Koon’s Golden Rule - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 24 Apr 2017, 01:17 PM

Last night, someone who has not met me before wrote to tell me that she has been losing money for a long time until she applied my share selection golden rule to pick stocks. Her email encourages me to write this piece to help more people. If you have not been successful, you must read this article carefully to learn a new method of picking stocks to make money.

Statistics has shown that there are more losers than winners in the stock market. In fact, there are a lot more losers but most of them would not admit it because of shame.

Recently Maybank, Hong Leong Bank, TA Securities and RHB Investment Bank invited me to give an investment talk. One Bank Director told me he noticed that all their various business divisions except stock broking are profitable because the volume of transactions is reducing and most of their registered clients remained inactive. This encourages me to write this piece so that more people can make money from the stock market.

How I started? I started serious investing in 1983 when the Hong Kong stock market crashed because China gave notice to the British Government to take back the sovereignty of Hong Kong. The Hang Seng index went down below 1,000. For comparison, the Hang Seng index closed at 24,042 last Friday.

During the crash, it was so easy to make money. All I needed was bravery; I dare to buy when the Chinese Communists were going to rule HK and most Hongies were simply dumping their holdings as if there were no more tomorrow.

I identified one of the most undervalued stock called HK Realty & Trust. Before the crash, it was selling at HK$ 13.60 and during the crash it was selling at HK$ 3.60 per share. Moreover, its audited accounts showed that its cash value per share was HK$ 10.00.

As soon as China granted 50 years extension of the lease, the market rebounded and HK Realty & Trust shot up above HK$ 15.00, so also most of the other counters. The market had a new lease of life and every investor quickly jumped in to buy. As my holdings went higher I could buy more shares on margin finance. Eventually after 3 years, I made so much money that I bought 46% of a stock broking company called Kaiser Stock & Shares Co Ltd..

After the HK experience, I noticed that it was not so easy to make money. I started to read the method as practiced by Warren Buffet, Benjamin Graham, Peter Lynch and other gurus. All of them are preaching value investing which is very safe and sure of making money. But it is too slow for me.

For example: currently there are many shares of property companies selling below NTA. It is safe and sure of making money but you have to wait until all the unsold properties are sold. It can take several years.

After having tried many other methods such as buying low P/E stocks, companies with good discounted cash flow, companies selling below their NTA and companies with no borrowings and with huge cash in fixed deposit.

I found out that all these methods could not really work. Among all these criteria, the most important is profit growth prospect. EPS growth is the most powerful catalyst to move share prices. That is why I formulated my share selection golden rule.

Koon's Golden Rule

By looking at the profit for the last 1 or 2 quarters, you can know if the company will most likely make more profit in the current year than last year. Wait for a few months, you can most likely see increased profit and more people will rush to buy to push up the share price.

Once you have selected a company with good profit growth, do not quickly sell to take profit. Only novice investors or day traders will quickly sell to take profit. As long as the company continues to show increasing profit, its share price will continue to rise. You will only sell as soon as you see the company is making less profit. But you must be careful because the sales of some products are seasonal which will affect profit.

I have been using my golden rule to have selected Latitude Tree and Lii Hen each of which has gone up more than 800%. I have also selected V S Industry which has gone up about 600% and it is still going up.

I am no longer a substantial shareholder of Latitude and VS but I am obliged to tell you that I am still one of the top 5 shareholders of Lii Hen.

Exception

As an English saying “exception proves the rule. There is always an exception in any rule.”

For example, although JAKS lost money last year due to interest charges for its mall development in KL, it has a fantastic profit growth from its independent power plant project in Vietnam. After careful study, its Chinese JV partner with a consortium of 3 Chinese Government Banks have sub-contracted and taken full responsibility of the project. They will pay JAKS Rm 400 million during the construction period of 3 years of the 1,200 MW coal fired power plant in Vietnam. After the completion of the construction, JAKS will be paid 40% of the profit every year for 25 years from the sale of electricity to the Vietnamese Government.

I am obliged to tell you that my wife and I have bought about 120 million JAKS shares which you can see in Bursa company announcements. I do not need you to buy to support or push up the share price.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 23, 2024

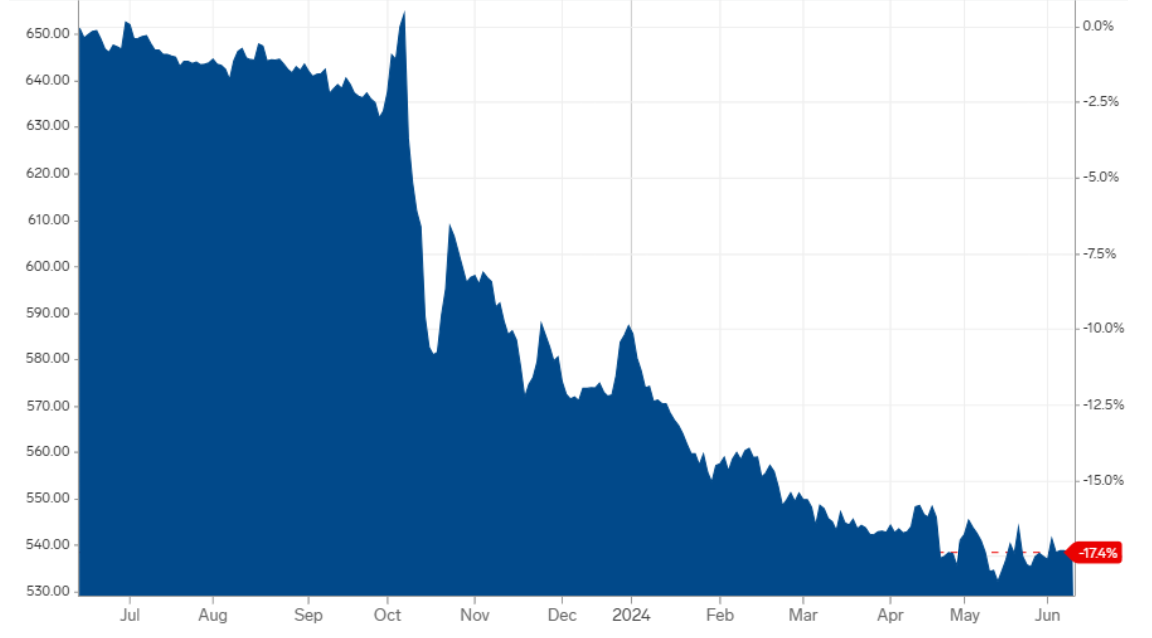

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024