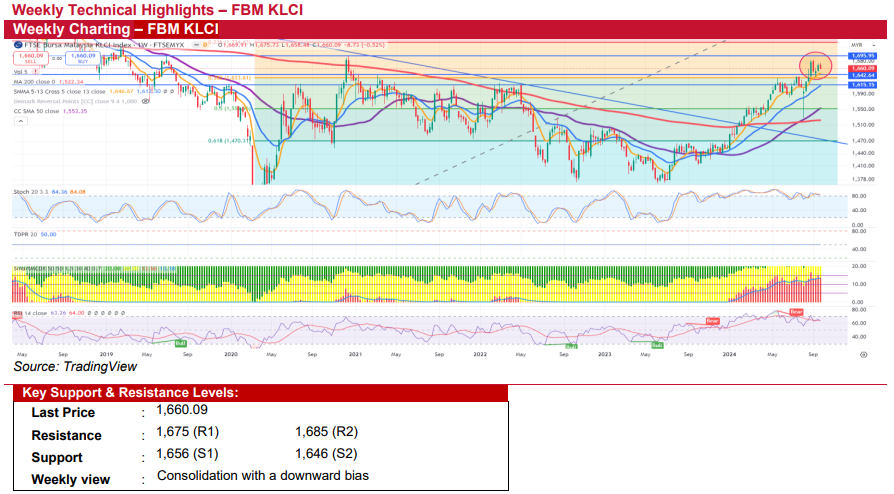

- Technically, the FBM KLCI’s short- and medium-term uptrend remains intact as the index continues to stay above its 5- and 13-week SMA lines despite some mild profit-taking last week. The weekly stochastic indicator remains in overbought territory, while the RSI has eased to 63, slightly below its 14-day average of 64.

- We expect the market to remain in a consolidation phase with a downward bias this week. If profit-taking and foreign outflows persist, the index may test its key 1,646 level before bargain-hunting activities emerge. Key support levels are 1,656 and 1,646, in line with the 5-week SMA. On the upside, resistance levels are at 1,675, followed by its recent high of 1,685.

Source: Kenanga Research - 30 Sept 2024

More articles on Kenanga Research & Investment

Actionable Technical Highlights - RANHILL UTILITIES BHD (RANHILL)

Created by kiasutrader | Dec 23, 2024

Actionable Technical Highlights - HUP SENG INDUSTRIES BHD (HUPSENG)

Created by kiasutrader | Dec 23, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments