Comfort compares with Supermax - Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 17 May 2020, 10:12 PM

My old trusted friend Mr Ooi Teik Bee and I had a long discussion about share investing during the Covid 19 pandemic which is affecting almost all the listed companies. We also noticed that the daily traded volumes for Comfort, Supermax, Kossan, Top Glove etc are much larger than before the Covid 19 pandemic. The reason is that all the institutional investors have to sell to cut loss on most of their holdings which they bought before the pandemic to buy glove manufacturers’ shares.

Due to Covid 19 pandemic the demand for gloves far exceeds supply. As a result, the price for gloves continues to go higher and all glove manufacturers will continue to make increasingly more profit which is being reflected on their share prices.

Covid 19 pandemic is affecting the profit of most listed companies with the exception of companies making products for the prevention of the virus infection. Based on this situation, I bought Comfort and Supermax shares recently. Fortunately, the share prices for both have been going up quite rapidly.

Compare annual production of each company with its market capitalization:

Comfort: The last traded price for Comfort is Rm 2.31 and it has 580 million issued shares. Its market capitalization is Rm 1,340 million and its annual production is 5.40 billion gloves. 5.40 billion gloves divided by Rm 1,340 million = 4 sen per glove.

Supermax: The last traded price for Supermax is Rm 3.97 and it has 1,300 million issued shares. Its market capitalization is Rm 5,161 million and its annual production is 27 billion gloves. 27 billion gloves divided by Rm 5,161 million = 5.23 sen per glove.

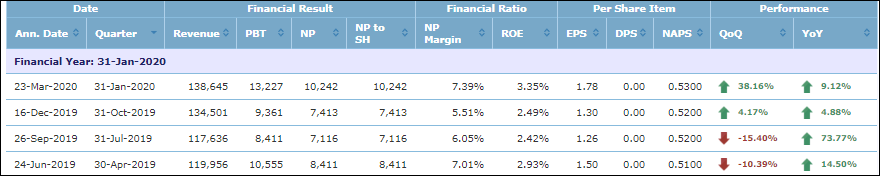

Compare historical P/E ratio for Comfort:

The above chart shows Comfort’s earning for each quarter for the last 4 quarters below, totalling 5.84 EPS. Current price divided by EPS is Rm 2.31 divided 5.84 = 39.5 P/E.

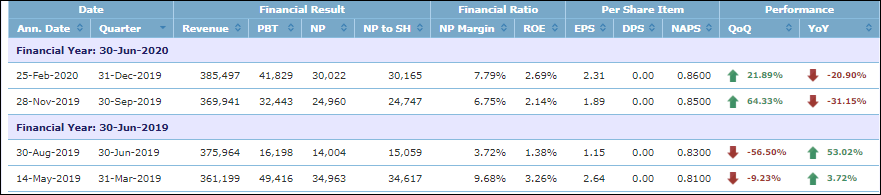

Compare historical P/E ratio for Supermax:

The above chart shows Supermax’s earning for each quarter for the last 4 quarters totalling 7.99 EPS. Current price divided by EPS is Rm 3.97 divided 7.99 = 49.6 P/E.

Conclusion:

Basing on production cost for 1 glove with market capitalization, Comfort is cheaper.

Basing on historical P/E ratio, Comfort is also cheaper.

A few day ago, Comfort shot up 30% to limit high with about 100 million shares traded. The average volume traded daily is about 70 million in the last few weeks. Only institutional investors have so much money to buy such big volume.

Nevertheless, Investor should consider Supermax’s advantages. Supermax is a larger company with its own brand and its own marketing organisation to sell its product, it should be able to sell its products at relatively higher prices with better margin of profit.

Currently my investment is 70% on Comfort and 30% on Supermax. I am not sure which has the better profit growth prospect in future.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.