Cree to Invest $1 Billion to Expand SiC Capacity - Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 24 Jul 2021, 12:22 PM

Since I have cashed out from the stock market, I have been searching for good profit growth stocks to invest. I came across this American listed company called Cree Inc. and its share price is shooting up higher and higher. I Googled to find this useful information which I like to share with you. I am not asking you to buy the share.

Cree Inc. is an American listed company. It manufactures SiC wafer material for making electric vehicle battery which reduces the battery charging time. Since the demand for electric vehicle is increasing, Cree Inc. decided to invest US$1 billion expansion.

- Expansion to generate up to a 30-fold increase in SiC wafer fabrication capacity and 30-fold increase in SiC materials production to meet the expected market growth by 2024

- Five-year investment leverages an existing building (“North Fab”) and refurbished 200mm equipment to build state-of-the-art automotive-qualified production facility

- Investment: $450M for North Fab; $450M for materials mega factory; and $100M in other investments associated with growing the business

As part of its long-term growth strategy, Cree, Inc. (Nasdaq: CREE) announces it will invest up to $1 billion in the expansion of its silicon carbide capacity with the development of a state-of-the-art, automated 200mm silicon carbide fabrication facility and a materials mega factory at its U.S. campus headquarters in Durham, N.C. It marks the company’s largest investment to date in fuelling its Wolfspeed silicon carbide and GaN on silicon carbide business. Upon completion in 2024, the facilities will substantially increase the company’s silicon carbide materials capability and wafer fabrication capacity, allowing wide bandgap semiconductor solutions that enable the dramatic technology shifts underway within the automotive, communications infrastructure and industrial markets.

“We continue to see great interest from the automotive and communications infrastructure sectors to leverage the benefits of silicon carbide to drive innovation. However, the demand for silicon carbide has long surpassed the available supply. Today, we are announcing our largest-ever investment in production to dramatically increase this supply and help customers deliver transformative products and services to the marketplace,” said Gregg Lowe, CEO of Cree. “This investment in equipment, infrastructure and our workforce is capable of increasing our silicon carbide wafer fabrication capacity up to 30-fold and our materials production by up to 30-fold compared to Q1 of fiscal year 2017, which is when we began the first phase of capacity expansion. We believe this will allow us to meet the expected growth in Wolfspeed silicon carbide material and device demand over the next five years and beyond.”

The plan delivers additional capacity for its industry-leading Wolfspeed silicon carbide business with the build out of an existing structure as a 253,000 square-foot, 200mm power and RF wafer fabrication facility as an initial step to serve the projected market demand. The new North Fab is designed to be fully automotive qualified and will provide nearly 18 times more surface area for manufacturing than exists today, initially opening with the production of 150mm wafers. The company will convert its existing Durham fabrication and materials facility into a material’s mega factory.

“These silicon carbide manufacturing mega-hubs will accelerate the innovation of today’s fastest growing markets by producing solutions that help extend the range and reduce the charge times for electric vehicles, as well as support the rollout of 5G networks around the world,” said Lowe. “We believe that this represents the largest capital investment in the history of silicon carbide and GaN technologies and production with a fiscally responsible approach. By using existing facilities and installing a majority of refurbished tools, we believe we will be able to deliver a state-of-the-art 200mm capable fab at approximately one-third of the cost of a new fab.”

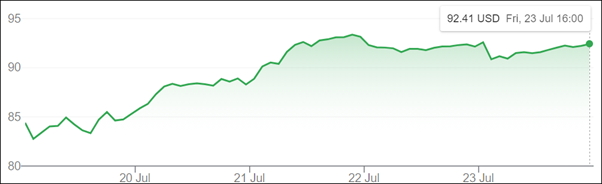

Since Cree’s US$ 1 billion expansion, its share price has been going up as shown on the above chart.

My purpose for writing this article is to share this useful information and not to encourage you to buy Cree shares.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

what golden rule?

oh the one that he changed whenever he want to justify his reason of buying?

2021-07-24 23:49

Uncle Koon, do look at this hidden oil gem..

https://klse.i3investor.com/blogs/truthfinder2021/2021-07-26-story-h1568787018-A_hidden_oil_company_you_do_not_want_to_miss_for_its_potential_upside.jsp

2021-07-26 11:12

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)

ming

Ur golden rule macam not applicable here..

2021-07-24 19:32