Why foreign funds return? Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 10 Oct 2021, 06:11 PM

NST reported that foreign investors remained net buyers of stocks on Bursa Malaysia for the week ended September 3 this year with an inflow of RM786.42 million.

This was the fourth consecutive week of net buying by the foreign investors, MIDF Research said.

As the market reopened last Monday, foreign investors were net buyers amounting to RM513.62 million.

Local institutions and retailers as net sellers to the tune of RM485.65 million and RM27.97 million respectively.

"Foreign investors were net buyers for everyday of the week. The largest foreign inflow was recorded on Monday with the smallest inflow on Thursday to the tune of RM513.62 million and RM6.78 million respectively," MIDF Research said in its weekly fund flow report today. As for the retailers, they were net buyers for everyday of the week except on Monday.

Why foreign funds are back?

The reason for foreign investors to come back is that the number of Covid 19 cases is reducing rapidly due to rapid vaccinations.

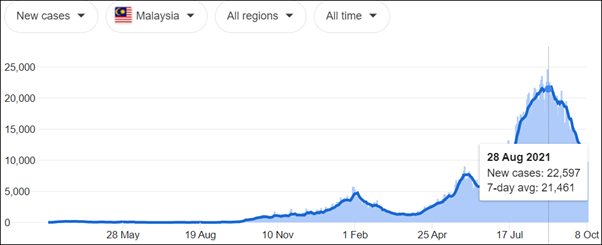

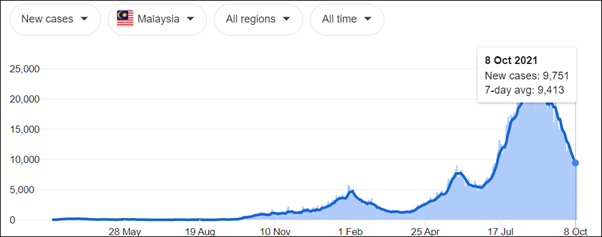

We have a total of 2.32 Covid 19 cases and 27,191 deaths. On 28 Aug the 7-day average of new cases is 21,461. On 8 Oct the 7-day average of new cases is only 9,413 as shown on the 2 charts below.

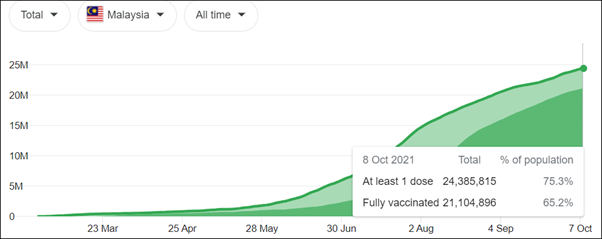

The vaccination chart above shows that 21.1 million people are fully vaccinated or 65.2% of our population. Last month 4.5 million people were fully vaccinated. If another 4.5 million people were to be fully vaccinated in this month, the total number of people with 2 doses of vaccination will be 25.6 million or 80% of our population. That means there will no more MCO lockdown and shut down factories. People will be free to go to work.

Despite of 2 months shut down in Hiap Teck’s Kelang factory and 1 month shut down in its associate Eastern Steel factory, Hiap Teck reported 4.26sen EPS in its latest quarter ending July. If there is no longer shut down, Hiap Teck’s profit for next month will be fantastic. That is why its share price is going up higher and higher.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

Dear Mr Koon Yew Yin,

You must understand, steel stocks may or may not rise, however what is proven is that the sector is highly cyclical and subject to one-offs. Foreign investors know this

What is not one-off is Gaming. After all, gambling is human nature and is as old as Man himself.

In fact, with all the other travel and tourism stocks closing due to the pandemic, Genting's attractions in Genting Highlands, US & Bahamas, UK & Egypt will be that much more attractive - as the aphorism goes, 'what doesn't kill you, makes you stronger'.

As such, we hope that you are able to take a position in Genting before you miss the boat on the greatest run in Genting's history

1971 Genting Highlands Opens

2021 50 Years of History and Growth

2009 Global Financial Crisis

2020 Covid-19 Pandemic

2009 Year of the Ox

2021 Year of the Ox

2010 Resorts World Sentosa (SG) opens

2021 Resorts World Las Vegas (US) opens

2009 Mar RM3.08 (low) to 2011 Nov RM 11.98 (all time high)

2020 Nov RM2.95 (low) to 2022 Xxx RM ????

History always repeats itself

Sincerely,

emsvsi

2021-10-11 09:13

This is exactly how he reasoned out during gloves golden qtr . But turned out bad instead . bEcareful

2021-10-11 12:34

US tapering means it is good for export biz in Malaysia mah as USD will be rising for 1-2 years if there is no depression.

2021-10-11 12:34

Are you sure it is foreign fund?

Why not black money stashed away in foreign banks?

2021-10-12 09:17

I salute Uncle KYY, he can easily post on the reverse (U-turn) as he seen fit. Today, I have read one news on iron ore prices and another on natural gas prices, both might change what he has written!!

Happy trading and TradeAtYourOwnRisk.

2021-10-12 09:38

Foreign funds are smart money. When they have data that they can make money, they'll come.

2021-10-12 09:45

@周海, you are right, they are smart and professional. They can hire the smartest brain to gather all the data, having the latest equipment and world wide news to their advantage. So is our institution players. Only we as retailers, depend on our own self reading the market trend.

So really needs to TradeAtOurOwnRisk. My 2sen worth of opinion.

2021-10-12 10:02

Foreign fund return to buy steel? Too good to be true. Our made in malaysia steel very nice?

2021-10-12 18:05

abang_misai

Hari-hari hiaptek. Haha

2021-10-11 07:28