Why steel stocks are good investment? Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 12 Jun 2021, 02:15 PM

In the last few months, Mr Ooi Teck Bee has been writing about the rise of steel price and how it has been benefiting all the listed steel companies. All his subscribers of his weekly circulars, would have read his articles. In fact, yesterday Mr Ooi rang to ask me to look at Melewar which has net cash. It is controlled by the royal family of Negri Sembilan.

All the steel companies have been reporting increasing profit in the last few quarters despite the Covid 19 pandemic lockdown when most of the construction of infrastructures and properties are affected. All the steel companies will surely make more and more profit when there is no more movement control. They all have good profit growth prospect.

To support Mr Ooi, I am writing this piece.

Why the prise of steel continues to rise?

China is the biggest steel producer in the world

China’s economic progress is unstoppable by the West especially USA. Since China will soon become the richest Nation in the world and it has not neglected its social responsibility in reducing the use of coal to produce steel and to reduce air pollution. China has reduced steel production and stopped steel export as China requires all the steel for its own property and infrastructure development.

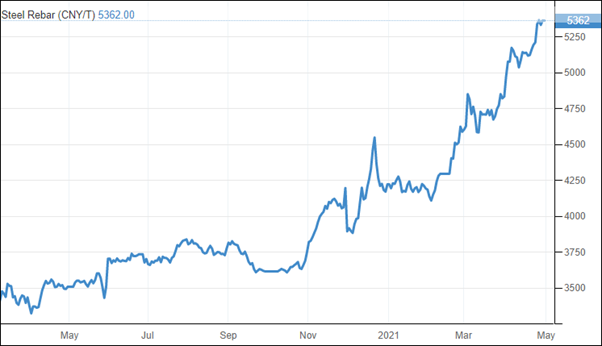

The steel price chart below shows the price of steel has been going up about 50% in the last 12 months.

As a result, all the companies involved in steel manufacture in Malaysia have benefited. That is why all of them are reporting increasing profit in the last few quarters. Moreover, most of the local steel companies are currently enjoying strong cash flows and reasonably good demand visibility in the intermediate term despite of the movement restriction due to the Covid 19 pandemic.

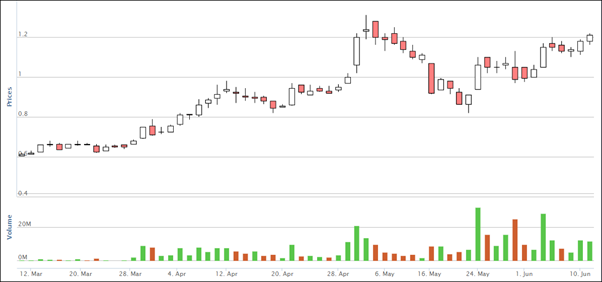

Leon Fuat price chart below

Choo Bee price chart below

|

Name |

price |

Latest EPS |

EPS ÷ price |

|

Leon Fuat |

Rm 1.21 |

11.65 sen |

9.65 |

|

Choo Bee |

Rm 2.30 |

20.94 sen |

9.10 |

|

Prestar |

Rm 1.28 |

9.45 sen |

7.81 |

|

Leader Steel |

70.5 sen |

5.47 sen |

7.76 |

|

Southern Steel |

Rm 1.00 |

6.85 sen |

6.85 |

|

Melewar |

62 sen |

3.87 sen |

6.24 |

|

Astino |

Rm 1.51 |

6.34 sen |

420 |

|

CSC Steel |

Rm 1.69 |

5.91 sen |

3.50 |

The above table is a comparison of all the listed steel companies in Malaysia. You can see the comparison of the latest quarter EPS for each company. I divided their latest EPS by their share prices to show how much EPS for every Rm 1.00 investment. For example, if you invest Rm 1.00 in Leon Fuat you will get 9.65 sen for 1 quarter. You will get 4 X 9.65 sen = 38.6 sen per year.

There are 1,100 listed companies in Malaysia. Can you find another listed company as good as Leon Fuat?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

kyy taklat gila lah. He is onli exhibiting his stock analysis skill.

Rating : perfect, 5 stars !!!!

2021-06-12 15:50

kyy turns complex financial ratio analysis into a simple kacang putih analysis for all to understand to help in their stock investment !

2021-06-12 15:57

Ok lah, in stock mkt we always agree to DISAGREE with another bcos in any mkt transaction there is a seller who think the stock sold by him will go down n a buyer who think the stock will go up.

2021-06-12 16:28

MR TAN SACK SEN (a company director) disposed 100,000 shares at 1.080 on 03-Jun-2021.

2021-06-12 22:09

Very true what is said below. Beware of Sharks.

Posted by zestyy90 > nope. ppl like kyy and otb only push when they want to dump.

