Top Glove: my target price - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 10 Aug 2020, 10:18 AM

Malaysia Sin Chew reported Top Glove’s average selling price ASP was increased by 15% for June, July and 30% for Aug. Top Glove’s ASP will be increased more than 30% for September

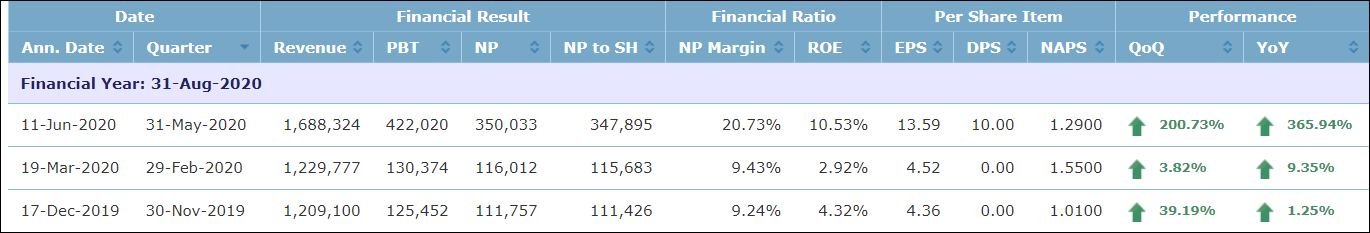

In the 3rd quarter ending May, its revenue Rm 1,688 million – PBT 422 million = Rm 1,266 million production cost.

Monthly revenue = 563 million

Monthly PBT = 141 million

Monthly Production cost = 422 million

June 2020

Revenue = 563X1.15 = 647 million

June PBT = 647- 422 = 225 million

July 2020

Revenue = 647X1.15 = 744 million

July PBT = 744 – 422 = 322 million

August 2020

Revenue = 744X1.3 = 967 million

August PBT = 967-422 = 545 million

Total PBT for 3 months = 1.092 billion

Assume 25% tax

PAT for Q4 2020 = 1092X0.75 = 819 million

Total number of shares = 2.704 billion

EPS for Q4 2020 = 30.2 sen

EPS for Q3 2020 = 13.6 sen

Growth of EPS QoQ = 30.2/13.6 = 2.22 times.

That means its 4th quarter profit is 2.22 times its 3rd quarter profit.

What will be Top Glove’s PAT for financial year 2021?

If Top Glove has increased its ASP by 15% for June, 15% for July and 30% for Aug. it is very safe and conservative to assume that it will increase its ASP by 15% per month for 12 months of the next financial year. Top Glove also reported that its production will be increased by 25% to achieve 100 billion gloves for 2021.

September PBT will be Aug PBT 545 X 1.15 X 1.25 = 783 million.

October PBT 783X 1.15X = 900 million

November PBT 900X1.15 = 1035 million

December PBT 1035 X1.15 = 1190 million

January 2021 PBT 1190 X 1.15 = 1369 million

February PBT 1369 X 1.15 = 1574 million

March PBT 1574 X 1.15 = 1810 million

April PBT 1810 X 1.15 = 2082 million

May PBT 2082 X 1.15 = 2394 million

June PBT 2394 X 1.15 = 2753 million

July PBT 2753 X 1.15 = 3166 million

Aug PBT 3166 X 1.15 = 3641 million

Total PBT for 12 months Rm 22,700 million

PAT 22700 X 0.75 = Rm 1703 million

EPS 1703 divided 2.704 billion = Rm 6.30

Based on P/E 20 target price Rm 126

Now I can believe Affin Hwang Capital Research analyst Mr Ng Chi Hoong’s Rm 100 as Top Glove’s target price is achievable.

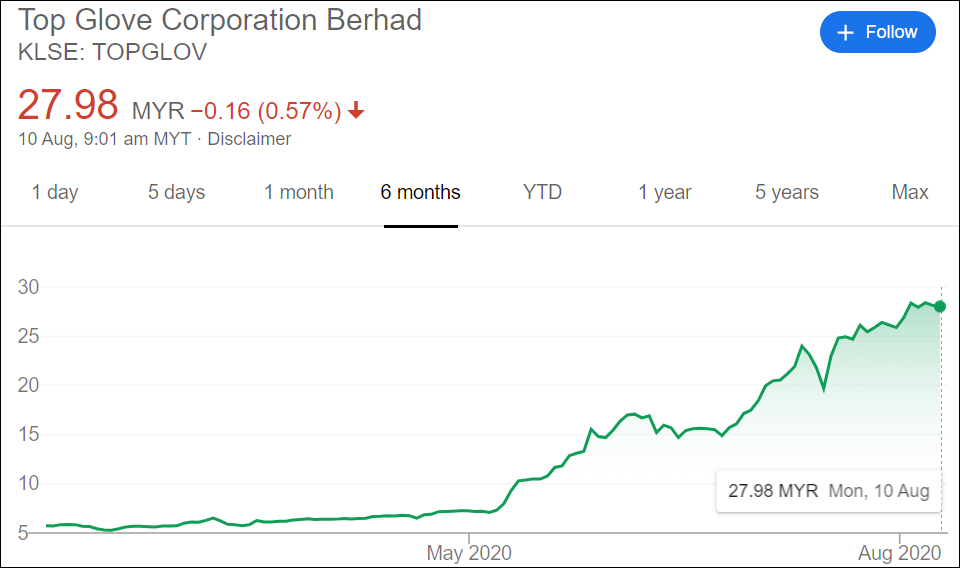

The Supermax price chart shows that it has shot up from Rm 2 to Rm 23, an increase of 11.5 times in the last few months.

While Top Glove has gone up from Rm 6 to Rm 28, an increase of 4.7 times in the last few months. Logically investors should sell Supermax to buy Top Glove.

Currently there are 19.981 million Covid19 cases and 732,782 deaths in the world. The number of cases and deaths are still spiking up. As a result, the demand for medical gloves will continue to exceed supply. Top Glove being the largest glove producer should be able to increase its selling price easily.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...