The Star wrote an article about the issues at hand: "Who is bigger – Tony or AirAsia?"

First of all, I have never been a fan of private placements, rights issues are so much more fair, giving all shareholders a chance to participate. And if they don't want to participate (for instance because they don't have money at that moment), they can still sell the rights in the open market.

The rationale given in the prospectus is as follows (first paragraph):

I don't think the reasons given are strong: both the underwriting and the successful completion should be no issue since the 559 million shares to the founders are apparently already underwritten.

Secondly, it is stated that the issuance "indicates the continued commitment" of the founders "by making further substantial investments".

This would suggest that the founders have been doing this for a long time, increasing their stake in AirAsia by investing in new shares.

However, exactly the opposite has been the case, the founders have been disposing shares for a long, long time, and in huge quantities, more than 600,000,000 shares in total.

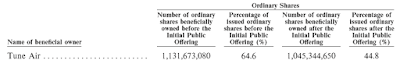

At the IPO Tune Air sold 86 million existing shares:

After the IPO in their 2005 annual year report they owned 1,045 million shares (44.8%), which they sold down in the open market to 529 million shares (18.9%) currently. Large disposals were made in 2005 and 2006, 2011 and 2014. There is not a single year in which the founders actually increased their shareholding.

That bags the question, why after twelve years of heavy selling do the founders now suddenly want to increase their shareholding in AirAsia? Surely the minority investors, who will get strongly diluted by the proposed private placement, deserve a proper explanation.

Lastly, there is the following, rather remarkable issue:

"..... why Tune Air, which is their holding company, is disposing its stake in the market at about RM2 prior to the AGM? It does not look good for them to get placement shares at RM1.84 when Tune Air is reducing its stake at RM2. To be fair, in announcements to Bursa Malaysia, Tune Air has stated that the shares disposed were in favour of Datuk Abdul Aziz Abu Bakar, who is one of the founders of AirAsia. "

I would suggest to replace the private placement by a rights issue of comparable size, to shore up the balance sheet.

And if the founders of AirAsia want to increase their stake, well, they can go ahead and buy the shares in the open market. If they can sell hundreds of millions of shares in the open market then surely they can also buy those quantities at the same venue.

Indiaman

Mr feeling is telling me tuneair will reject the PP of Airasia at at the end. This PP story is just a tamil soap opera cheating all innocent ikan bilis. ironically, SC give the blessing of this open manipulation of AA shares. total debts of AA is myr13 Billion! In addition, when market price is ~myr0.80, tony dont buy but 'bluffing' to buy at myr1.80. This is a kindergarden story

2016-05-01 13:38