2021-06-13 11:56

Posted by zestyy90 > Jun 13, 2021 11:48 AM | Report Abuse

nope. ppl like kyy and otb only push when they want to dump.

--------------

Talk is easy, please show proof that I am dumping.

You buy and do not buy is none of my business.

Please note that I do not post my recommendation in I3.

Please leave my name outside.

Please talk with facts and figures.

Show me the proof again !!

I did very well in my share investment in KLSE.

Thank you.

2021-06-13 12:05

No longer have any respect for KYY based on his past dealings !!! Whatever target prices he promotes, better exit earlier bcos he already bought them much earlier and cheaper.... ready to dump to you all !!!

2021-06-13 14:25

Manipulation for profits? That’s the endgame? Still want to play by following YKK?

2021-06-13 17:34

he won't be the same guide as he was. We all love money, anybody who says they don't are just kidding themselves as they don't have it but the reality is there is also a word called GREED, and unfortunately he's shown his true colors and the truth has revealed itself..

2021-06-13 18:09

U.S. President Joe Biden and other G7 leaders hope their plan, known as the Build Back Better World (B3W) initiative, will provide a transparent infrastructure partnership to help narrow the $40 trillion needed by developing nations by 2035, the White House said.

So all building material price will increase so are many commodities price due to every country printing more money. The day of hyper inflation is here.

So need to know what to invest in order to beat inflation and keep the value of your money.

2021-06-13 18:26

Posted by Sslee > Jun 13, 2021 6:26 PM | Report Abuse

U.S. President Joe Biden and other G7 leaders hope their plan, known as the Build Back Better World (B3W) initiative, will provide a transparent infrastructure partnership to help narrow the $40 trillion needed by developing nations by 2035, the White House said.

===========

really meh? They cannot maintain their own needs can build for others meh?

2021-06-13 18:29

BILLC Mana Masteel and lionind ??

This two not steel stocks kah?

Masteel last quarter EPS 1.87 cents.

Lionind last quarter EPS -1.42 cents

So how to in KYY list?

The question is why steel price increase Masteel and Lionind did not report a good quarter?

2021-06-13 18:35

I think Insas is low risk high reward if the controlling shareholder intend to unlock the value.

Hope Inari next phase of expansion will be the catalyst to unlock Insas value.

2021-06-13 19:14

low risk high rewards

They call themselves investors. But they also can get the risk wrong. Serba for a long time is considered a low PE low risk share but turns out to be a mistake. sad. or just plain unlucky.

Serba was never a low risk high rewards stock for serba expand into non core competant business too fast with too much borrow money.

2021-06-13 19:19

yes Serba a lot of red flags but one red flag people over look..... Serba under perform analyst expectations long long time already. many correctly call Serba a sadist stock long long time already

2021-06-13 20:36

stocks that over perform analyst expectations is called over valued.... but stocks that under perform analyst expectations is also a red flag

2021-06-13 20:38

Sslee > Jun 13, 2021 7:19 PM | Report Abuse

Serba was never a low risk high rewards stock for serba expand into non core competant business too fast with too much borrow money.

===========

serba surely had a lot of flags before KPMG but many red flags and many stocks with red flags never become red bombs.

2021-06-14 00:32

Haha.. nanti kyy Akan cakap steel overpriced.. no future bla bla bla.. chase la korang hahaha

2021-06-14 00:52

Now MCO, all steel companies down to 10% work force. better sell as next QR will be very bad

2021-06-14 09:08

OMG cant believe this guy.. again??

https://klse.i3investor.com/blogs/shareseatreasure/2021-06-14-story-h1566198208-Koon_Yew_Yin_do_not_INTENTIONALLY_MISLEAD_the_public.jsp

2021-06-14 12:44

Tiger66, i've been told 10% also but where do you see this? i can't find it. i thought it is 60% or totally close.

2021-06-14 12:58

Ahhh still to sell high to Bilis and then run away kah?

My dear Bilis who never learn.

2021-06-14 20:25

Generally, steel industry is considered capital intensive where profitability can swing widely depending on a variety of reasons. If for instance, if demand is low due to a economic downturn, it can report huge quarterly losses due to reduced revenue, loan repayments, depreciation etc . So we need to consider this when buying steel stocks.

2021-06-14 22:46

Geezer will tell lies just to make money even at this old age. I stop here. You guys figure out the rest. Shameful when you learnt who he used to be.

2021-06-14 22:52

"Can you find another listed company as good as Leon Fuat?" - Almost - SUPERMX trailing P/E: 2.56, EPS/Price: 8.24

but Im not saying its a good buy, just presenting numbers: https://miloshtrading.blogspot.com/2021/06/gloves-simple-table-comparison.html

2021-06-16 14:03

abang_misai

Gila ke Koon? Ajak yang tak berdosa chase high lagi?

2021-06-12 15:11