Malaysia's steel price to ride global wave in 2021 - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 26 Oct 2021, 09:57 AM

I am writing this article to support Mr Ooi Teck Bee’s statement quote ”All steel stocks in the world are up including steel stocks listed in China. No reason for steel stocks listed in KLSE are down. Please be informed” unquote.

KUALA LUMPUR: Malaysia's steel industry is expected to pick up again in 2021 after a slowdown in 2020, in line with rising global steel prices and the rollout of mega projects by the government.

Industry players said this would be boosted by the New Industrial Master Plan (NIMP) 2021-2030, which will chart the future direction of industrial development in the country.

The Lion Group said with strong demand for steel products coupled with raw materials shortages such as iron ore and metal scrap, steel prices would tend to improve.

"The steel industry will continue to play its crucial role in ensuring continuous development to cater for the future," the company spokesperson told the New Straits Times (NST).

The spokesperson said domestic steel production growth had been on the uptrend since 2017 with exception in 2020 due to the outbreak of Covid-19.

"As Malaysia's economic recovery trails others in Asia, her trajectory is shaped by the extent of domestic outbreaks of the pandemic, the pace of vaccines rollout and how much Malaysia is able to benefit from the global economic recovery.

"Considering a modest domestic steel demand growth amid expectations of an improved economic outlook with firmer crude palm oil and oil prices, current global steel supply shortages and favourable pricing will further boost domestic steel production growth to exceed pre-pandemic levels," the spokesperson said.

Steel prices reportedly are spiking from Asia to North America, with iron ore marching higher, as bets on a global economic recovery fuel frenzied demand.

According to a recent Bloomberg report, prices for hot-rolled coils (HRC), a benchmark steel product, had edged up threefold in North America from pandemic lows and they were also soaring in Europe.

The Lion Group spokesperson said all the HRC in Malaysia were currently imported since there was no local production.

HRC are imported mostly from Asian countries since the closure of Megasteel Sdn Bhd in 2016.

"Hence we plan to restart our HRC plant to replace imports, with any surplus for export.

"With the government's support and policy of nurturing the local industry and value chain covering both the upstream and downstream, it augurs well for our HRC production," the spokesperson said.

Sarawak-based Asteel Group commercial director Fong Fui Yee said domestic steel manufacturers were experiencing an overload of inquiries, but noted that steel allocation in Malaysia was limited.

"We find that the demand in Malaysia is merely spurred by earlier purchases made by industry players such as construction and automotive industry, so it does not impact their budgeted costs. By doing so, they will not be impacted by the global price hike.

Chiu said many steel producers around the world had reduced their export volume due to high steel demand in their own countries.

He said for instance, the steel production in the US and EU continued to climb mainly attributed by the strong steel demand that had driven the price to a record high.

"On the other hand, several measures implemented by China's government such as decarbonisation and cancellation of export tax rebates might affect steel production and prices further.

"Moreover, major economic activities in Malaysia is expected to continue picking up its momentum with the roll-out of Covid-19 vaccines, the steel production is expected to continue growing in order to meet the rising steel demand providing that there is enough of raw material supply," he said.

Asked if Malaysian steel players can ride along big steel players from Korea and China to meet this global surge in demand in the coming months, Fong said some Malaysian steel industry players were only passing the costs to the next supply chain.

Asteel Group managing director Datuk Seri Victor Hii Lu Thian pointed out that the Malaysian Iron and Steel Industry Federation had projected domestic steel production to grow to 12.4 million tonnes in 2025 at a compound annual growth rate of 3.5 per cent.

"We are hopeful that this is still achievable, and we believe that if we start our post-pandemic recovery efforts from now coupled with the help from our government, we may have the opportunity to reach greater heights," he said.

Asteel Group, a subsidiary company under YKGI Holdings Bhd, expects higher steel consumption in 2021 due to efforts made by governments around the world in rolling out recovery packages to stimulate the economy.

"On the local front, we forecast a double-digit growth this year on domestic steel consumption," Fong said.

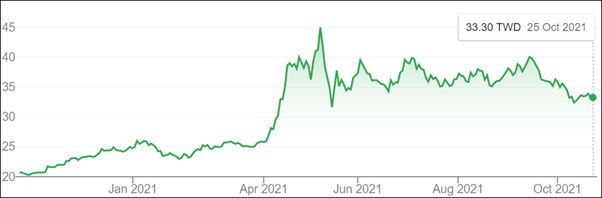

This is the steel price chart in the global market.

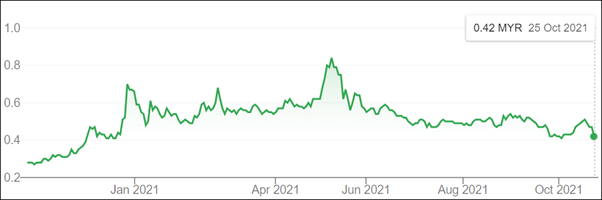

This is the steel price chart for Malaysia which shows that steel price is currently cheaper than the global steel price. All steel producers can easily increase their selling price.

