All Steel Companies will report better profit - Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 27 Jun 2021, 01:25 PM

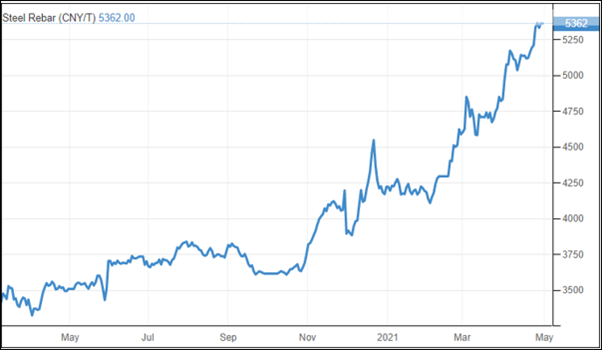

Currently China is the 2nd richest nation and very soon China will be the richest nation in the world. China has been using coal to produce steel and it has been the largest steel producer and exporter in the world. China is now taking its social responsibility seriously to improve its air quality and its environment. China has stopped steel export. As a result, steel price has risen about 50% in the last 12 months as shown on the chart below.

All the steel companies have reported much better profit in their latest quarter. Since steel price is rising, all the steel companies will continue to report increasing profit in the next few quarters.

A few days ago, Astino reported its EPS jumped from 6.43 sen to 8.46 sen for quarter ending April 2021. As a result, its share price also shot up to close at Rm 1.40 per share.

Based on Astino’s profit growth, all the other steel companies will surely report increased profit for their next quarter ending June 2021.

The table below is a comparison of all the steel stock EPS. Leon Fuat is the best. Even if I assume that Leon Fuat’s EPS for the next 3 quarter is the same as 11.42, its annual EPS will be 4 X 11.42 = 45.68 sen. Last traded price Rm 1.02 divided by 45.68 = 2.2 PE ratio.

Best buying opportunity

Covid 19 pandemic is affecting almost all the listed companies. We also have so much of political uncertainty. Moreover, many investors have lost their employment and money in their businesses. As a result, almost all the listed shares are being depressed and many investors are forced to sell their holdings.

Clever investors should take advantage of this fire sale opportunity to buy steel stocks. My largest holding is Leon Fuat.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

Dear Mr Koon Yew Yin,

It seems you have an interest in the travel & tourism (T&T) industry. Indeed, this will is the final stretch before immunizations in Malaysia are completed and life moves forward

As such, the numbawan top pick sure win Recovery (T&T) and Value and Growth stock is Genting (3182)

The world moves in cycles - the seasons, economic cycle and recession (10 years), stock market cycle, property cycle, commodities cycle...

1971 Genting Highlands Opens

2021 50 Years of History and Growth

2009 Global Financial Crisis

2020 Covid-19 Pandemic

2009 Year of the Ox (KLCI + 44%)

2021 Year of the Ox

2010 Resorts World Sentosa (SG) opens

2021 Resorts World Las Vegas (US) opens

2009 Mar RM3.08 (low) to 2011 Nov RM11.98 (all time high)

2020 Nov RM2.95 (low) to 2022 RM ????

History always repeats itself

Years of downtrend will be replaced with years of uptrend

Genting will once again go on a supercycle SuperBull run in the Year of the Golden Ox as the economy recovers and accelerates as history has shown countless times after every recession

Sincerely,

EMSVSI

2021-06-28 20:45

Selling price increases so does raw material price, at the end we yet to know if the kind of profit is sustainable

2021-06-28 23:20

Price divided by price, you get a ratio or % if multiplied by 100. Don’t make this kind of kindergarten mistake lah if you wanna convince others to buy your stocks.

2021-06-28 23:57

During MCO:

Meanwhile, the five sectors allowed to operate with 10% workforce are automotive (vehicles and components); *** IRON and STEEL ***; cement; glass; and ceramics.

2021-07-04 22:39

ahbah

Just get some lah.

2021-06-27 20:04