Is Capital A’s Liability Too Big?

Alex_Kho

Publish date: Thu, 01 Aug 2024, 12:42 AM

There are valid concerns from people who think Capital A’s liability is too big. Given the rapid expansion and financial commitments of Capital A, it’s crucial to understand how it stacks up against other major low-cost carriers (LCCs) in Southeast Asia. Let’s dive into the details, comparing growth and liability to see if these concerns hold water.

Capital A’s Current Liabilities (Q1 2024) Position

Lease Liabilities: RM 5.99B

Trade & Other Payables: RM 4.02B

Total Liabilities: RM 10.01B

How Do Other LCCs Compare?

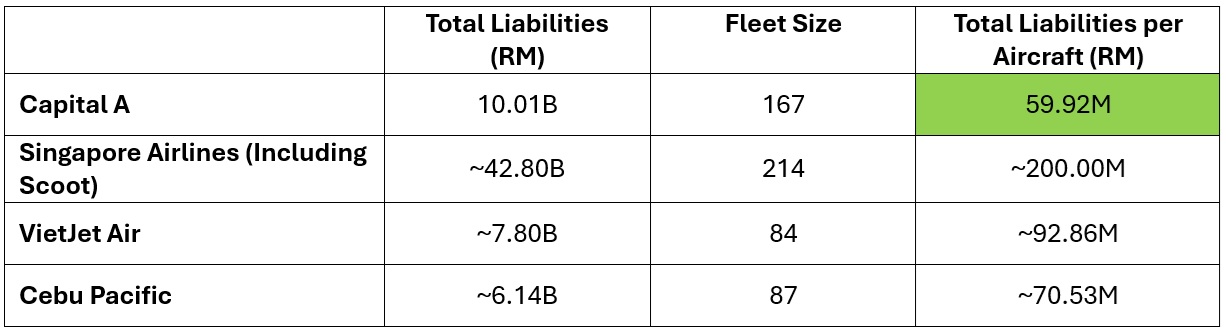

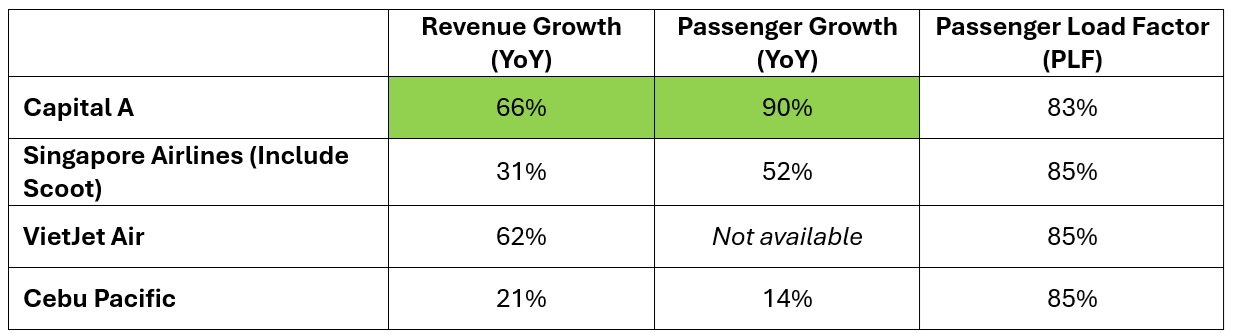

To make a fair comparison, we’ll look at the same period (Q1 2024) for other major LCCs: Singapore Airlines Group (including Scoot), VietJet Air, and Cebu Pacific. We’ll examine their growth metrics and liabilities per aircraft.

LLCs Liabilities Comparison (Q1 2024)

LLCs Growth Compaison (Q1 2024)

Analysis and Insights

1. Growth Perspective:

- Capital A has shown impressive growth with a 66% increase in revenue and a 90% increase in passenger numbers. This growth is supported by strategic fleet expansion plans, increasing the total active fleet from 187 to 221 by the end of 2024.

- VietJet Air and Cebu Pacific also demonstrate strong growth, with revenue increases of 62% and 21% respectively. Both airlines are expanding their fleets to capitalize on increasing demand.

- Singapore Airlines Group (including Scoot) shows steady growth, with a 31% increase in revenue and a 52% increase in passenger traffic for Scoot, leveraging the parent company’s robust financial backing.

2. Liability Perspective:

- Capital A has a total liability per aircraft of RM 59.92M, which is significantly lower than Singapore Airlines Group’s RM 200.00M per aircraft. This indicates that despite the large absolute figures, Capital A manages its liabilities more efficiently on a per-aircraft basis.

- VietJet Air and Cebu Pacific have higher liabilities per aircraft compared to Capital A but are still within a manageable range given their growth trajectories.

Conclusion

Capital A’s liabilities, while substantial, are balanced by its strong growth and strategic fleet expansion. The lower liability per aircraft compared to Singapore Airlines Group suggests that Capital A is managing its financial commitments effectively relative to its size. The impressive revenue and passenger growth rates further support its competitive position in the Southeast Asian LCC market.

It's important to note that the airline business is inherently capital-intensive, requiring significant investments in aircraft and infrastructure. High liabilities are common in this industry due to the substantial capital expenditures (capex) required for fleet acquisition and maintenance. Therefore, Capital A’s liabilities, while noteworthy, are not unusual within the context of the aviation sector.

Additionally, if Capital A successfully exits PN17 status, there is little doubt that the company will be able to recover to its pre-COVID price levels, continuing its growth trajectory in the post-pandemic era.

Disclaimer

This article is for informational purposes only and should not be construed as financial or investment advice. Investing in stocks involves risks, and it is essential to conduct your own research or consult with a financial advisor before making any investment decisions.

Source

https://www.rappler.com/business/cebu-pacific-earnings-report-q1-2024/

https://business.inquirer.net/457885/cebu-pacific-income-soared-in-q1-to-p2-24b

Read the detail on my Medium :

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Finance for All : Demystifying the Stock Market

Created by Alex_Kho | Sep 30, 2024

Created by Alex_Kho | Jun 12, 2024

Created by Alex_Kho | Jun 10, 2024

Created by Alex_Kho | May 21, 2024

In this insightful article, we delve into the golden opportunities presented by the recent surge in gold prices, focusing on two leading Malaysian jewellery retailers, Tomei Bhd and Poh Kong Bhd.

Created by Alex_Kho | May 16, 2024

KSL Holdings Bhd, an undervalued Malaysian property stock with attractive ratios, is poised to soar with the market's anticipated 2024 recovery. Don't miss out on this hidden gem!