As Mr Ooi Teck Bee said ”All steel stocks in the world are up including steel stocks listed in China. No reason for steel stocks listed in KLSE are down. Please be informed”.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jun 28, 2024

Created by Koon Yew Yin | May 28, 2024

It is a human nature that most men would complain to their wives that they were overworked and the wives would tell their husbands to get some assistants. As a result, the number of staff increases...

Created by Koon Yew Yin | May 13, 2024

Eversendai Corporation Berhad recently reported its earnings results for the fourth quarter ended December 31, 2023. Here are the key financial highlights:

Created by Koon Yew Yin | May 06, 2024

Eversendai Corporation Berhad made a remarkable comeback in FY2023, reporting strong profit growth. Here are the key highlights from their financial performance:

Created by Koon Yew Yin | Apr 30, 2024

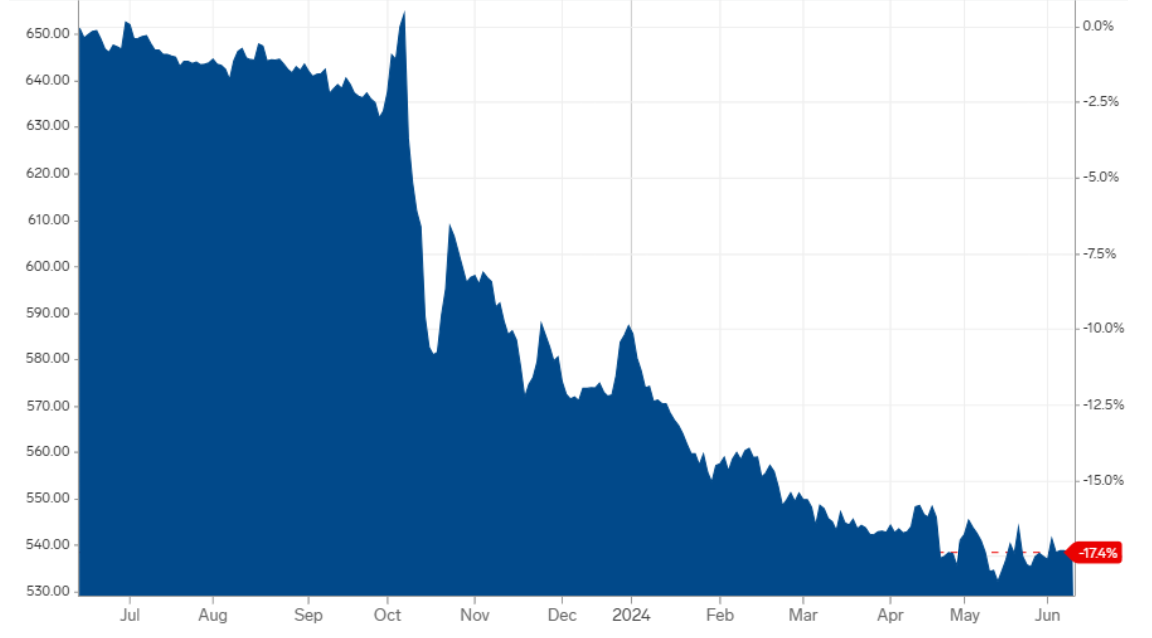

As shown on the chart below, Sendai has been dropping in the last few days. Today all shareholders must be wondering to sell, hold on or to buy some at a cheaper price.

Discussions

LOL! so desperate until must take some unknown price chart showing some taiwan dollar price and ringgit price? for everyone else who wants to know the real prices, refer to this:

https://tradingeconomics.com/commodity/steel

this is why this con man koon yew yin is desperate to get people to buy the steel stocks that he holds so that he can unload quickly.

2021-10-27 01:28

Steel price dropping la. Please see csan website he posted above comment. Don't get konned

2021-10-27 10:14

In America, they say market is king, market first, in China its people first, its what is good for the people, good for the country the CCP will find a solution.

2021-10-27 22:11

How high the profit margin of steel manufacturing is important, provided it can maintain there for long time.

Take lesson learned from glove and plantation companies, the market gave a single digit PE only because the prediction is the high profit margin could not last for long.

2021-10-28 08:41

TOP WIN

我认同 Kyy 老人家 。钢铁股 会 越来越 赚钱 。我 90% 股票资金 都在 钢铁股 。不过 我不买 HIAPTEK 因为 HIAPTEK 很贵 ,还有很多 SIFU 同 跟随者 在 0.70 以上等 。哈哈 !我不做 【 水魚 】。

2021-10-26 15:20