Supermax has increased selling price - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 09 Jul 2020, 12:19 AM

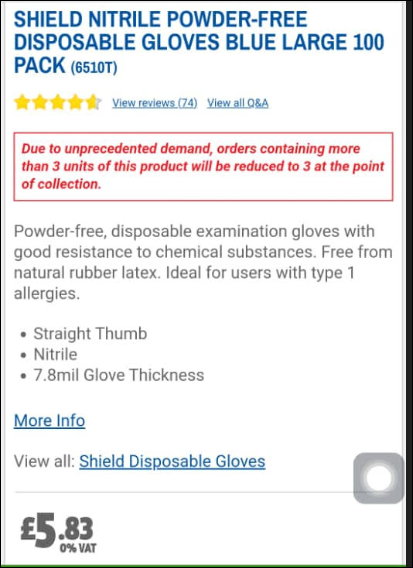

My nephew Yap Sung Pang from Manchester, UK sent these 2 posters which show the glove price has shot up from 5.83 pounds to 14.99 pounds for 100 pieces, an increase of 260% due to Covid 19 pandemic. The demand for glove far exceeds supply.

Supermax has its own brand and sale out lets in US, UK and many other countries. Unlike other smaller glove manufacturers, Supermax can easily increase its selling price. Even if I assume that Supermax can double its original selling before the pandemic, its profit would be phenomenal. Bearing in mind that the additional selling price is pure profit because it does not involve production cost.

Based on this new information, I realised that I have under estimated my target price of Rm 18. I believe the share price for Supermax should be above Rm 20 after the announcement of the next 2 quarter results. The next quarter ending June should be announced soon.

RHB and CIMB just informed me that they have increased the capping from Rm 5.00 to Rm 7.00 for margin finance from tomorrow onwards. Investors will have additional margin loan facility for buying more Supermax shares which will push up the share price.

Mr Ooi Teik Bee said that he believes Supermax will be included into FBM KLCI component stock index effective on 18th Dec 2020. This higher rating will also push up Supermax share price.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.