Supermax: My 2nd revised target price - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 01 Jul 2020, 04:52 PM

Yesterday I attended Comfort AGM during which the Chairman openly said that due to the Covid 19 pandemic, the demand for gloves far exceeds supply. As a result, the company can easily increase their selling price for their products. They are now increasing their selling price by 5-10% every month. They sell cheaper to long term customers and at higher prices to non-regular customers.

Based on the new information, I need to revise my target price for Supermax. Since Supermax has its own sale outlets in USA and many other countries, it is reasonable to assume it can increase its revenue and PAT by 15% every month.

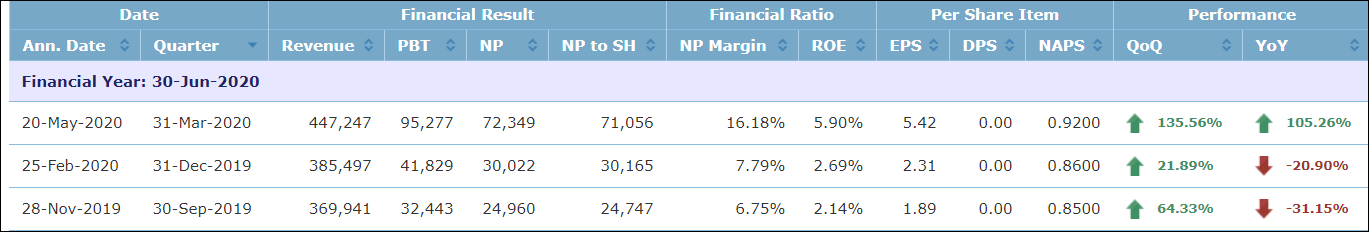

I refer to the above report, total issued number of shares is 1,300 million.

1st quarter revenue Rm 447 million, PAT or profit after tax 71 million.

For the next 9 months, each month its PAT and revenue will be increased by 15% (compound).

1st month its revenue PAT will be 15% X 447 = 67 and revenue 447+67=514

2nd month its PAT 15% X 514 = 77 and its revenue 514+77=591

3rd month its PAT 15% X 591= 89 and its revenue 591+89=680

4th month its PAT 15%X 680= 102 and its revenue 680+102= 782

5th month its PAT 15%X782= 117 and its revenue 782+117= 899

6th month its PAT 15%X889= 133 and its revenue 889+133= 1002

7th month its PAT 15% X 1002= 150 and its revenue 1002+150= 1152

8th month its PAT 15% X 1152= 173 and its revenue 1152+173= 1325

9th month its PAT 15% X 1325= 199 and its revenue 1325+199= 1524

Total for the whole year Rm 1178 million

EPS 1178 divided 1300 shares = 90 sen

Based on P/E 15 target price Rm 13.50

Based on P/E 20 target price Rm 18

Since the company has its own sale outlets in US and other countries, it can easily increase its selling price for gloves. Any price increase is pure profit because the company does not need additional cost to increase the selling prices.

Due to the Covid 19 pandemic, Supermax deserved to sell at P/E 20.

Relevant information:

The World Health Organisation has just reported 150,000 new Covid 19 cases, the biggest number of Covid 19 cases in one single day. US has 2.68 million cases and 129,000 deaths and Brazil has 1.40 million cases and 60,000 deaths. Based on the continuous increase of cases in almost all the countries in the world, the pandemic is still spreading quietly rapidly. Even though vaccine is under human testing, FDA still need time to examine to approve the safe use of the vaccine. Many scientists predicted the pandemic will not be under control for at least another year.

It looks like the demand for gloves will continue to exceed supply for a long time. As a result, glove price will continue to increase and all the glove manufacturers are making more and more profit which should be reflected on their share prices.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.